The California 3805Z form serves as a Deduction and Credit Summary specifically for businesses operating within designated Enterprise Zones. This form is essential for taxpayers looking to claim various credits and deductions related to their operations in these zones. Completing...

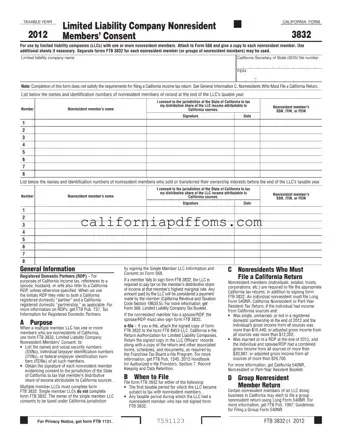

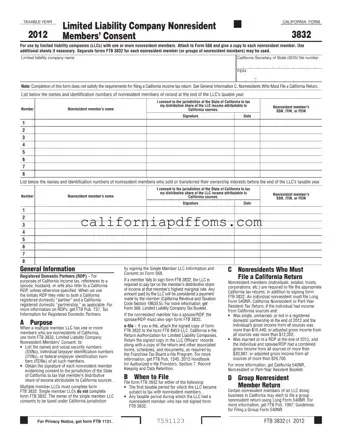

The California Form 3832 is a document required for limited liability companies (LLCs) that have one or more nonresident members. This form serves to obtain consent from nonresident members, allowing California to tax their distributive share of LLC income sourced...

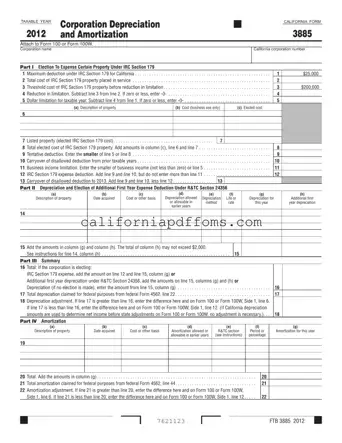

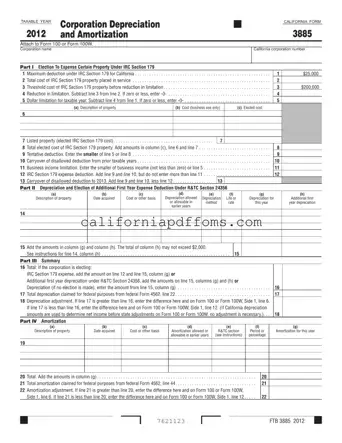

The California Form 3885 is designed for corporations to calculate their depreciation and amortization deductions in accordance with state tax laws. This form allows businesses to take advantage of specific tax benefits related to their tangible and intangible assets. For...

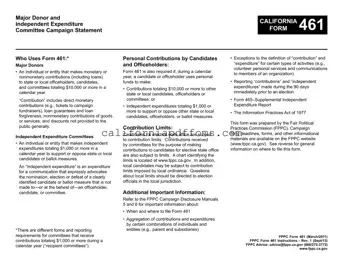

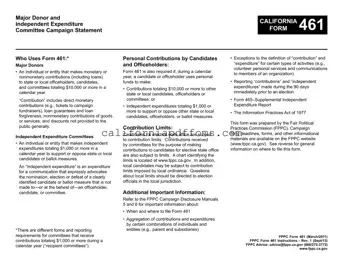

The California 461 form is a campaign statement used by major donors and independent expenditure committees. It reports contributions and expenditures related to state or local candidates and measures. Understanding this form is essential for compliance with California's campaign finance...

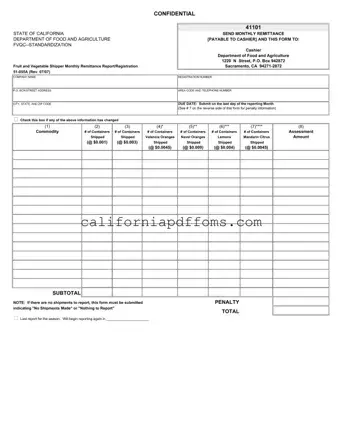

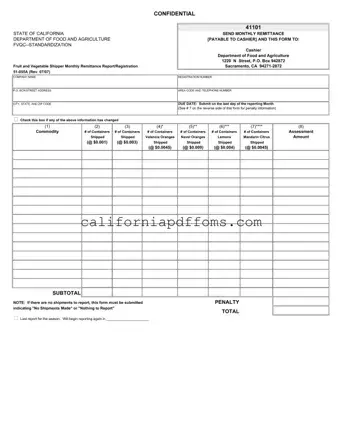

The California 51 055A form is a confidential document used by the Department of Food and Agriculture for reporting and remitting fees related to the shipment of fruits and vegetables. This form, known as the Fruit and Vegetable Shipper Monthly...

