Fill in Your California 700 U Template

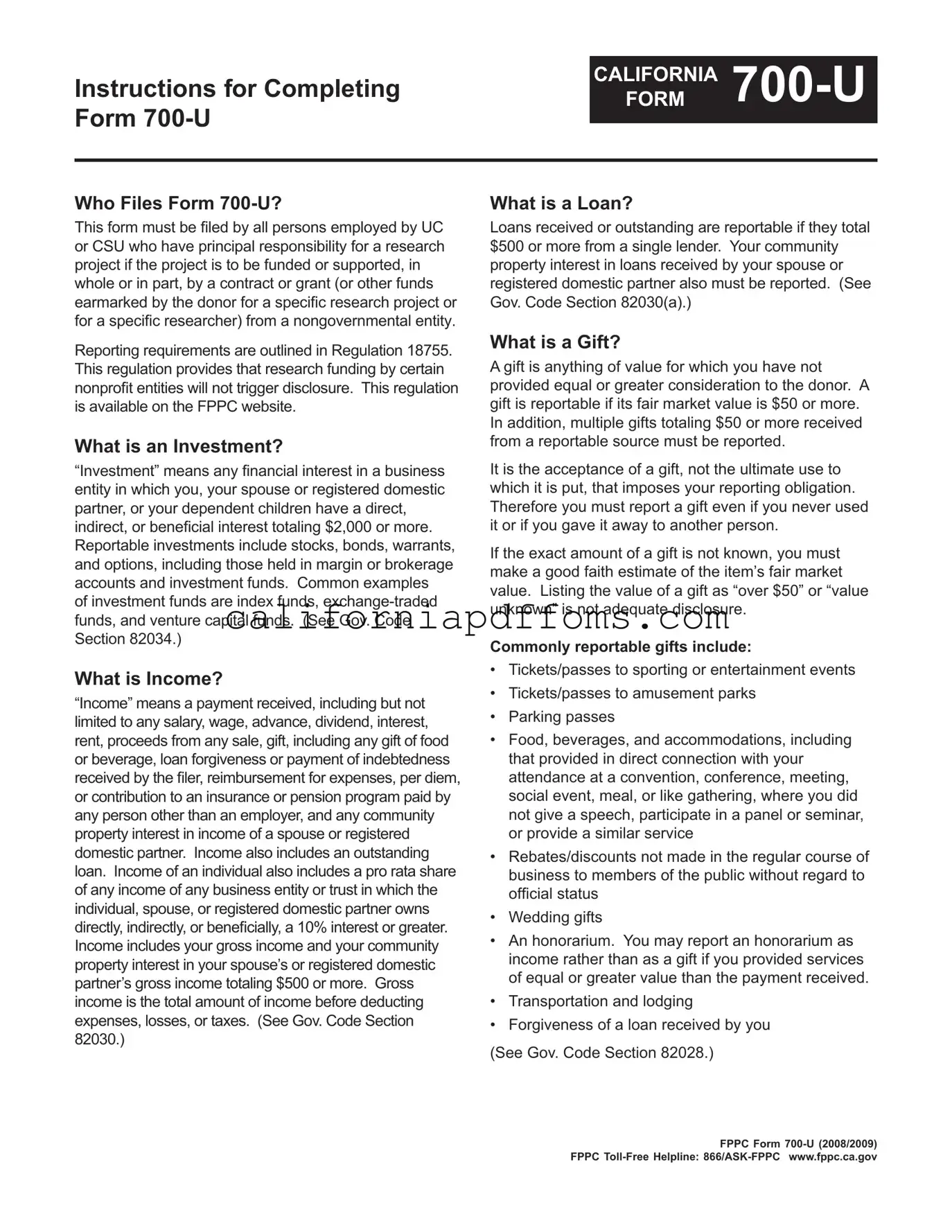

The California 700 U form is a critical document for individuals employed by the University of California (UC) or California State University (CSU) who oversee research projects funded by non-governmental entities. This form ensures transparency in financial interests and relationships that may influence research integrity. It requires disclosure of various financial aspects, including investments, income, loans, and gifts. Specifically, any investment valued at $2,000 or more, income exceeding $500, and gifts valued at $50 or more must be reported. Additionally, travel payments related to these projects must be classified as either gifts or income, depending on the services provided in exchange. Understanding the nuances of this form is essential, as failure to comply with reporting requirements can result in significant civil liabilities and potential disciplinary actions from the university. The form must be completed accurately and submitted in a timely manner, emphasizing the importance of diligence in financial reporting for principal investigators.