Fill in Your California De 305 Template

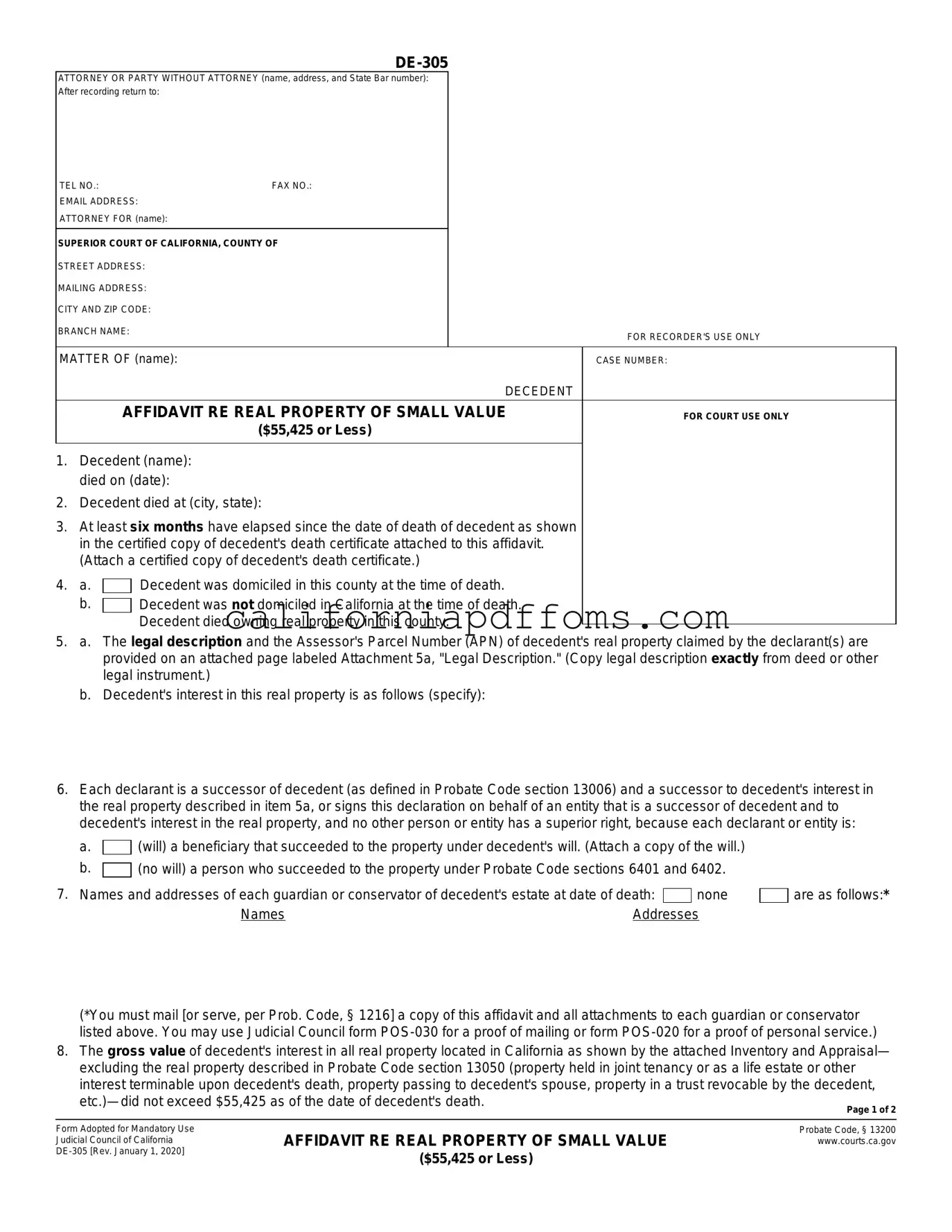

The California DE-305 form serves as an essential legal document for individuals seeking to transfer real property of small value, specifically when the total value does not exceed $55,425. This affidavit is primarily utilized in probate situations where the decedent has passed away, and their estate requires administration. The form requires various pieces of information, including the decedent's name, date of death, and the location of their demise. Additionally, it necessitates a certified copy of the death certificate, which must be attached to the affidavit. The form also outlines the relationship of the declarants to the decedent, confirming their status as successors to the property. To substantiate the claim, the legal description and Assessor's Parcel Number of the real property must be included. Furthermore, the document mandates that an inventory and appraisal of the decedent's interests in real property be attached, demonstrating that the total value of such interests does not exceed the specified threshold. Importantly, the DE-305 form also requires the declaration that all known debts and expenses related to the decedent have been settled, ensuring that the transfer of property occurs without encumbrances. This form thus facilitates a streamlined process for transferring ownership of modestly valued real estate while adhering to California probate laws.

Create Common PDFs

Can You Take a Restraining Order Off Someone - Employers can request specific personal conduct orders against the respondent.

Ca Tax Credit - A detailed explanation of the requested action helps expedite processing.