Fill in Your California Fl140 Template

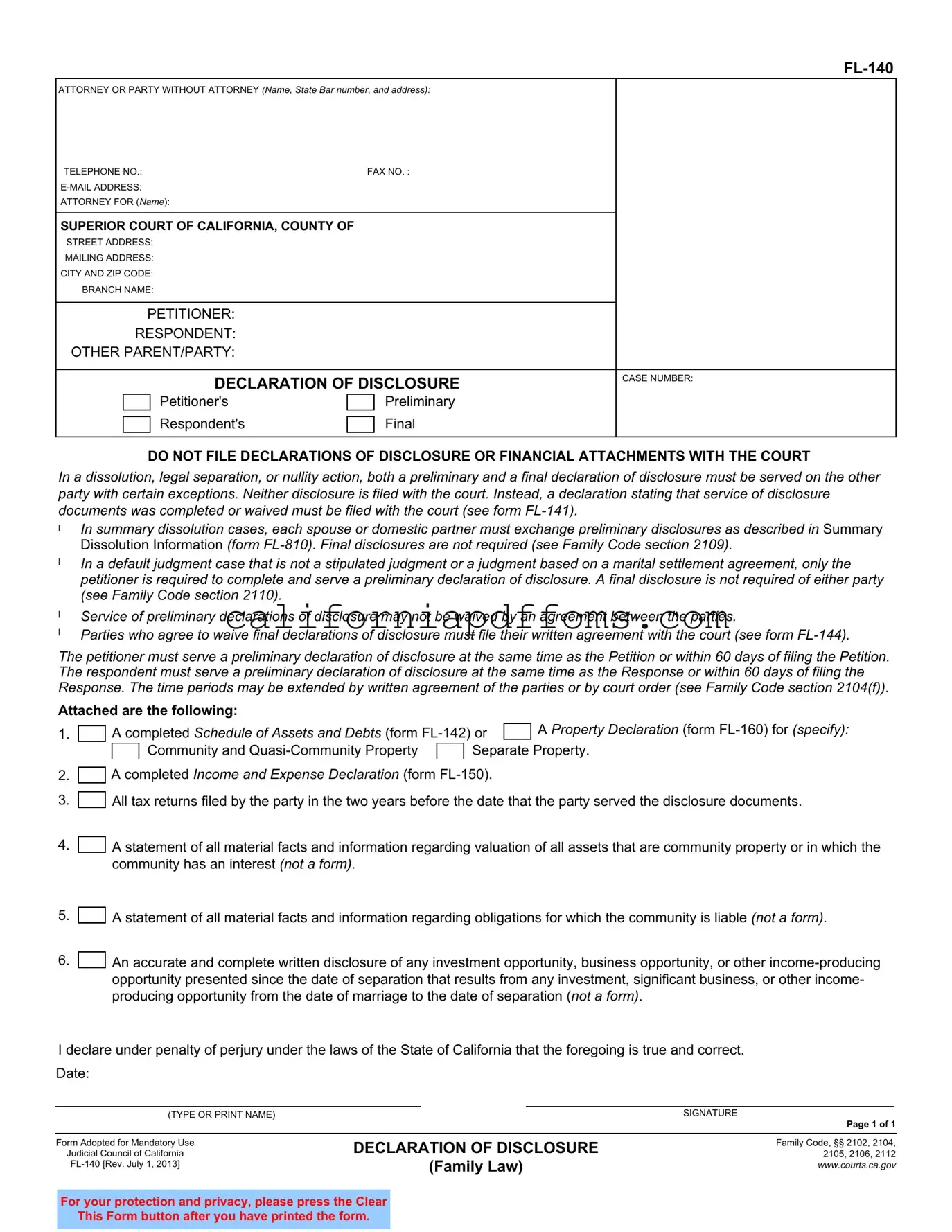

The California FL-140 form plays a crucial role in family law proceedings, particularly in cases involving dissolution, legal separation, or nullity. This form is part of the disclosure process required by California law, ensuring that both parties in a family law case provide essential financial information to each other. It encompasses details such as the parties' names, contact information, and the specific court handling the case. Importantly, the FL-140 facilitates the exchange of preliminary and final declarations of disclosure, which must be served to the other party but not filed with the court. Exceptions exist, such as in summary dissolution cases where final disclosures are not mandated. The form also outlines the obligations of both the petitioner and respondent regarding the timing and content of the disclosures, which include a Schedule of Assets and Debts, an Income and Expense Declaration, and pertinent tax returns. The completion of the FL-140 is vital for maintaining transparency and fairness in the division of assets and liabilities, ultimately aiding the court in making informed decisions. Furthermore, it emphasizes the necessity of accurate reporting of all financial interests, ensuring that both parties are fully aware of their financial circumstances during the proceedings.

Create Common PDFs

Schedule R Instructions - It is specifically designed for corporations that operate both within and outside California.

Ca Cosmetology License Lookup - Signature on the form certifies your information is true and complete under penalty of perjury.

How to File Mechanics Lien California - The form must be served in a timely manner to fulfill legal requirements.