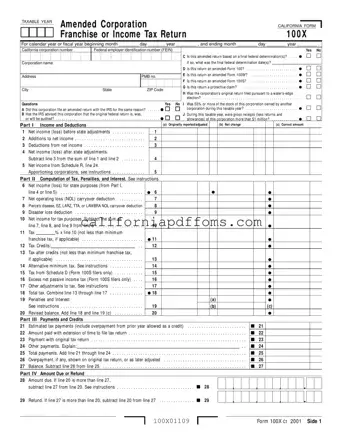

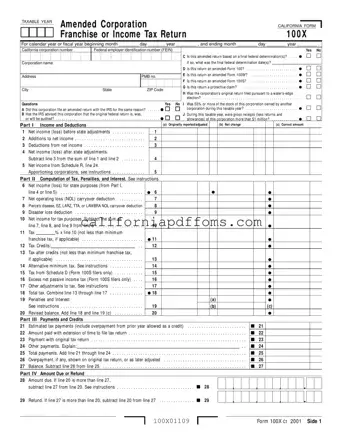

The California 100X form is an amended corporation franchise or income tax return used by corporations to correct or update previously filed tax returns. This form allows businesses to report changes in income, deductions, or other relevant information that may...

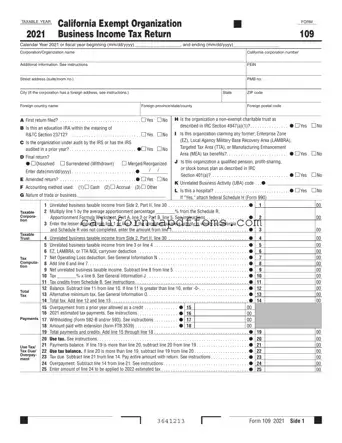

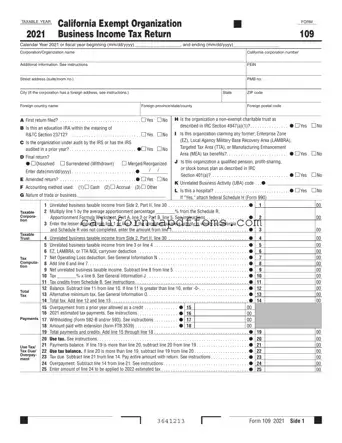

The California 109 form is a tax return specifically designed for exempt organizations operating within the state. This form allows these organizations to report their unrelated business income and calculate any taxes owed. If you need to fill out the...

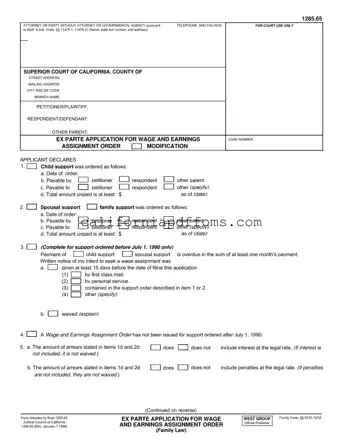

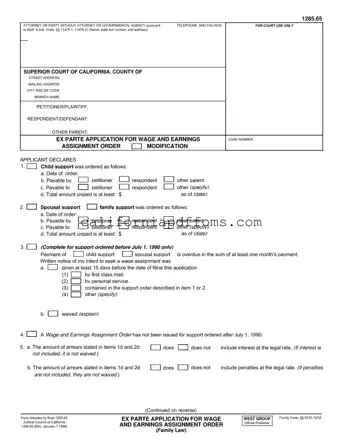

The California 1285 65 form is an official document used in family law cases to request modifications to wage and earnings assignment orders related to child or spousal support. This form allows individuals to declare their circumstances and request adjustments...

