Fill in Your California De 4 Template

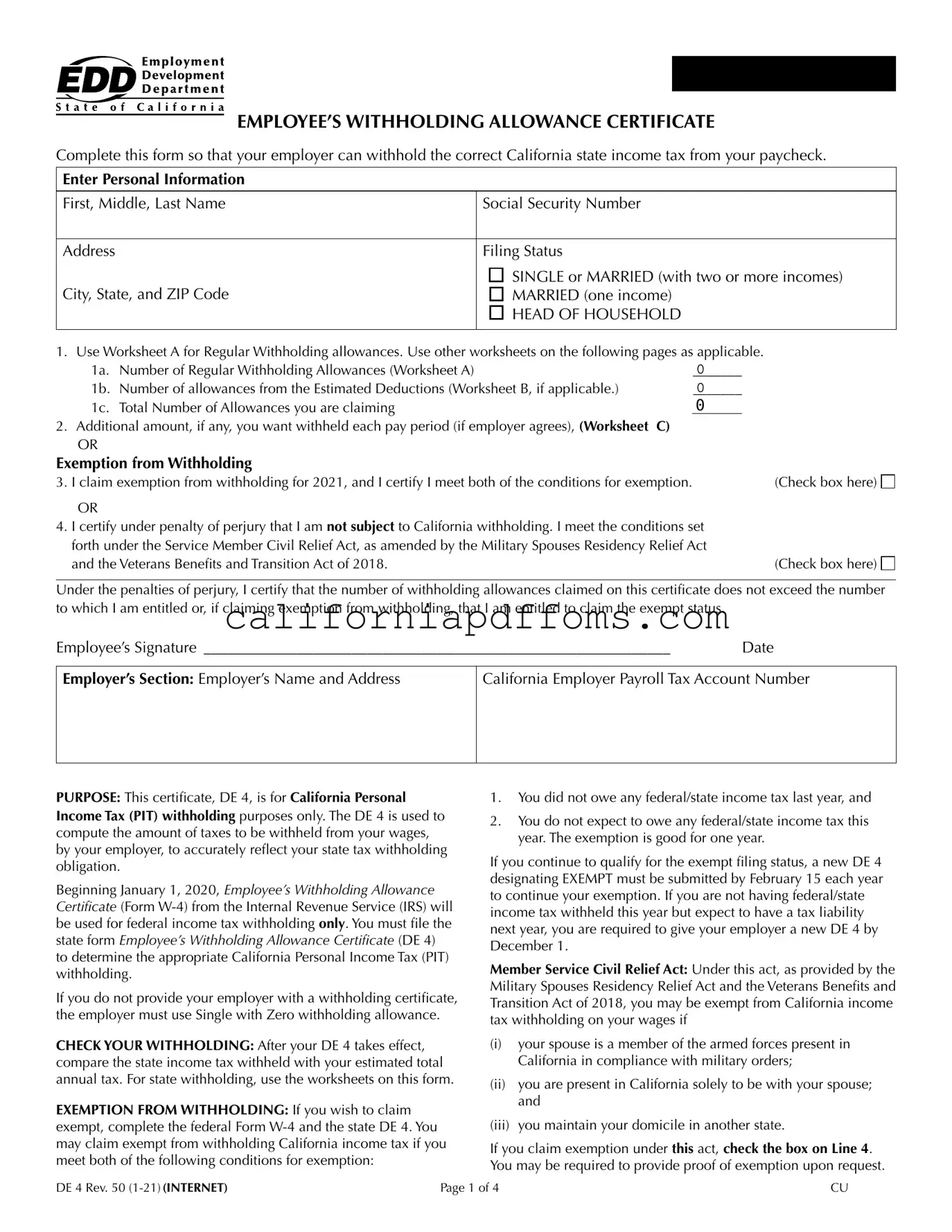

The California DE 4 form, known as the Employee’s Withholding Allowance Certificate, is an essential document for anyone working in California. This form helps employees communicate their tax situation to their employers, ensuring that the correct amount of state income tax is withheld from their paychecks. By completing the DE 4, individuals provide personal information, including their name, Social Security number, and address, along with their filing status, which can be single, married, or head of household. The form includes worksheets that guide employees in calculating their withholding allowances based on their unique financial situations, such as dependents or expected deductions. Additionally, employees can indicate if they wish to claim exemption from withholding or certify their eligibility for special exemptions under military provisions. It is crucial for individuals to review their withholding periodically to ensure that they are not over- or under-withheld, which can impact their tax obligations at the end of the year. Failure to submit a DE 4 may result in default withholding at the highest tax rate, which could lead to unexpected tax liabilities. Understanding the DE 4 form is vital for effective tax planning and financial management in California.

Create Common PDFs

California Re 214 - Salespersons who do not reside in California may need to submit an additional form.

3521 - The California Form 3521 is used to claim the Low-Income Housing Credit for eligible individuals and corporations.

Osha 5020 - Every worker deserves to be protected and cared for after an injury.