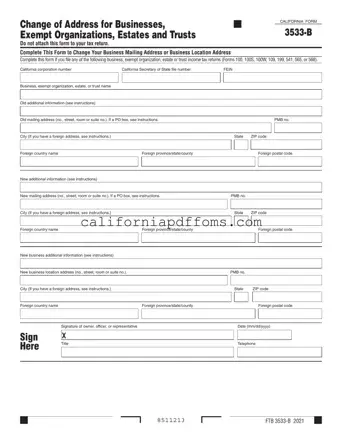

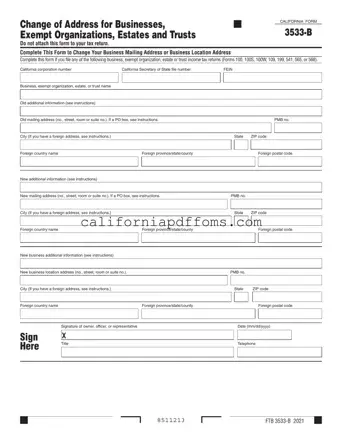

The California 3533 B form is designed for businesses, exempt organizations, estates, and trusts to officially change their mailing or business location address. This essential form ensures that your updated information is accurately reflected in state records, preventing any potential...

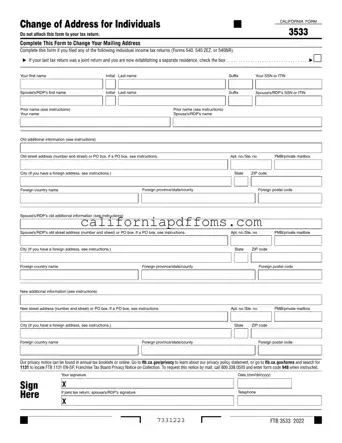

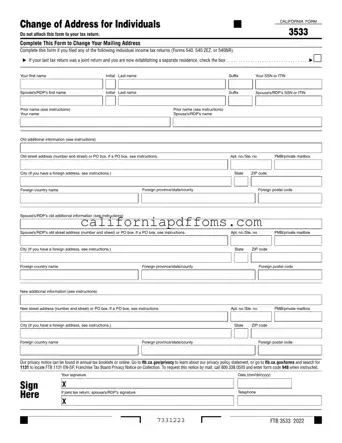

The California 3533 form is used to change your mailing address for individual income tax returns. If you have filed Forms 540, 540 2EZ, or 540NR, completing this form ensures that your tax information reaches you at your new address....

The California Form 3539 is a document used to request an automatic extension for filing tax returns for corporations and exempt organizations. This form is essential for those who cannot meet the original filing deadline and need additional time to...

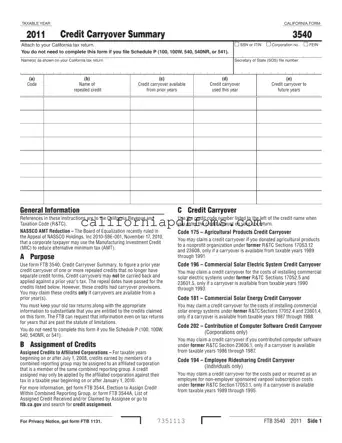

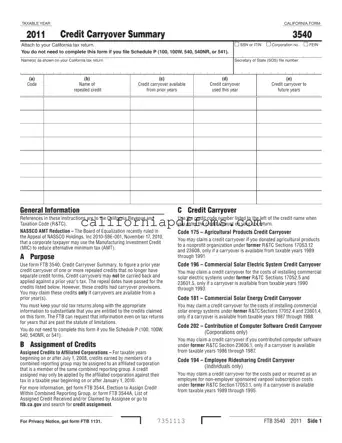

The California Form 3540 serves as a Credit Carryover Summary, designed for taxpayers to report and calculate credit carryovers from prior years for certain repealed credits. This form is essential for individuals and corporations looking to utilize available credits that...

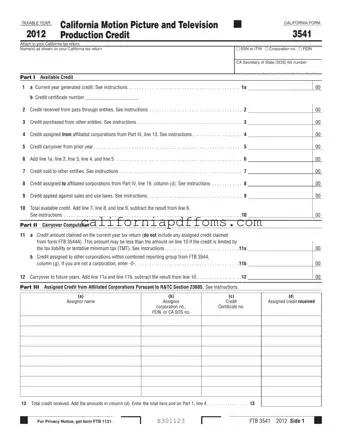

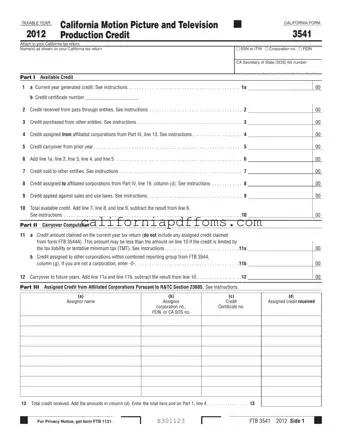

The California 3541 form is a crucial document for taxpayers involved in the motion picture and television industry. It allows qualified individuals and corporations to claim tax credits for production expenses incurred in California. By understanding how to fill out...

