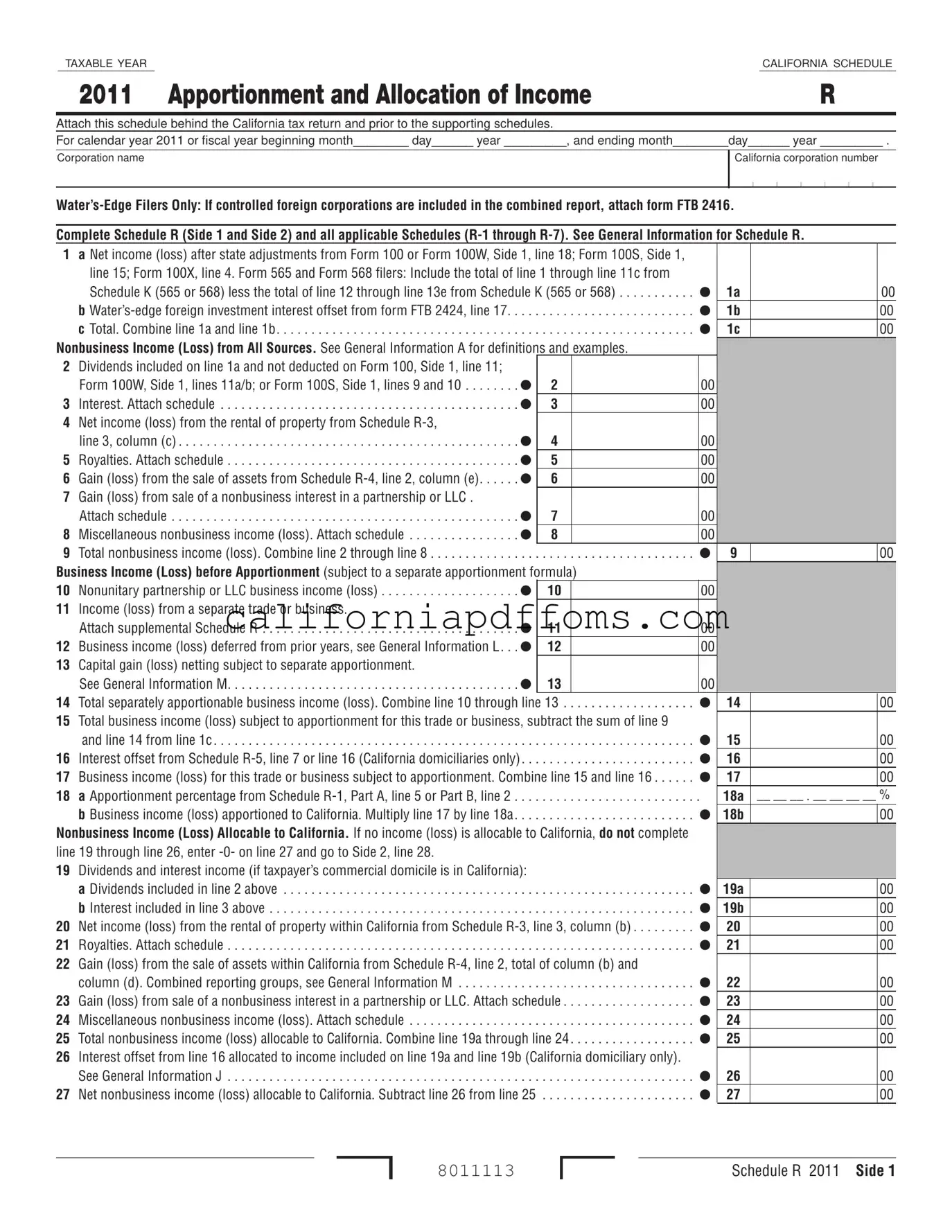

Fill in Your California Schedule R Template

The California Schedule R form is an essential document for corporations operating within the state, particularly those that need to allocate and apportion income for tax purposes. This form must be attached to the California tax return and includes detailed instructions for completing both sides, as well as associated schedules R-1 through R-7. It is designed to capture various types of income, including business and nonbusiness income, and it provides a framework for determining how much of that income is subject to California taxation. Corporations must report net income or loss after state adjustments, as well as any dividends, interest, rental income, royalties, and gains or losses from asset sales. The form also includes provisions for calculating apportionment percentages, which are critical for determining the portion of income that is taxable in California. For corporations that engage in water's-edge filing, there are additional requirements, such as attaching form FTB 2416 if controlled foreign corporations are included in the combined report. Overall, understanding the nuances of the Schedule R form is crucial for compliance and accurate tax reporting in California.

Create Common PDFs

Form 5805 California 2022 - Use this form to verify whether your tax withholdings were sufficient to avoid penalties.

Ca Tax Credit - This form is used to request a refund of tax deposits in California.