Fill in Your California Ftb 626 Template

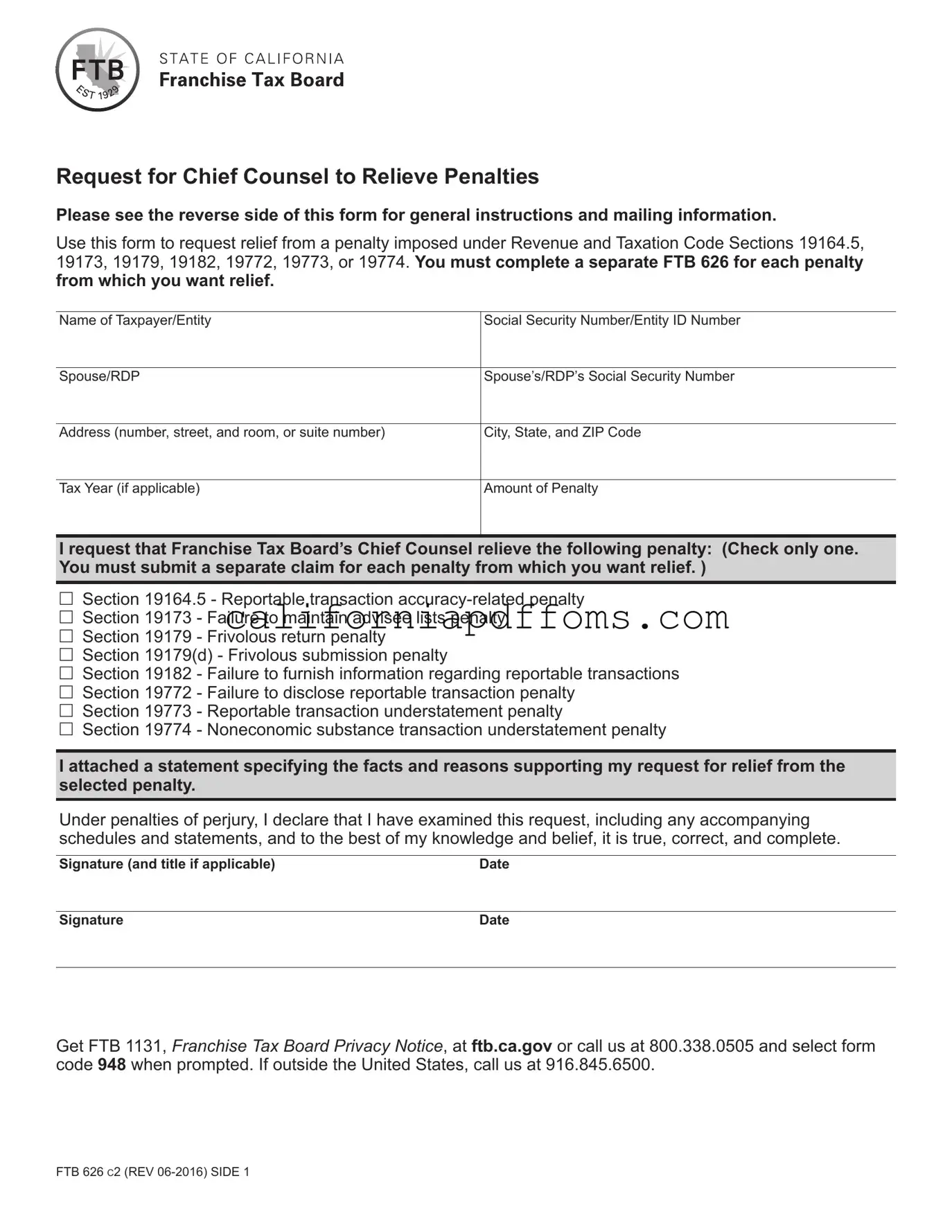

The California FTB 626 form serves as a crucial tool for taxpayers seeking relief from specific penalties imposed by the Franchise Tax Board. This form allows individuals and entities to formally request that the Chief Counsel exercise discretion in relieving penalties under several sections of the Revenue and Taxation Code. Taxpayers must complete a separate FTB 626 for each penalty they wish to contest, ensuring that all necessary information is accurately provided. Key details required on the form include the taxpayer's name, Social Security Number or Entity Identification Number, and the specific penalty from which relief is being sought. The penalties eligible for relief cover a range of issues, such as reportable transaction accuracy-related penalties and frivolous return penalties, among others. To support their request, taxpayers are required to attach a statement that outlines the facts and reasons justifying their appeal for relief. The importance of accurate completion and timely submission of this form cannot be overstated, as it directly impacts the outcome of the relief request. Furthermore, the form includes specific instructions for both individual and business entity taxpayers, ensuring clarity in the process of seeking penalty relief.

Create Common PDFs

Is It Hard to Get a Ccw in California - It includes sections for personal information and disclosure of background details.

Ca Mansion Tax - Clear documentation supports smoother tax management for businesses.