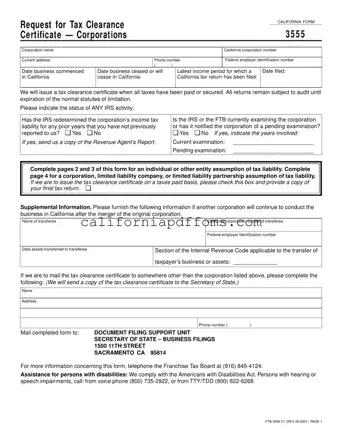

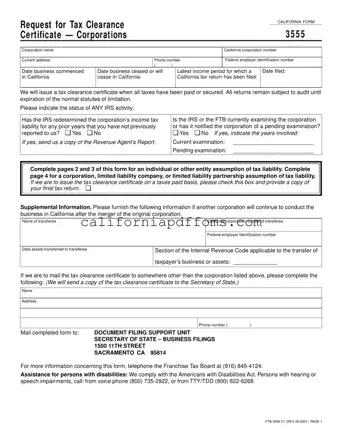

The California 3555 form is a document used to request a tax clearance certificate for corporations. This certificate confirms that all taxes have been paid or secured before a business can dissolve or transfer its assets. Completing this form is...

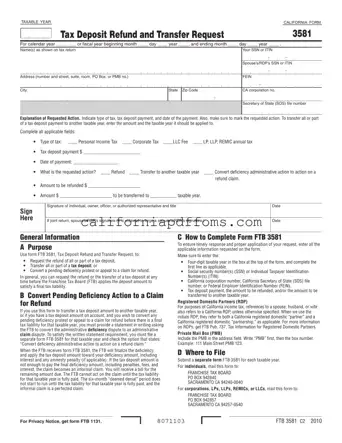

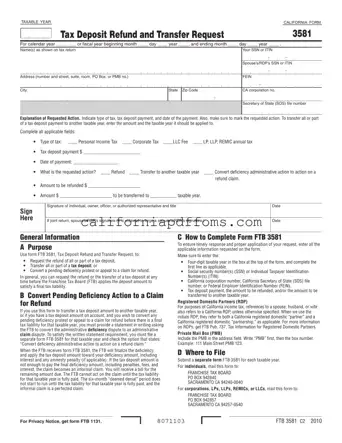

The California Form 3581 is a document used to request a refund or transfer of tax deposits made to the Franchise Tax Board (FTB). Taxpayers can utilize this form to manage their tax deposits effectively, whether seeking a refund, transferring...

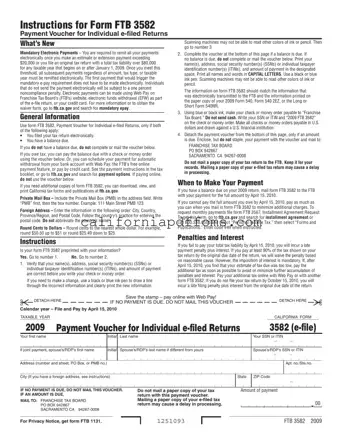

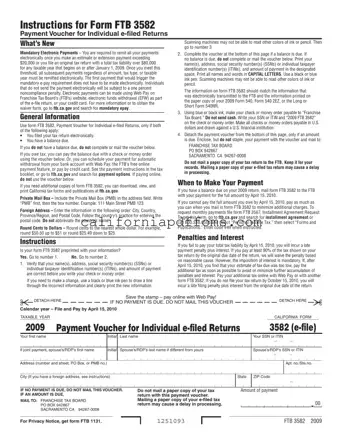

The California 3582 form, officially known as the Payment Voucher for Individual e-filed Returns, is essential for taxpayers who have filed their returns electronically and owe a balance. This form facilitates the payment process, ensuring that payments are submitted correctly...

