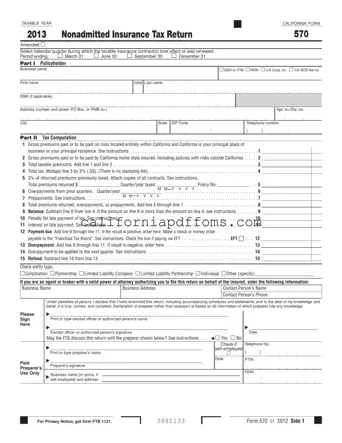

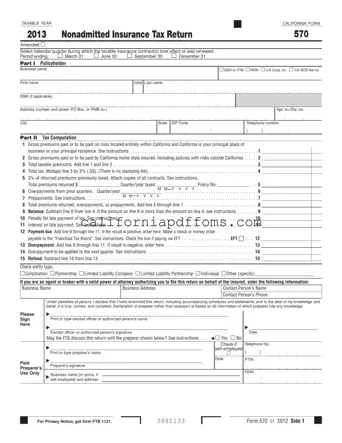

The California Form 570 is the Nonadmitted Insurance Tax Return used to report taxes on premiums paid to nonadmitted insurers. This form is essential for individuals and businesses that purchase insurance contracts covering risks within California. Understanding how to accurately...

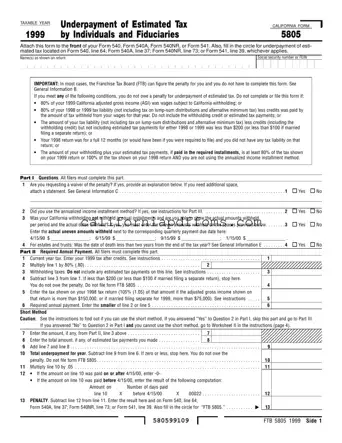

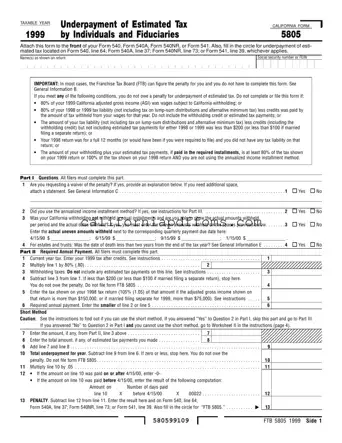

The California Form 5805 is used to determine if individuals and fiduciaries owe a penalty for underpaying estimated taxes. This form must be attached to the front of your California tax return, such as Form 540, Form 540A, Form 540NR,...

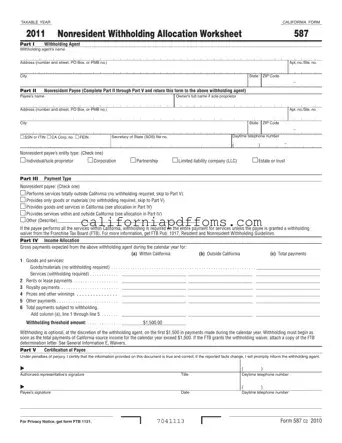

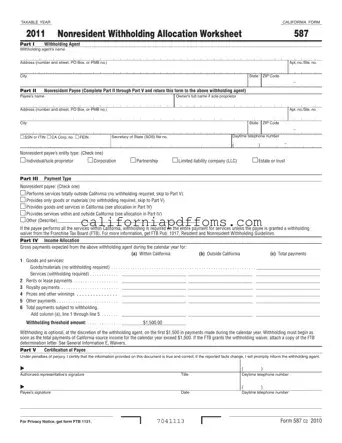

The California Form 587 is a Nonresident Withholding Allocation Worksheet used to determine the amount of tax withholding required on payments made to nonresidents for services performed in California. This form must be completed by the payee and returned to...

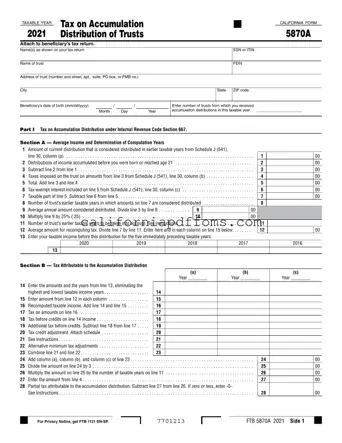

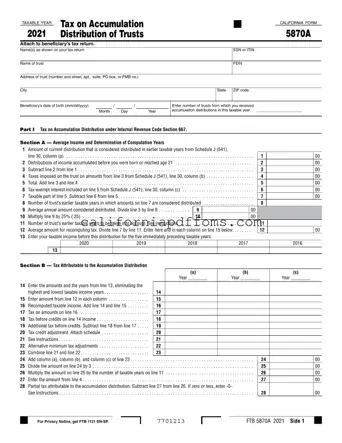

The California 5870A form is used to report the tax on accumulation distributions from trusts. Beneficiaries of trusts must attach this form to their tax returns to ensure accurate reporting of income received from the trust. If you need to...

