Fill in Your California 592 F Template

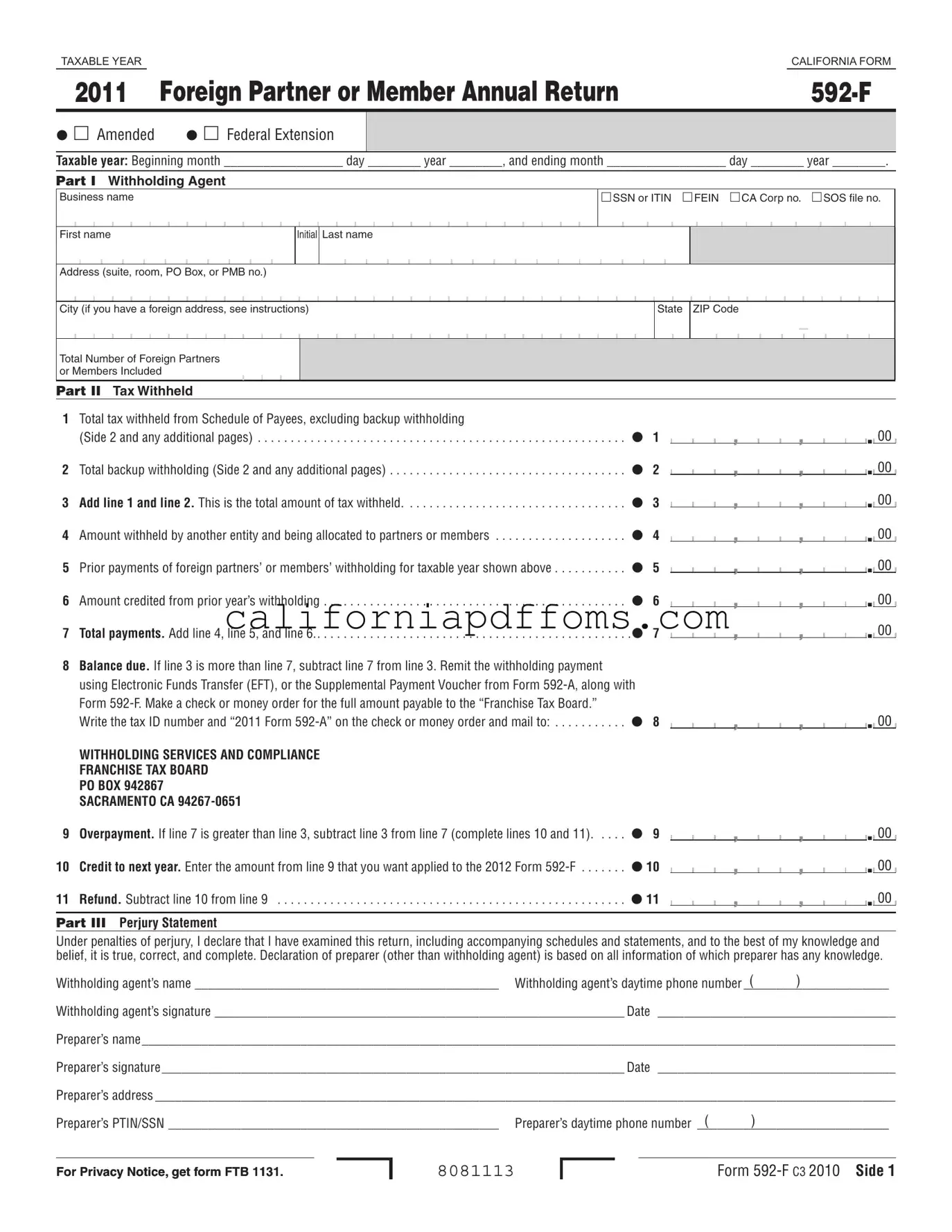

The California Form 592-F is an essential document for partnerships and limited liability companies (LLCs) that have foreign partners or members. This form is used to report the total amount of tax withheld for the year and to allocate income and related withholding to those foreign partners or members. Key sections of the form include information about the withholding agent, the total tax withheld, and details on any prior payments or credits. The form requires the withholding agent to provide their business name, identification number, and address. It also includes a Schedule of Payees, where specific details about each foreign partner or member, including their income and the amount of tax withheld, must be reported. Additionally, the form must be filed on time to avoid penalties, and if the withholding agent has filed for a federal extension, this must be indicated on the form. Understanding how to accurately complete and submit Form 592-F is crucial for compliance with California tax laws, particularly for those managing foreign investments.

Create Common PDFs

Fl 600 - The form details the obligations of the obligor, such as maintaining support payments and health insurance for the children covered.

Medicine Forms - The form also asks if the physician uses any practice management software.