Fill in Your California Note Secured Template

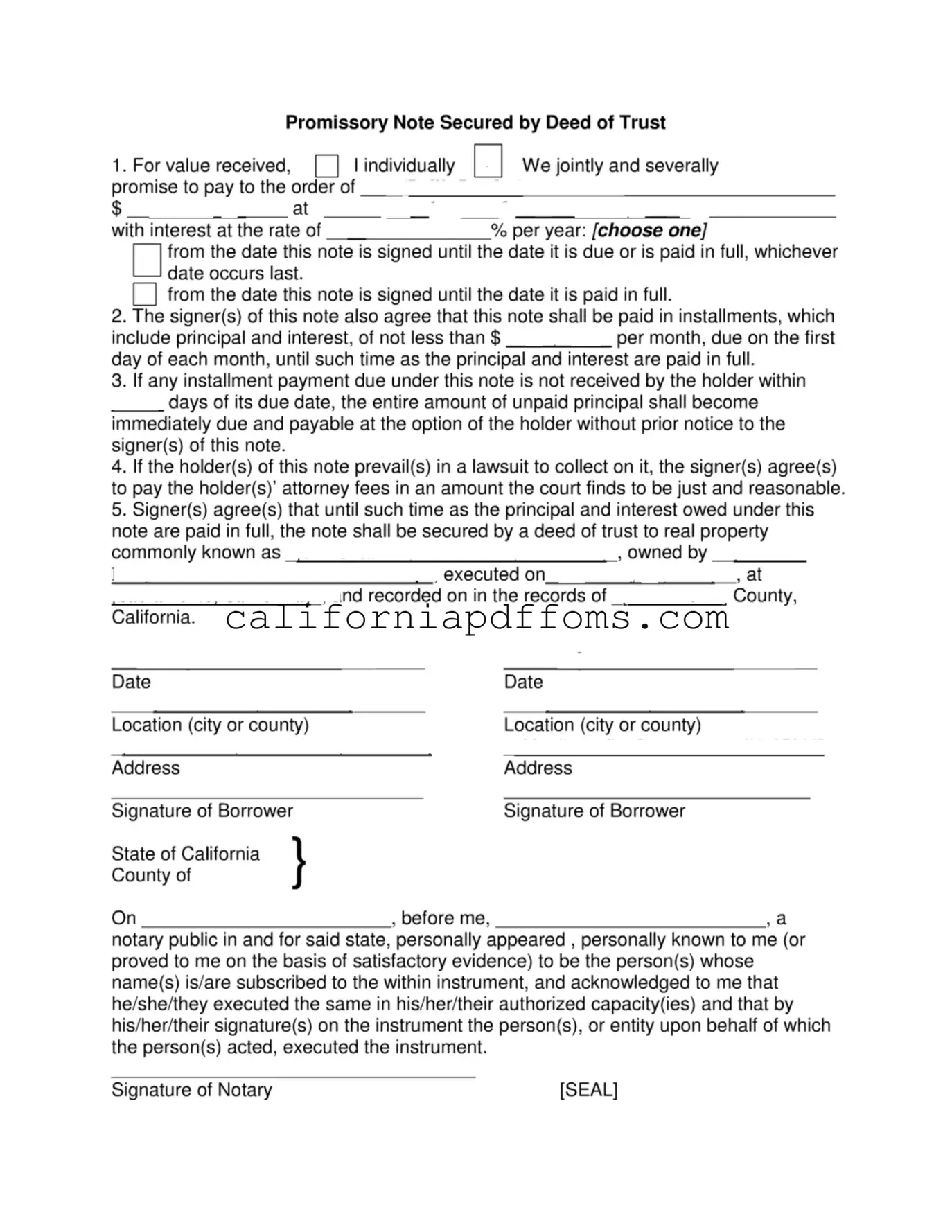

The California Note Secured form serves as a crucial document in the realm of real estate transactions and personal lending. This form outlines a promissory note that is secured by a deed of trust, providing both the borrower and the lender with a clear framework for repayment. At its core, the form stipulates that the borrower promises to repay a specified amount of money, along with interest, over a defined period. Importantly, it allows for installment payments, ensuring that the borrower can manage their financial obligations on a monthly basis. Should the borrower fail to make a payment on time, the lender has the right to demand the entire unpaid amount immediately. Additionally, the form includes provisions for legal fees, emphasizing that if the lender must resort to legal action to collect on the note, the borrower will be responsible for those costs. Security for the note is provided by a deed of trust on real property, which means that the lender has a claim to the property in case of default. This multifaceted approach not only protects the lender's interests but also outlines the responsibilities and rights of the borrower, creating a balanced agreement that is essential in financial transactions.

Create Common PDFs

California 3500 - The organization must confirm it has not had its exemption status revoked previously.

Can You Work 4 10 Hour Days in California - Clear communication with management is key to a successful transition to alternative hours.