Fill in Your California Balance Sheet Template

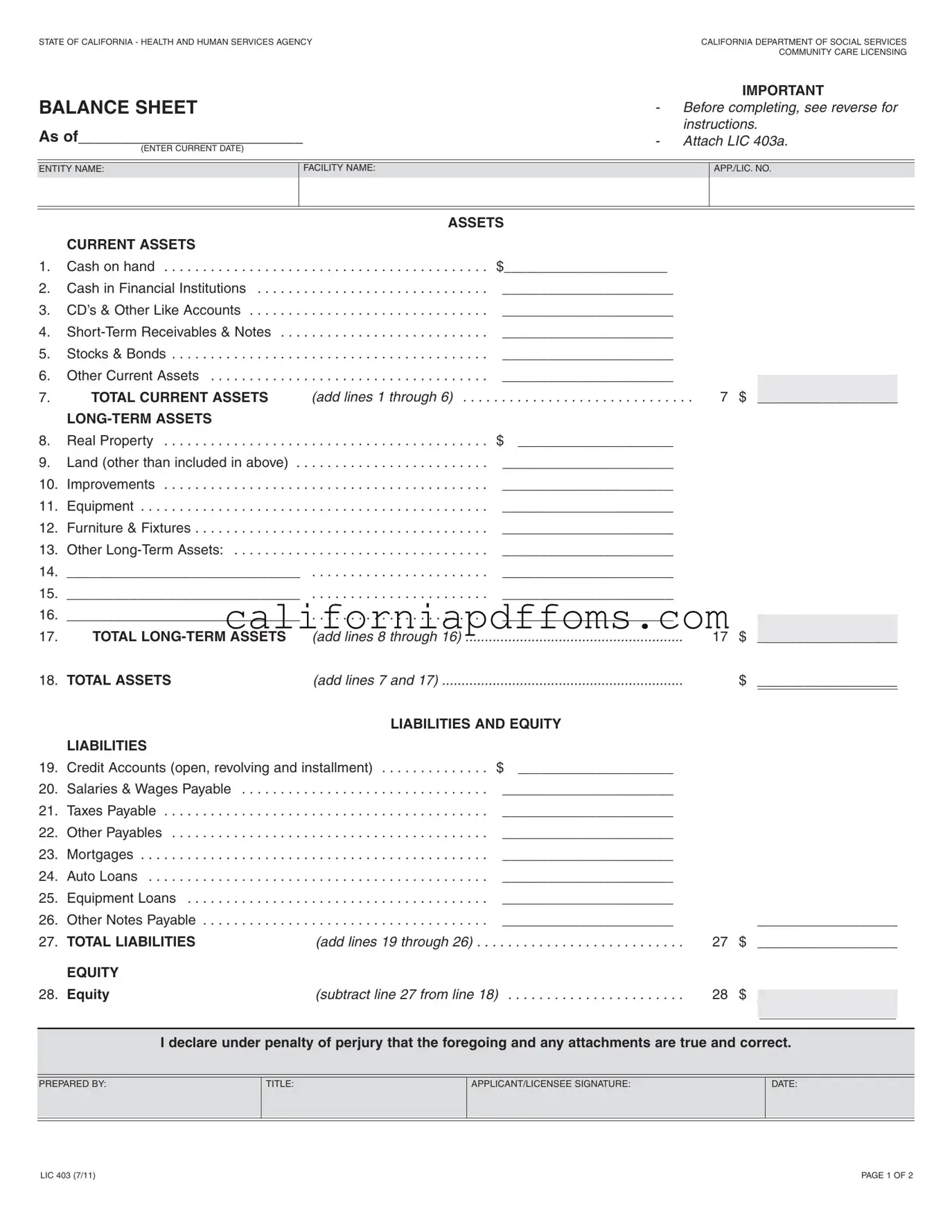

The California Balance Sheet form, officially designated as LIC 403, serves as a critical financial document for entities seeking to operate community care facilities within the state. This form requires applicants and licensees to provide a comprehensive overview of their financial standing by detailing both assets and liabilities. It begins with a section for current assets, where individuals must list various forms of cash and receivables, such as cash on hand, checking accounts, and short-term notes. Following this, the form transitions into long-term assets, encompassing real property, equipment, and other significant investments. The liabilities section demands a thorough accounting of all financial obligations, including credit accounts, salaries payable, and mortgages. Finally, the equity section calculates the difference between total assets and total liabilities, providing a snapshot of the entity's financial health. Completing this form accurately is essential, as it not only reflects the entity's financial position but also ensures compliance with state regulations. Each applicant must also attach the LIC 403a, a supplemental schedule that aids in compiling detailed financial information, making the process of reporting both structured and transparent.

Create Common PDFs

Cdph Laboratory Field Services - Specific addresses for document submission are clearly indicated in the form.

Affidavit of Witness - The purpose of the form is to evaluate potential interference with nearby residents.