Fill in Your California 5870A Template

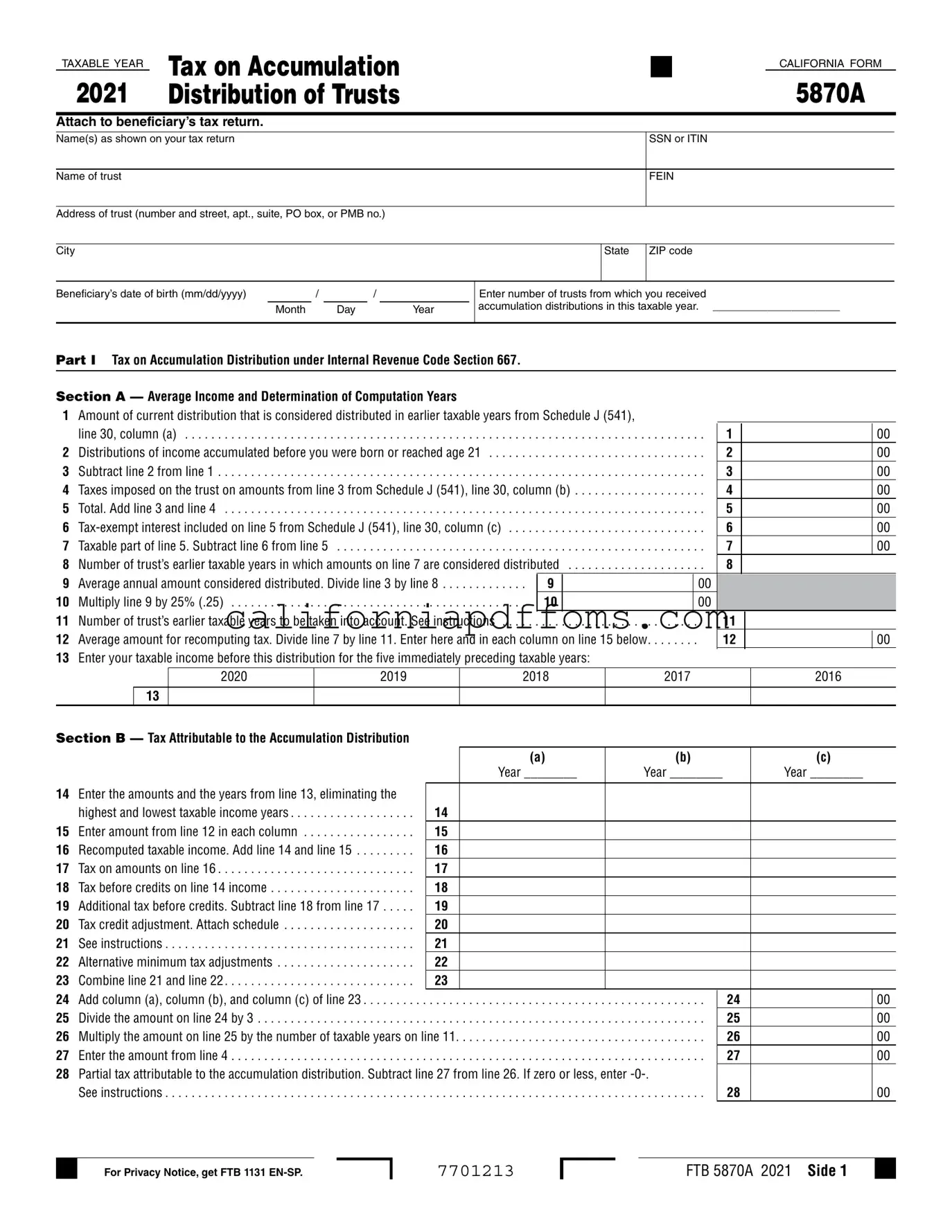

The California 5870A form is an important document for beneficiaries of trusts who receive accumulation distributions. This form is used to report taxes on distributions from trusts, specifically under Internal Revenue Code Section 667 and California Revenue and Taxation Code Section 17745. It requires beneficiaries to provide information such as their Social Security Number or Individual Taxpayer Identification Number, the name and address of the trust, and the beneficiary's date of birth. The form is structured into several parts, each addressing different aspects of the tax calculation process. Part I focuses on the tax on accumulation distributions, guiding users through the computation of taxable income based on past distributions and the trust's income history. Part II pertains to the tax on distributions of previously untaxed trust income, with sections dedicated to income accumulated over varying time frames. Finally, Part III addresses the Mental Health Services Tax, ensuring that beneficiaries account for this additional tax if applicable. Overall, the California 5870A form serves as a crucial tool for ensuring compliance with state tax regulations regarding trust distributions.

Create Common PDFs

Sworn to and Subscribed Before Me - This form ensures that a notary public verifies the signer’s identity.

Chp Dispatcher - The application requires a signature to validate the statements and claims made by the veteran.