Fill in Your Schedule California 540 Template

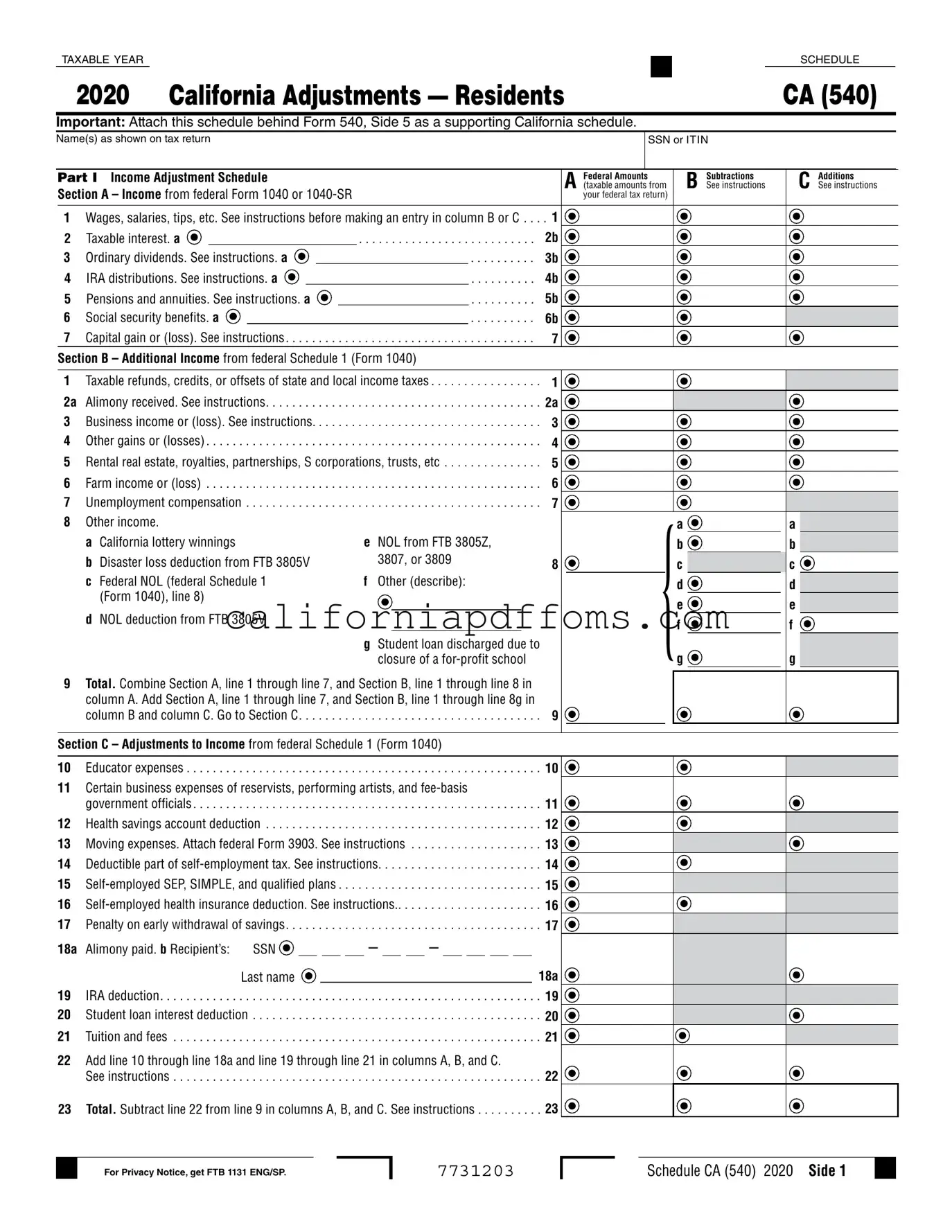

The Schedule California 540 form is an essential document for residents filing their state income tax returns. It is used to report adjustments to income and deductions that differ from federal tax calculations. This form includes several sections, such as income adjustments, where taxpayers list their federal income amounts and any necessary subtractions or additions specific to California tax law. Additionally, it addresses adjustments to itemized deductions, allowing taxpayers to modify their federal itemized deductions for state purposes. Important categories covered include wages, interest, dividends, retirement distributions, and various deductions like medical expenses and mortgage interest. By accurately completing this form, taxpayers can ensure compliance with California tax regulations while maximizing their potential deductions and credits. Remember to attach the Schedule CA behind Form 540, Side 5, as it serves as a supporting document for your state tax return.

Create Common PDFs

California Form 100s - Taxpayers need to keep previous tax returns and related documents to support their claims.

Dependent Care Credit Income Limit - The California 3506 form allows taxpayers to claim the Child and Dependent Care Expenses Credit for the taxable year 2009.