Fill in Your California 597 W Template

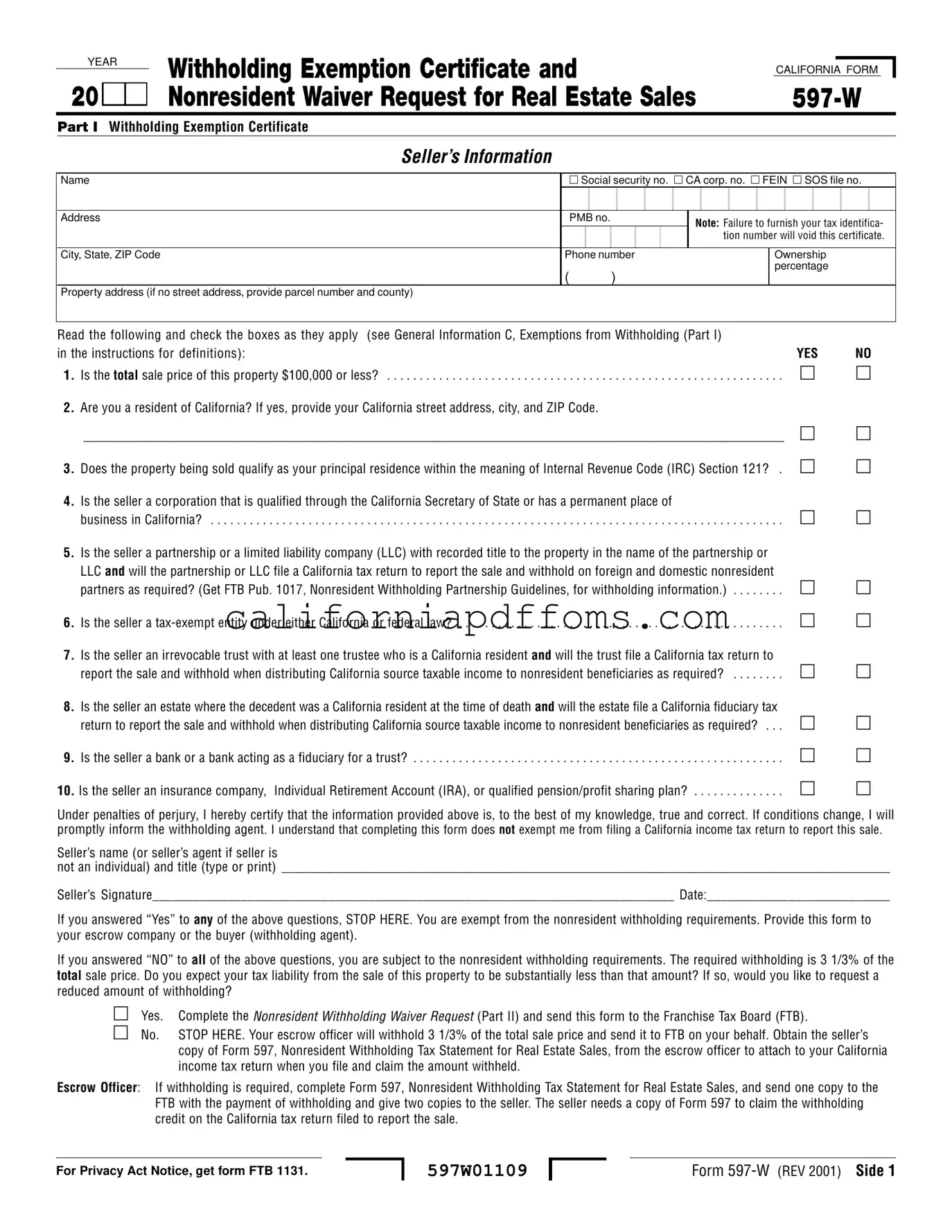

The California 597 W form serves as a crucial document for individuals and entities involved in real estate transactions within the state, particularly when it comes to nonresident sellers. This form includes two main parts: the Withholding Exemption Certificate and the Nonresident Withholding Waiver Request. In the first section, sellers provide their personal and business information, including their tax identification numbers, property details, and answers to specific questions that determine their eligibility for withholding exemptions. The questions assess factors such as the sale price of the property, residency status, and the nature of the seller's entity, whether it be an individual, corporation, partnership, or trust. If any of the criteria are met, the seller may be exempt from withholding requirements. Conversely, if none of the exemptions apply, the seller is subject to a withholding rate of 3 1/3% of the total sale price. The second part of the form allows sellers to request a waiver for reduced withholding if they anticipate a lower tax liability than the standard withholding amount. Completing this form accurately is essential, as it not only impacts tax obligations but also facilitates compliance with state regulations. Sellers must ensure that the information provided is correct and that they understand their responsibilities regarding California income tax filings.

Create Common PDFs

Affidavit of Witness - Residences include various types of housing, such as single-family homes and condos.

California State Bar Complaint Search - Write "N/A" for any sections that do not apply to your situation.