Fill in Your California Sales Tax Certificate Template

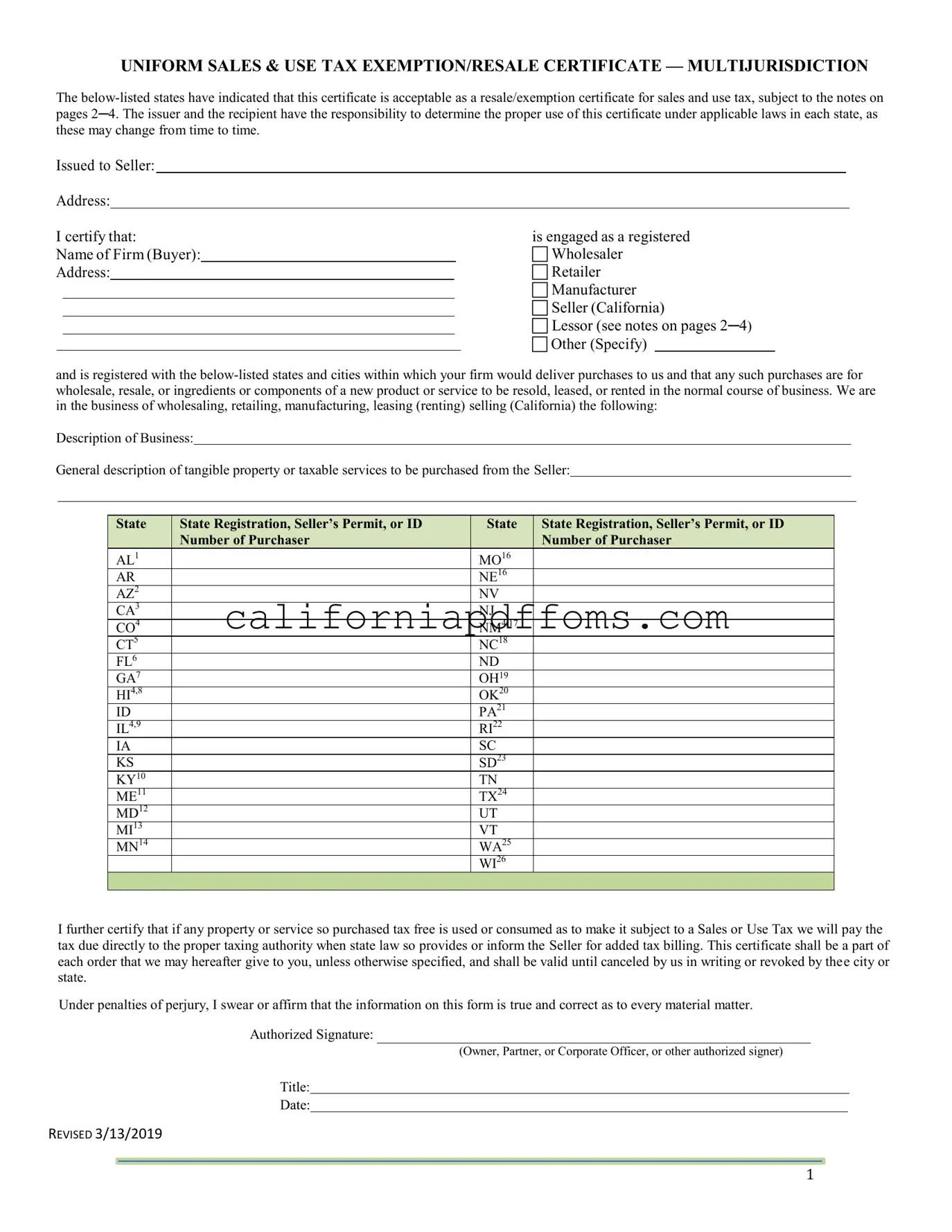

The California Sales Tax Certificate form is an essential document for businesses engaged in the sale of goods and services. It serves as a resale and exemption certificate, allowing buyers to purchase items without paying sales tax, provided those items are intended for resale or incorporation into a new product. The form requires the buyer to provide specific information, including their business name, address, and type of business, such as wholesaler or retailer. Additionally, buyers must list their state registration numbers, ensuring compliance with tax regulations across multiple jurisdictions. This certificate is not only a tool for tax exemption but also a way for sellers to protect themselves from potential tax liabilities. Buyers must complete the form accurately, and sellers need to keep it on file to validate the tax-exempt status of the transaction. Misuse of the certificate can lead to penalties, so it’s crucial for both parties to understand their responsibilities. Overall, this form plays a vital role in the sales process, streamlining transactions while ensuring adherence to tax laws.

Create Common PDFs

Form 500x - Individuals should write "CFC Credit" on their tax returns when attaching this form.

File a Motion for Child Support - Accurate completion of the form can prevent further complications in court.

California Jv 445 - Parents and guardians can find specifics regarding the child's educational, health, and developmental needs on this form.