Fill in Your California Llc 12 Template

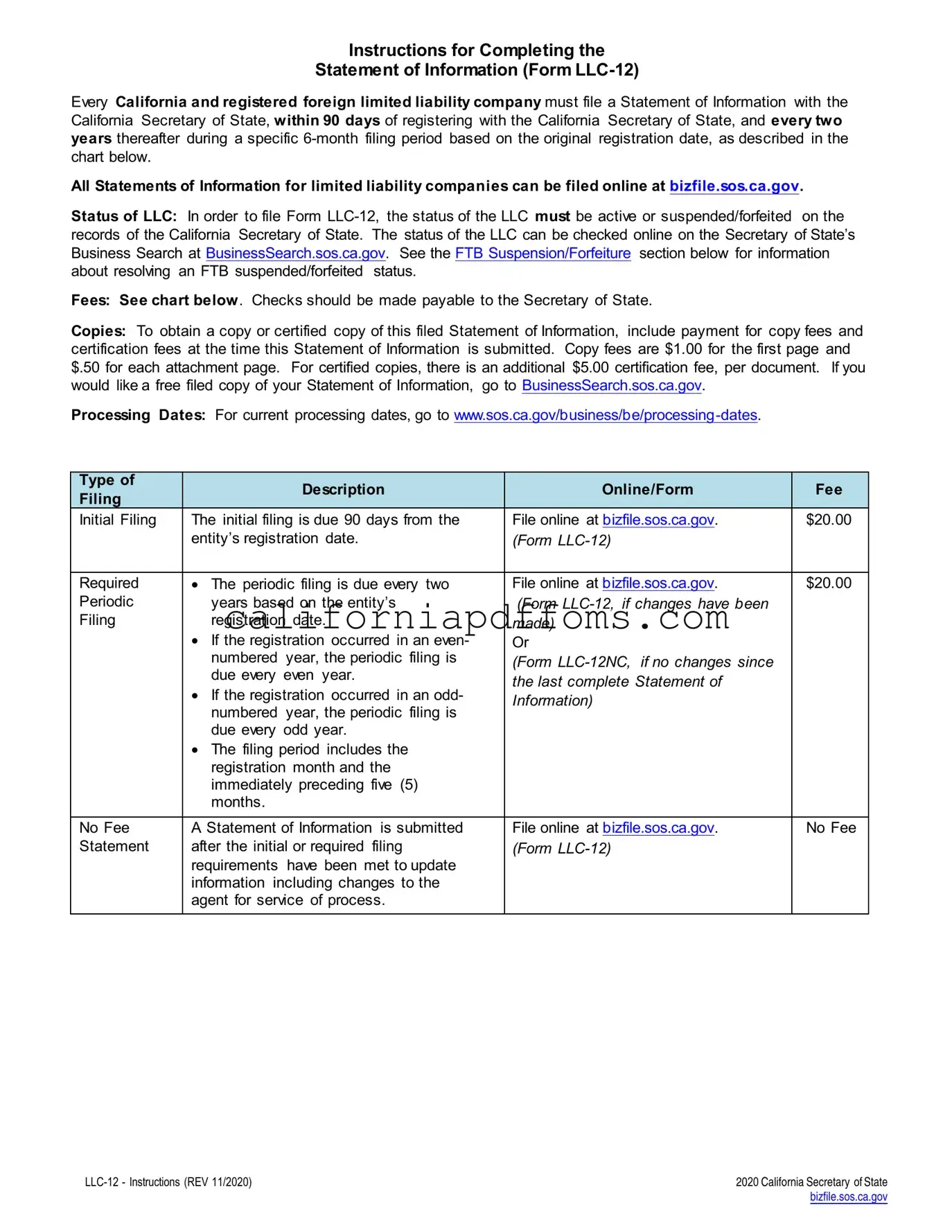

The California LLC 12 form, officially known as the Statement of Information, plays a crucial role in maintaining the transparency and accountability of limited liability companies (LLCs) in the state. Every California-based LLC, as well as registered foreign LLCs, must file this form within 90 days of their initial registration and subsequently every two years during a designated filing period. This ensures that the state has up-to-date information about the company’s structure and operations. The form requires essential details, including the LLC's name, principal office address, and the names of its managers or members. Additionally, it mandates the designation of an agent for service of process, who is responsible for receiving legal documents on behalf of the LLC. Filing can conveniently be done online, and while there is a nominal fee associated with the initial and periodic filings, there are no fees for submitting updates after the required filings are complete. It’s important to check the LLC's status with the California Secretary of State before filing, as only active entities can submit this form. Failure to comply with these filing requirements can lead to penalties, underscoring the importance of staying organized and proactive in managing your LLC's obligations.

Create Common PDFs

Earthquake Claims - Indicate to whom the insurance bill should be sent.

3521 - Previous years' credits can be carried over and must be reported accurately on the form.