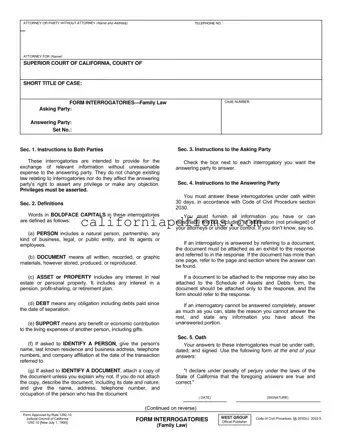

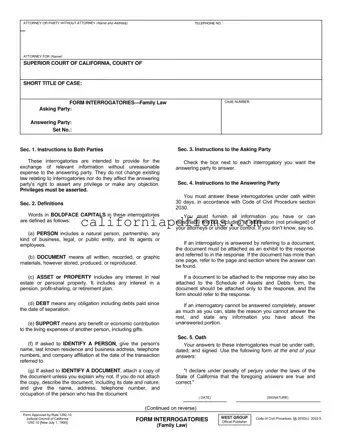

The California 1292 10 form, also known as the Form Interrogatories for Family Law, is a legal document used to facilitate the exchange of relevant information between parties involved in family law proceedings. This form includes a series of questions...

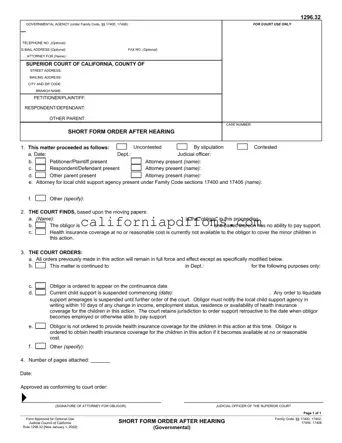

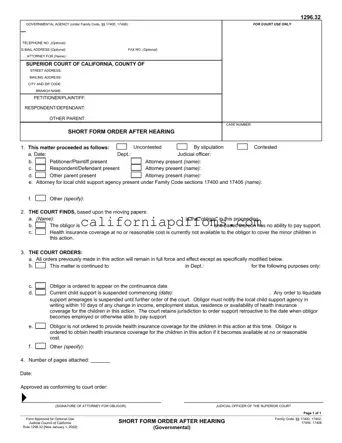

The California 1296 32 form serves as a Short Form Order After Hearing, primarily utilized in family law cases concerning child support matters. This form is designed for use by governmental agencies and outlines the court's findings and orders related...

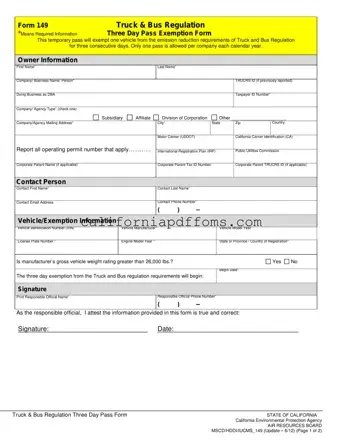

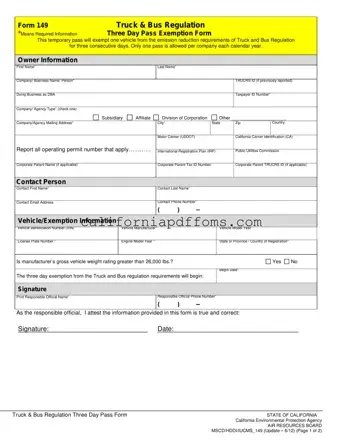

The California 149 form is a temporary pass that allows a fleet owner to operate one vehicle that does not meet emission reduction requirements for three consecutive days. This exemption is available once per company each calendar year. To ensure...

The California Form 3500 is an application used by organizations seeking tax-exempt status in California. This form collects essential information about the organization, including its structure, activities, and financial data, to determine eligibility for exemption from state taxes. Completing this...

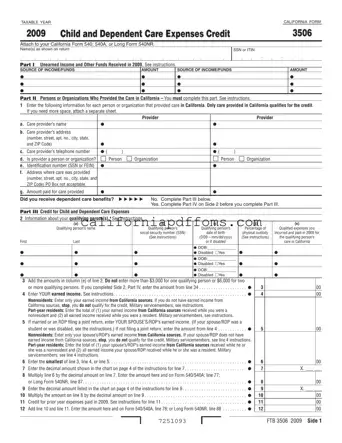

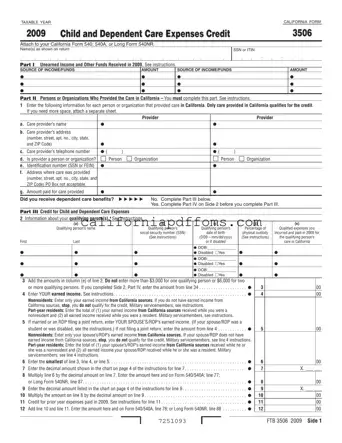

The California 3506 form is used to claim the Child and Dependent Care Expenses Credit for the taxable year. This form must be attached to your California tax return, specifically Forms 540, 540A, or Long Form 540NR. Completing this form...

