Fill in Your California 8879 Template

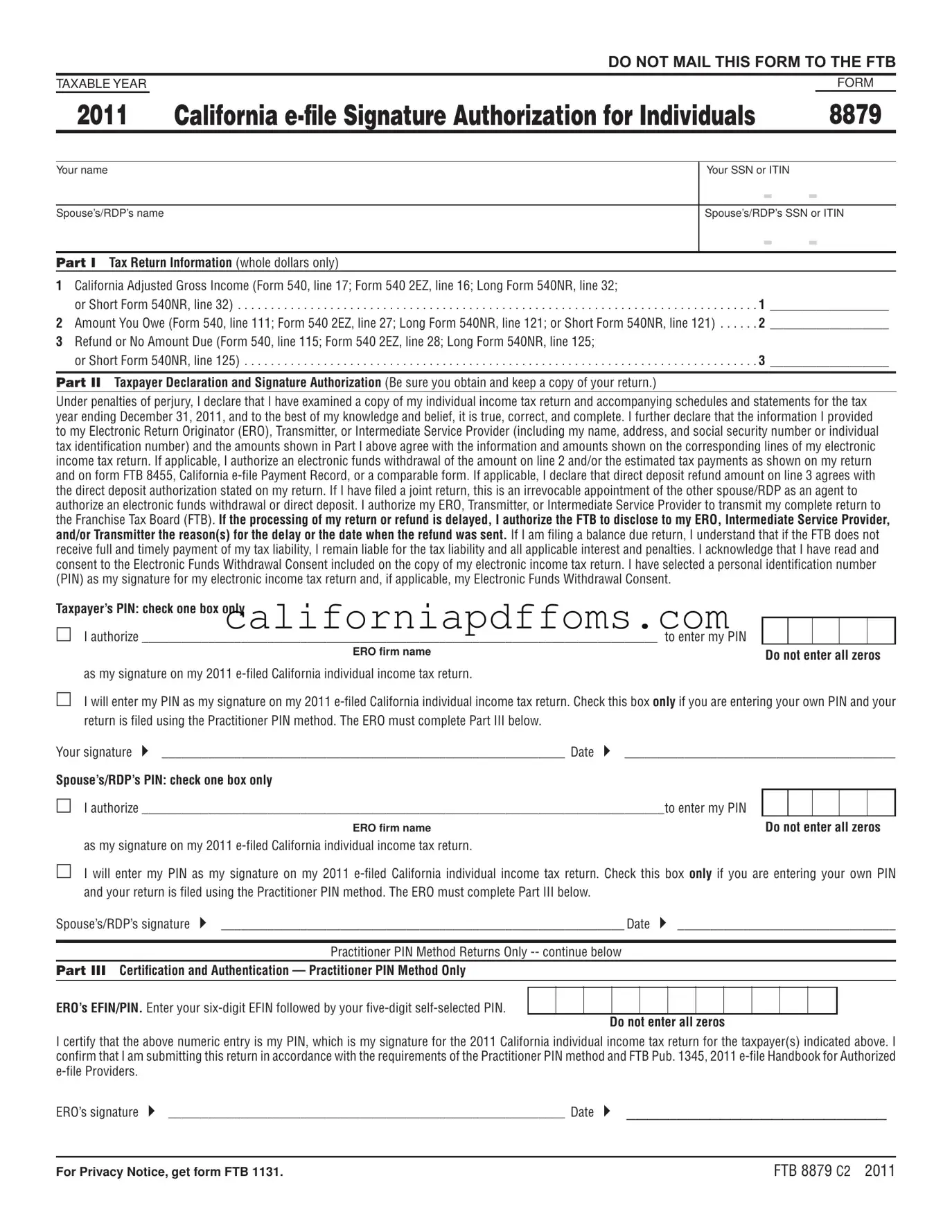

The California 8879 form, known as the California e-file Signature Authorization for Individuals, is an essential document for taxpayers who choose to e-file their individual income tax returns using the Practitioner PIN method. This form serves as a signature authorization, allowing the Electronic Return Originator (ERO) to enter the taxpayer’s personal identification number (PIN) on their electronic tax return. It is important to note that this authorization is specific to the tax return being filed and does not serve as proof of filing; that role is fulfilled by the acknowledgment received from the Franchise Tax Board (FTB) upon acceptance of the return. The form requires taxpayers to provide their names, Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs), and pertinent tax return information, including adjusted gross income, amounts owed, and potential refunds. Taxpayers must also review their tax return for accuracy before signing the form, as they are responsible for the correctness of the information provided. By signing the 8879, individuals consent to various conditions, such as the authorization of electronic funds withdrawal if applicable, and the appointment of their spouse or registered domestic partner as an agent for tax matters if filing jointly. Understanding the requirements and implications of the California 8879 form is crucial for ensuring a smooth e-filing process and compliance with tax obligations.

Create Common PDFs

Form 3832 - It’s used to document the relationship between the state and the LLC's members.

California De 4 - You may request an additional amount to be withheld each pay period.

Block Account - This form is concise yet comprehensive, catering to specific withdrawal needs.