Fill in Your California Std 236 Template

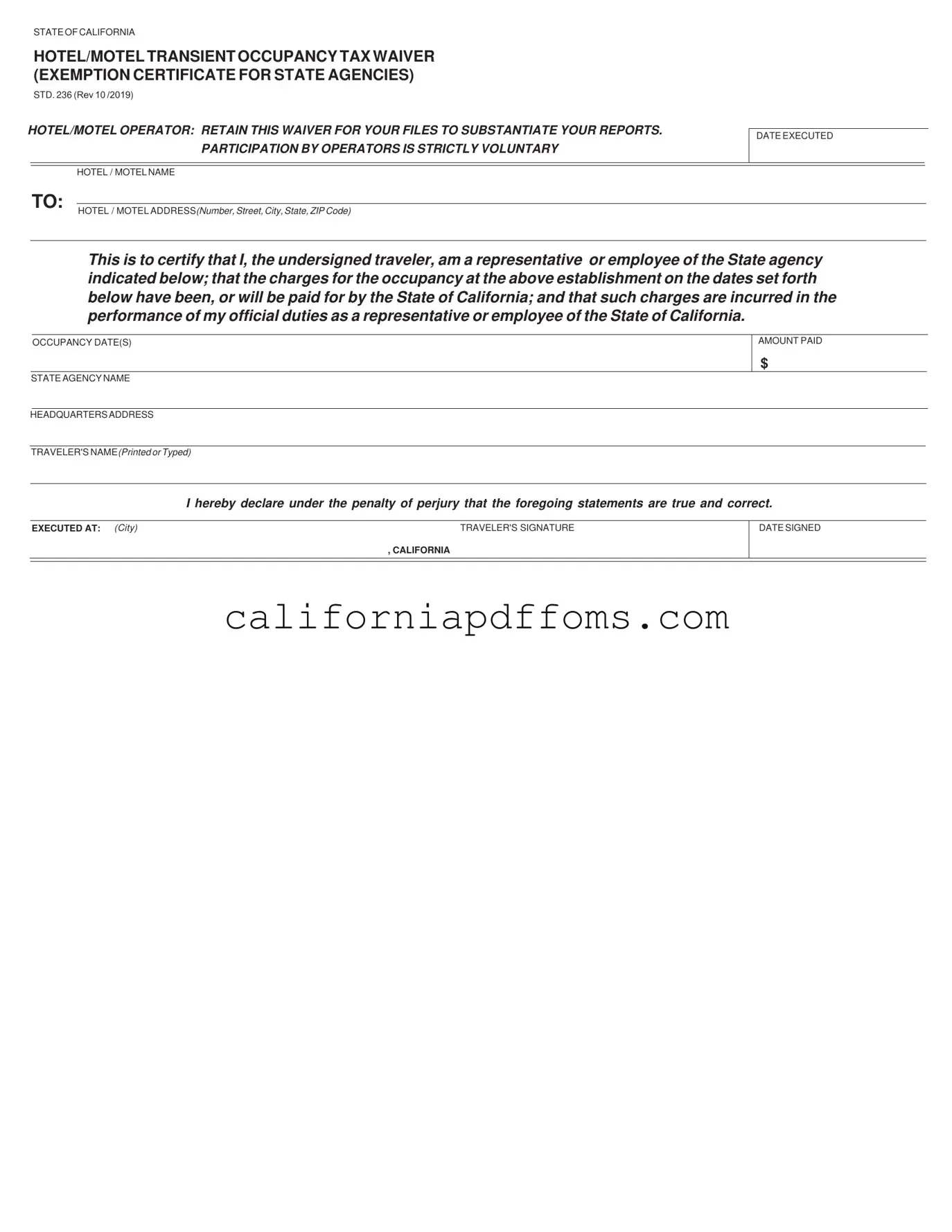

The California Std 236 form serves a crucial role in the management of transient occupancy taxes for state agencies. This waiver, also known as the Exemption Certificate for State Agencies, allows state employees to stay at hotels or motels without incurring the typical occupancy tax. By using this form, hotel operators can substantiate their reports and ensure compliance with state regulations. The form requires essential details, including the hotel or motel's name and address, the dates of occupancy, and the name of the state agency responsible for the payment. Travelers must also provide their name, signature, and a declaration affirming that their stay is for official duties. It is important for hotel operators to retain this waiver for their records, as participation is voluntary but necessary for proper tax documentation. Understanding the nuances of the Std 236 form can help both state employees and hotel operators navigate the complexities of state travel and tax obligations effectively.

Create Common PDFs

3521 - This form must be attached to your California tax return for the taxable year specified.

Balance Sheet Meaning - Signing and dating the form confirms the accuracy of the disclosed financial information.

Osha 5020 - Report all injuries no matter how minor; it’s better to be thorough.