Fill in Your California 8454 Template

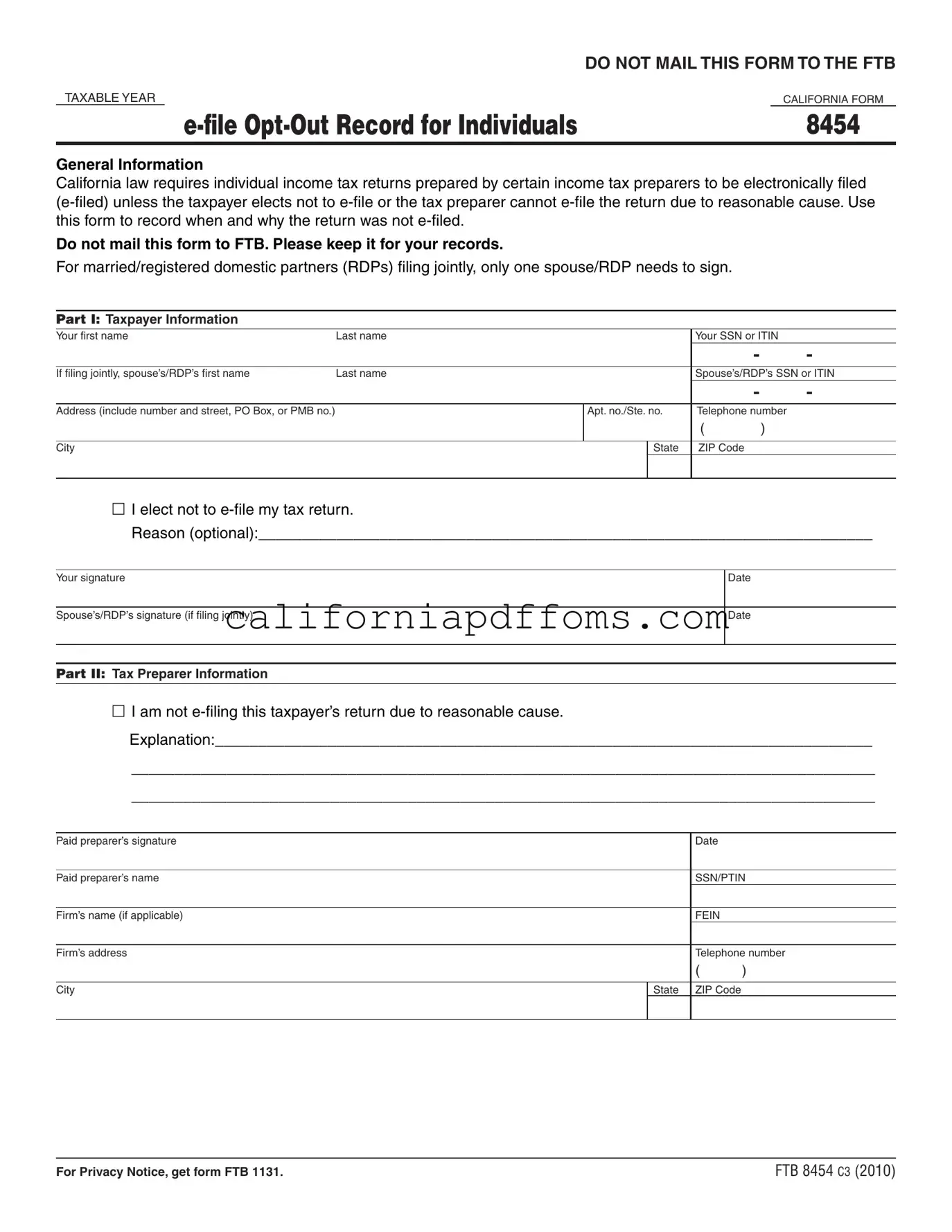

The California Form 8454 serves as an important document for individuals who choose not to electronically file their income tax returns. Under California law, certain tax preparers are required to e-file individual income tax returns unless specific circumstances arise. This form allows taxpayers to formally record their decision to opt out of e-filing, providing a clear reason for this choice if they wish. It’s essential to note that this form should not be mailed to the Franchise Tax Board (FTB); rather, it is meant for the taxpayer’s personal records. For couples filing jointly, only one signature is necessary, simplifying the process. The form includes sections for taxpayer information, including names, Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs), and contact details. Additionally, tax preparers must provide their information if they are unable to e-file the return due to reasonable cause. This ensures that both the taxpayer and the preparer are on the same page regarding the filing method chosen. Understanding the purpose and requirements of Form 8454 can help individuals navigate their tax filing options more effectively.

Create Common PDFs

Fee Waiver Form California - It's important to respond to the court as soon as possible to avoid complications.

Ftb 3522 Form 2024 - This form is specifically used for reporting appreciated properties that are moved to insurance company subsidiaries.