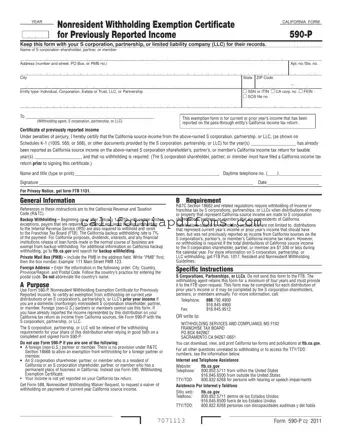

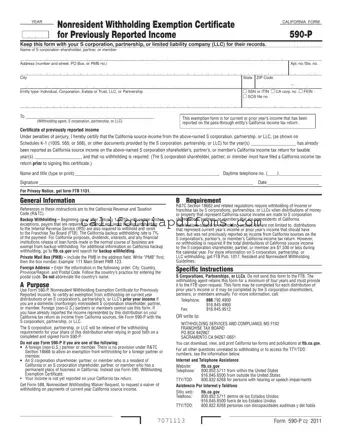

The California Form 590-P is a Nonresident Withholding Exemption Certificate for Previously Reported Income. This form allows nonresident S corporation shareholders, partners, or members to certify that certain income has already been reported on their California tax returns, thus exempting...

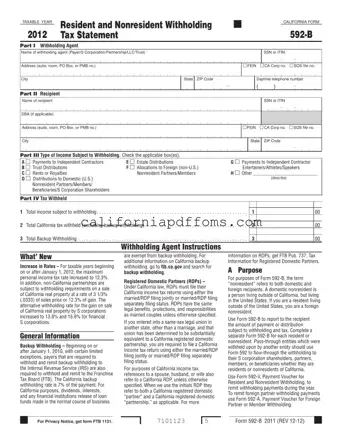

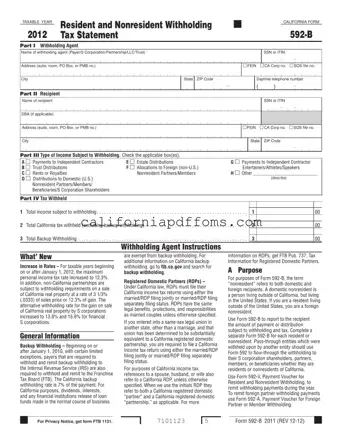

The California 592 B form is a tax document used to report withholding amounts for payments made to both residents and nonresidents. It serves as a crucial tool for withholding agents, ensuring that taxes are properly reported and remitted to...

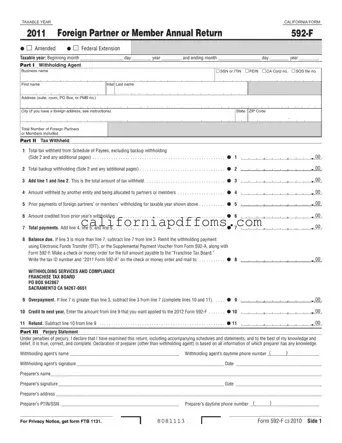

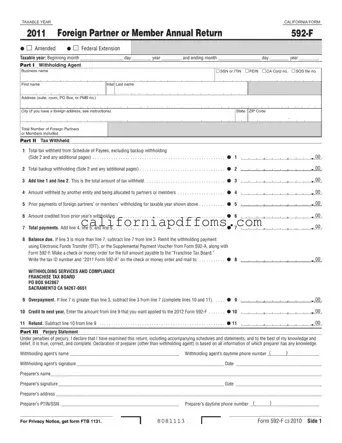

The California Form 592 F is an annual return used by partnerships and limited liability companies to report withholding taxes on foreign partners or members. This form simplifies the process of allocating income and related taxes, ensuring compliance with California...