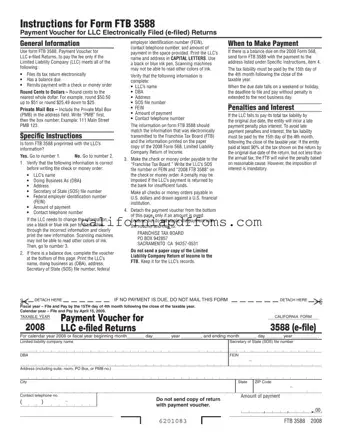

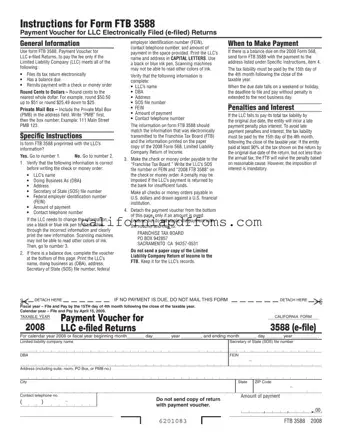

The California 3588 form is a payment voucher specifically designed for Limited Liability Companies (LLCs) that file their tax returns electronically and have a balance due. This form ensures that payments are processed correctly and helps avoid penalties associated with...

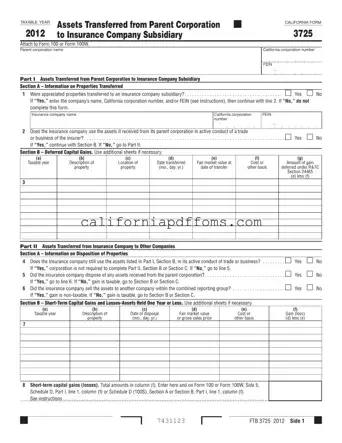

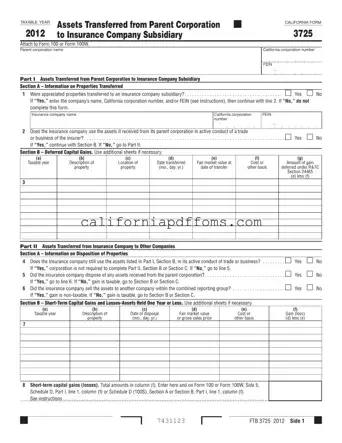

The California Form 3725 is used to report assets transferred from a parent corporation to an insurance company subsidiary. This form helps track these transactions and calculate any capital gains or losses that may arise from such transfers. If you...

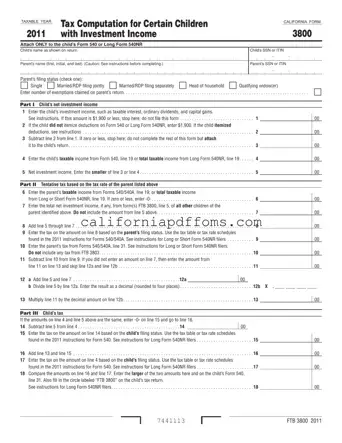

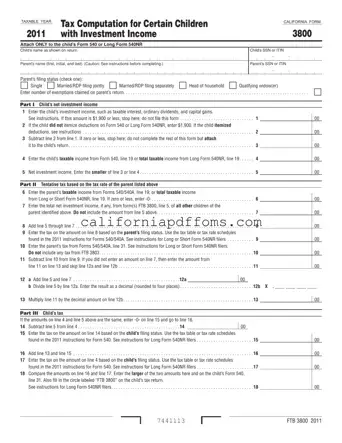

The California Form 3800 is used to compute the tax for certain children who have investment income exceeding $1,900. This form must be attached to the child's Form 540 or Long Form 540NR. Parents can utilize this form to determine...

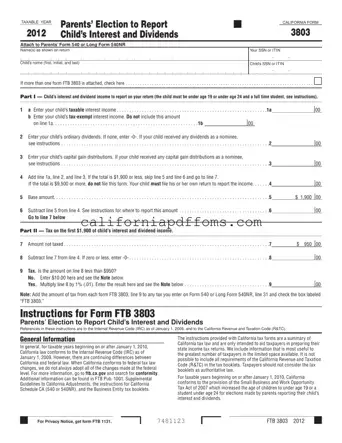

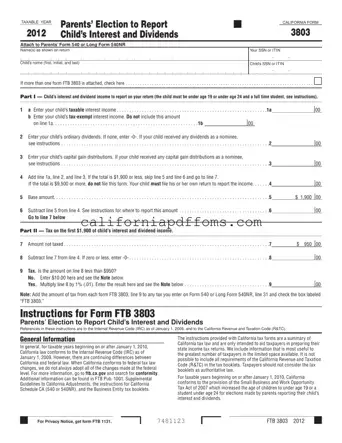

The California Form 3803, also known as the Parents’ Election to Report Child’s Interest and Dividends, allows parents to report their child's income on their own tax return. This form is applicable when a child is under 19 or a...