Fill in Your California 590 P Template

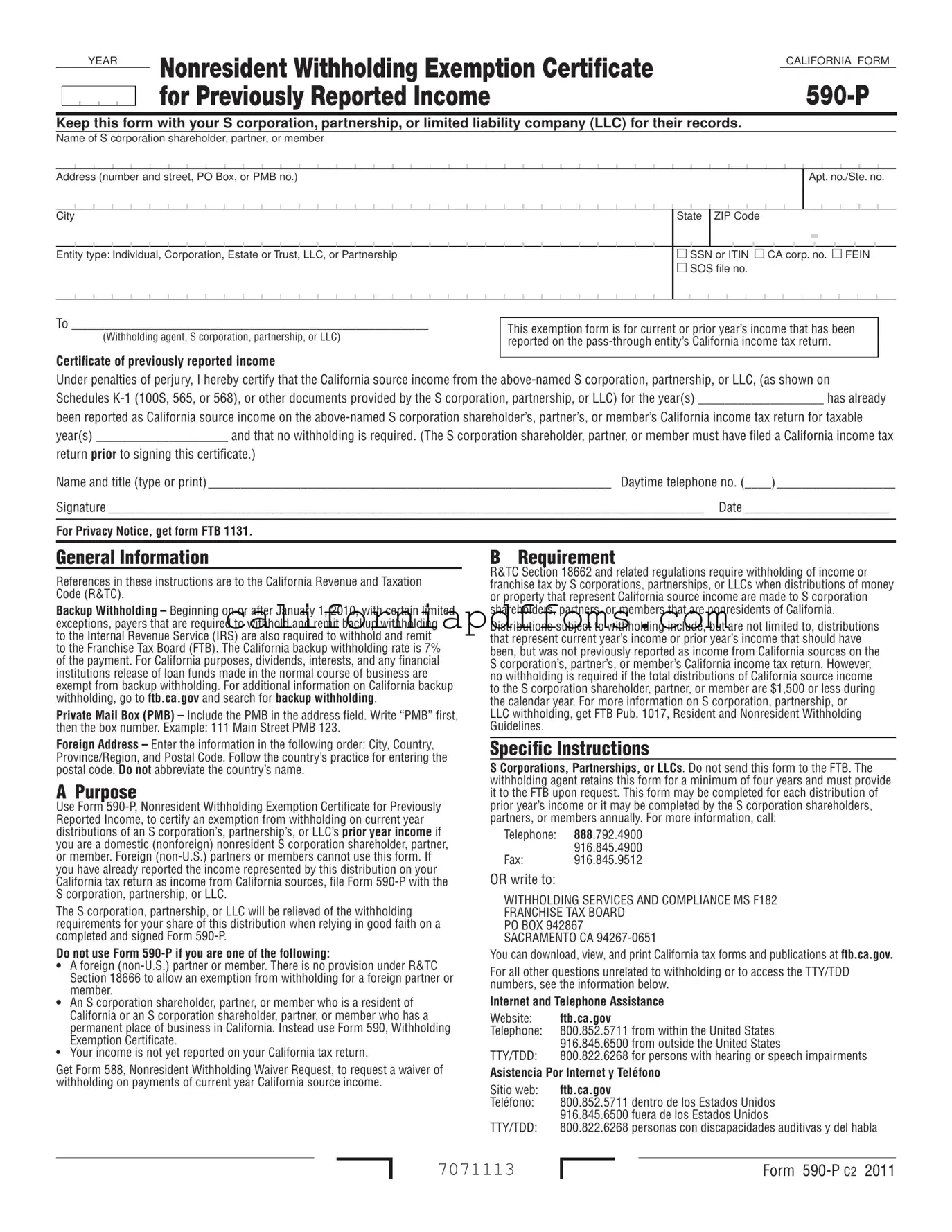

The California 590 P form, officially known as the Nonresident Withholding Exemption Certificate for Previously Reported Income, serves a specific purpose for nonresident shareholders, partners, or members of S corporations, partnerships, or limited liability companies (LLCs). This form allows individuals to certify that income from prior years has already been reported on their California income tax returns. By submitting this form, these nonresidents can avoid unnecessary withholding on current year distributions from these entities. It is essential to keep this form on file with the respective entity for record-keeping purposes. The form requires basic information such as the name and address of the individual, as well as details about the entity involved. It is crucial to note that this exemption applies only to domestic nonresidents; foreign partners or members cannot utilize this form. Additionally, if the distributions of California source income total $1,500 or less during the calendar year, no withholding is required. Understanding the requirements and proper use of Form 590 P can help streamline tax obligations for eligible individuals.

Create Common PDFs

Legal Guardianship California Form - It covers the conditions set forth by California's Probate Code regarding guardianship duties.

How to Stop Visitation Rights From Father - Petitioners need to indicate if there have been any judgments entered in related cases.

List of Alternatives to Incarceration Programs California - The California Alternative Custody Program (ACP) encourages family reunification for eligible inmates.