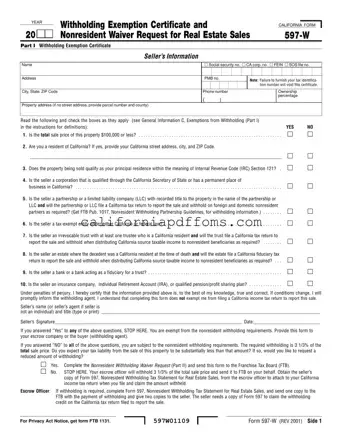

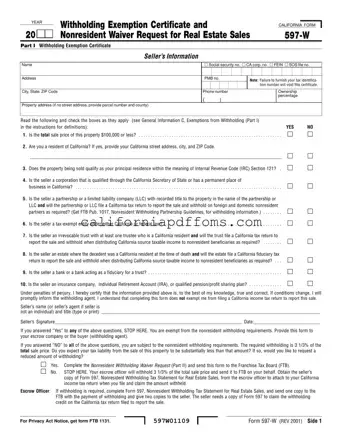

The California 597 W form is a Withholding Exemption Certificate and Nonresident Waiver Request for Real Estate Sales. This form is essential for sellers who may be exempt from nonresident withholding requirements when selling property in California. Understanding its purpose...

The California 700 U form is a Statement of Economic Interests that must be filed by individuals employed by the University of California (UC) or California State University (CSU) who lead research projects funded by non-governmental entities. This form helps...

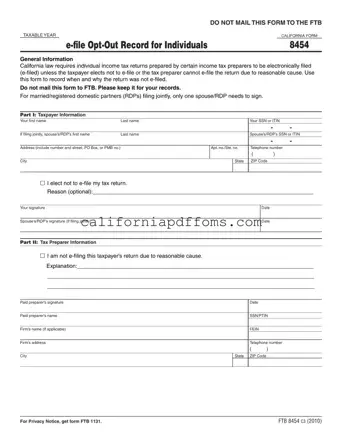

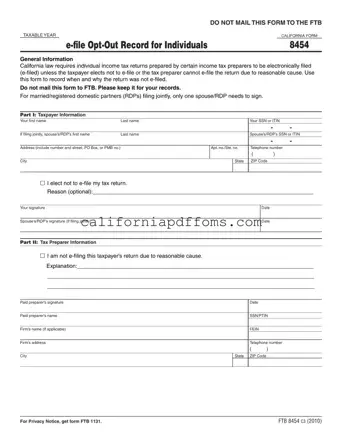

The California 8454 form is an essential document for individuals who choose not to electronically file their income tax returns. This form serves to record the decision not to e-file and the reasons behind it, ensuring compliance with California tax...

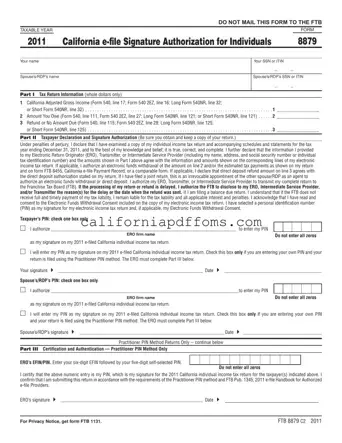

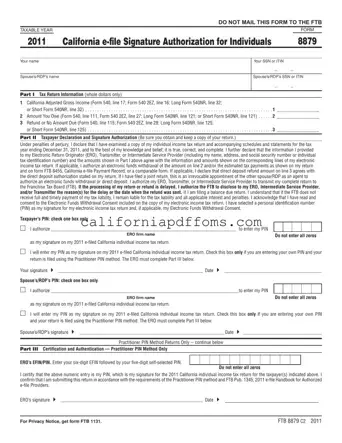

The California 8879 form is the California e-file Signature Authorization for Individuals. This form is essential for taxpayers who are e-filing their individual income tax returns through an Electronic Return Originator (ERO) using the Practitioner PIN method. By completing this...

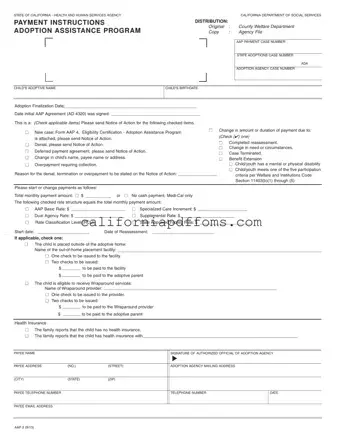

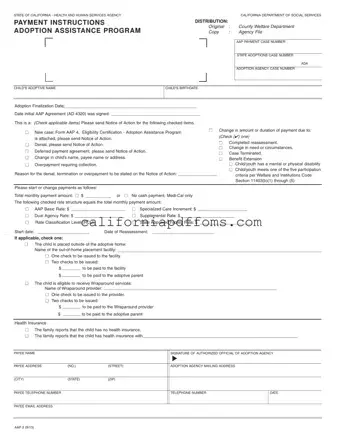

The California AAP 2 form is a crucial document used in the Adoption Assistance Program. It helps families apply for financial assistance related to the adoption of a child. Understanding how to fill out this form can simplify the process...