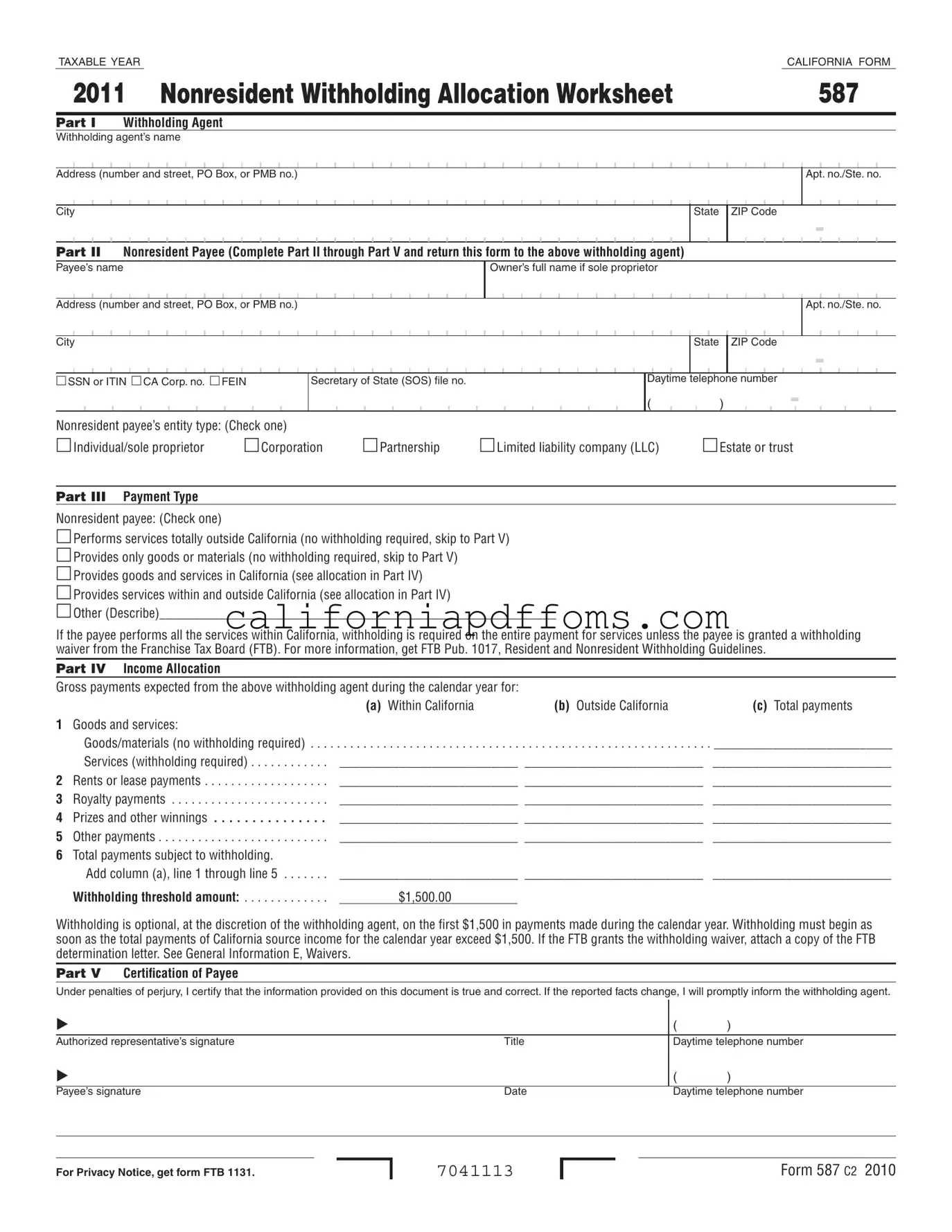

Fill in Your California 587 Template

The California Form 587, known as the Nonresident Withholding Allocation Worksheet, serves a crucial role in managing tax obligations for nonresidents earning income in California. This form is primarily used by withholding agents to determine the amount of income tax that must be withheld from payments made to nonresident payees. It encompasses various sections where both the withholding agent and the nonresident payee provide essential information. The form requires details such as the names, addresses, and taxpayer identification numbers of both parties. Additionally, it categorizes the types of payments being made—whether for services, goods, or other income sources—and outlines the allocation of income based on where the services were performed. Importantly, if the total payments to a nonresident exceed $1,500 in a calendar year, withholding becomes mandatory unless a waiver is granted by the Franchise Tax Board. The form also includes a certification section, where the payee affirms the accuracy of the provided information under penalty of perjury. Overall, Form 587 ensures compliance with California tax laws while protecting the interests of both payees and withholding agents.

Create Common PDFs

California De 4 - Ensure that your filing status aligns with your personal living situation.

Fair Political Practices Commission - Specific categories for reporting investments, income, loans, and gifts help organize the disclosures effectively.