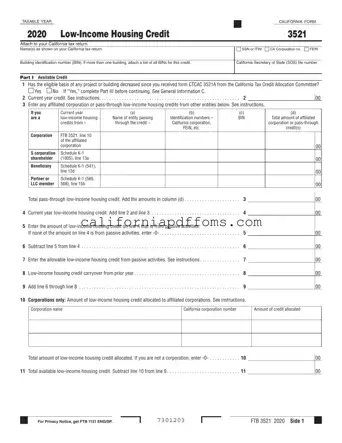

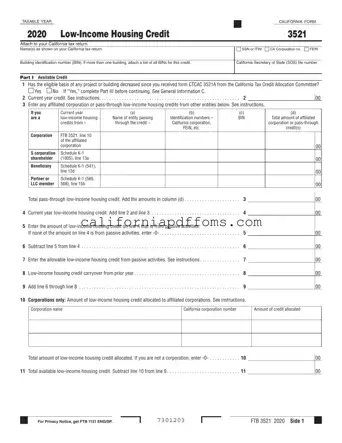

The California 3521 form is used to claim the Low-Income Housing Credit on your California tax return. This form is essential for those involved in low-income housing projects, as it helps ensure that eligible taxpayers receive the appropriate credits. Completing...

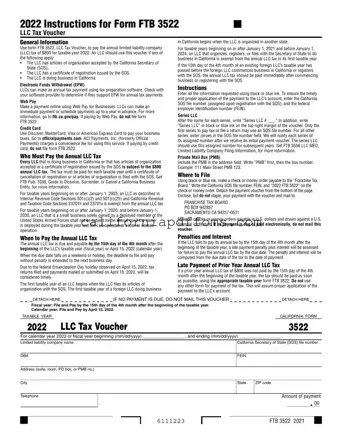

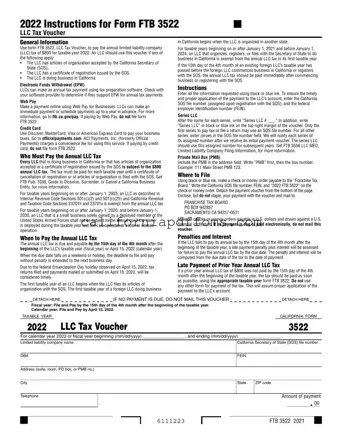

The California 3522 form, also known as the LLC Tax Voucher, is used by limited liability companies (LLCs) to pay the annual tax of $800 for the taxable year. This form is essential for any LLC that has been accepted...

The California Form 3523 is a tax document used to claim the Research Credit for businesses operating in California. This form is essential for corporations, individuals, and other entities that have incurred qualified research expenses during the taxable year. Completing...

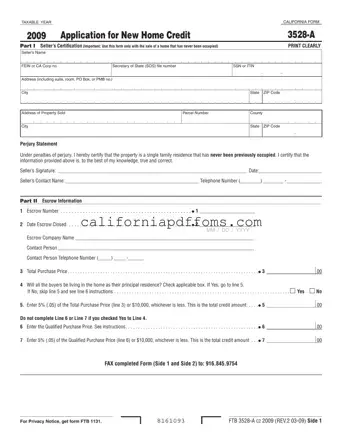

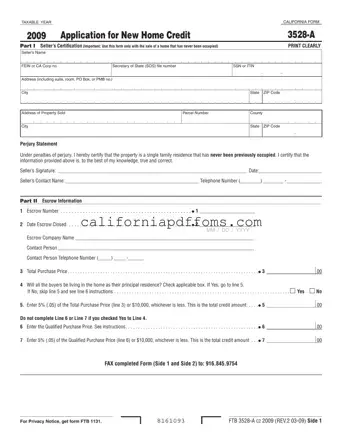

The California Form 3528 A is an application for the New Home Credit, designed for sellers of new homes that have never been occupied. This form is essential for individuals selling such properties and helps facilitate tax credits for eligible...