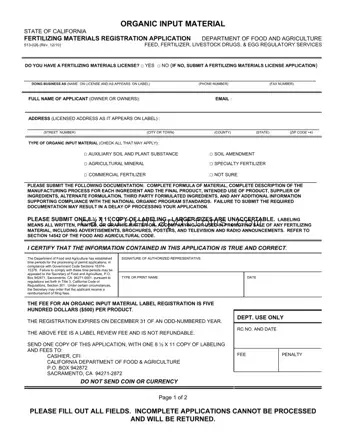

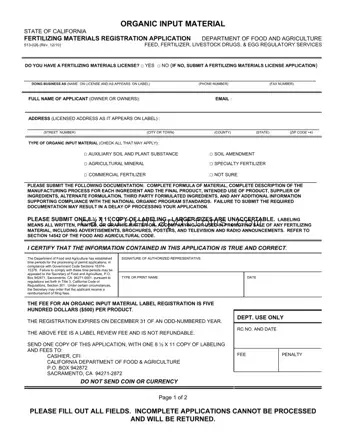

The California 513 026 form serves as the application for registering organic input materials with the Department of Food and Agriculture. This form is essential for businesses seeking to comply with state regulations regarding fertilizing materials. Completing the form accurately...

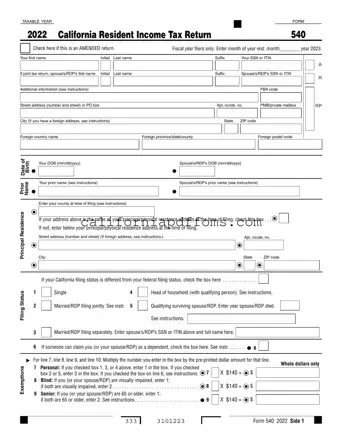

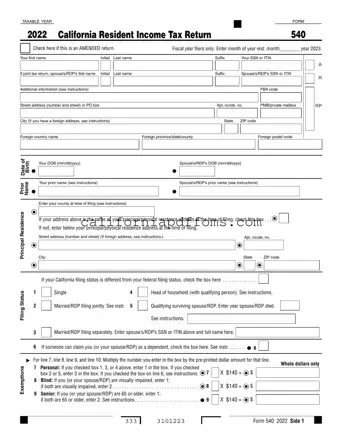

The California 540 C1 form is a tax return specifically designed for California residents filing their income taxes. This form is essential for reporting income, deductions, and credits, ensuring that taxpayers comply with state tax laws. If you need to...

The California 540 Schedule P form is an essential document for residents filing their state income tax returns who may be subject to the Alternative Minimum Tax (AMT). This form helps taxpayers calculate their Alternative Minimum Taxable Income (AMTI) and...

The California 540 V form is a return payment voucher designed for individuals filing their taxes. This form assists the Franchise Tax Board in processing payments more accurately and efficiently. While it is strongly recommended to use Form 540-V, there...

The California 540X form is an Amended Individual Income Tax Return used by taxpayers to correct errors or make changes to their original California tax return. This form allows individuals to report adjustments to income, deductions, or credits that may...

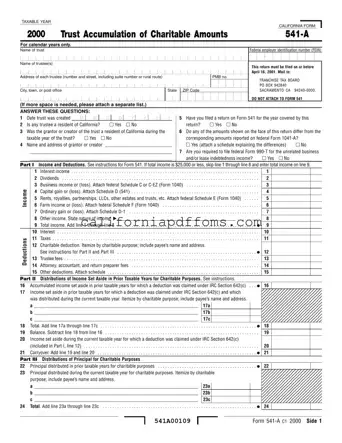

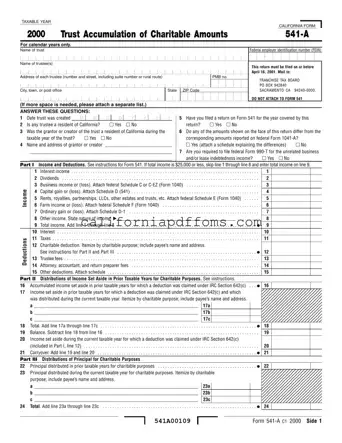

The California 541 A form is a tax document specifically designed for trusts that accumulate charitable amounts. This form allows trustees to report their charitable contributions and deductions, ensuring compliance with California tax law. Properly filling out this form is...

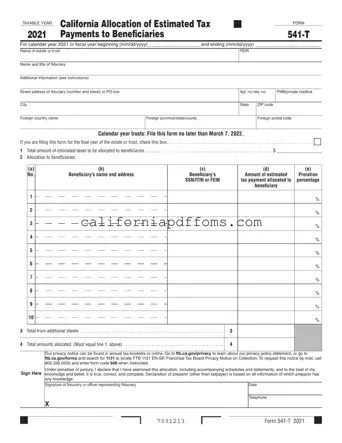

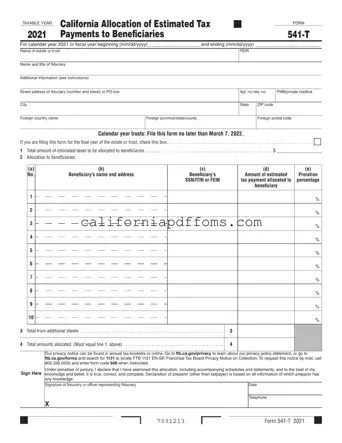

The California 541 T form is used for the allocation of estimated tax payments to beneficiaries from a trust or decedent's estate. This form allows fiduciaries to elect that part of the estimated tax payments be treated as made by...