Fill in Your California Sr 10 Template

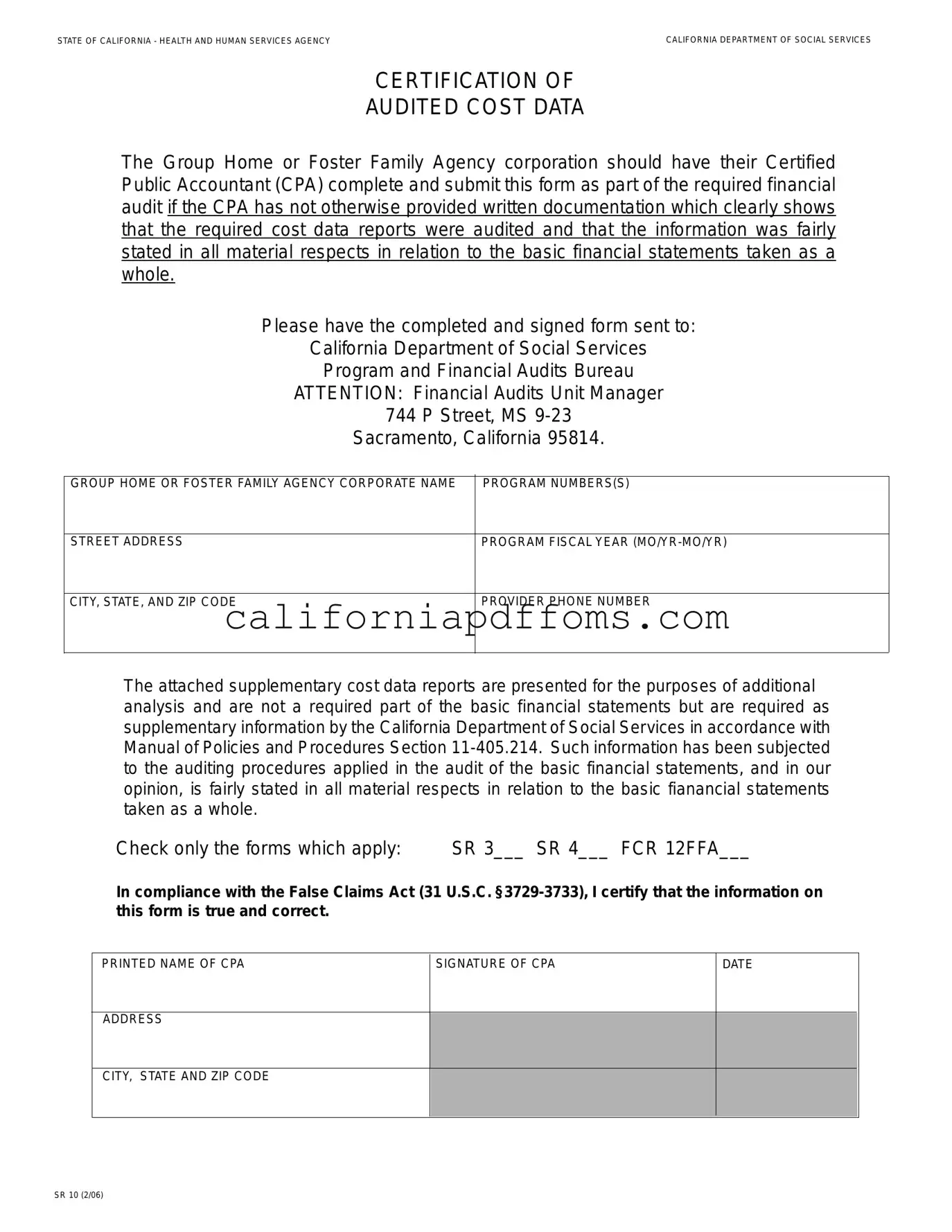

The California SR 10 form plays a crucial role in the financial auditing process for Group Homes and Foster Family Agencies. This form must be completed by a Certified Public Accountant (CPA) as part of the required financial audit, ensuring that the cost data reports are accurately represented. If the CPA has not provided separate documentation confirming that the required reports were audited and fairly stated, the SR 10 form becomes essential. It includes vital information such as the corporate name of the agency, program numbers, and fiscal year details. Additionally, the form requires submission to the California Department of Social Services, specifically to the Program and Financial Audits Bureau. Supplementary cost data reports accompany the SR 10, providing further analysis, although they are not mandatory for the basic financial statements. Nonetheless, these supplementary reports must still be audited to maintain integrity. The CPA must certify the accuracy of the information, adhering to the standards set forth by the False Claims Act. This certification underscores the importance of transparency and accountability in financial reporting for agencies serving vulnerable populations.

Create Common PDFs

Student Form - Submit the completed form directly to the California Student Aid Commission.

Medicine Forms - Each physician must certify the accuracy of the information provided in the application.

California Form 3532 - The form also asks for any prior names you may have used for identification purposes.