Fill in Your California 592 B Template

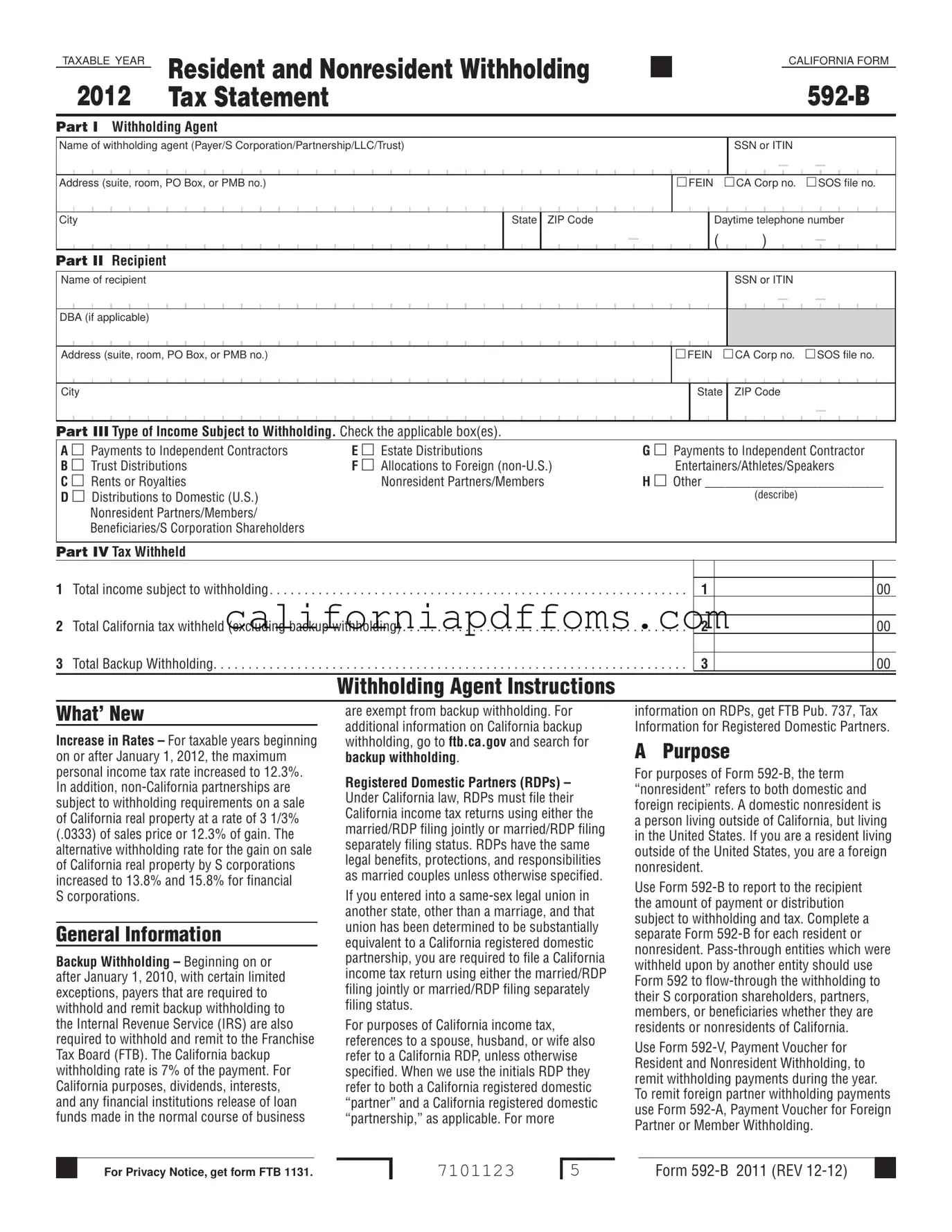

The California Form 592-B plays a crucial role in the state’s tax withholding process, particularly for payments made to both residents and non-residents. This form is essential for withholding agents—such as S corporations, partnerships, and trusts—who are responsible for reporting the amounts withheld from various types of income, including payments to independent contractors, estate distributions, and rental income. Each year, withholding agents must provide Form 592-B to recipients by January 31, detailing the total income subject to withholding, the California tax withheld, and any backup withholding. Withholding agents must also ensure that they accurately complete the form, as errors can lead to penalties. The form captures vital information about both the withholding agent and the recipient, including their names, addresses, and taxpayer identification numbers. Additionally, it outlines the types of income that are subject to withholding and provides guidance on the applicable tax rates. Understanding the nuances of Form 592-B is important for both withholding agents and recipients to ensure compliance with California tax laws and to avoid potential issues during tax season.

Create Common PDFs

Dependent Care Credit Income Limit - Only care provided in California qualifies for the Child and Dependent Care Expenses Credit.

Can You Work 4 10 Hour Days in California - Fostering a positive work culture can stem from implementing flexible work options.