Fill in Your California 5805 Template

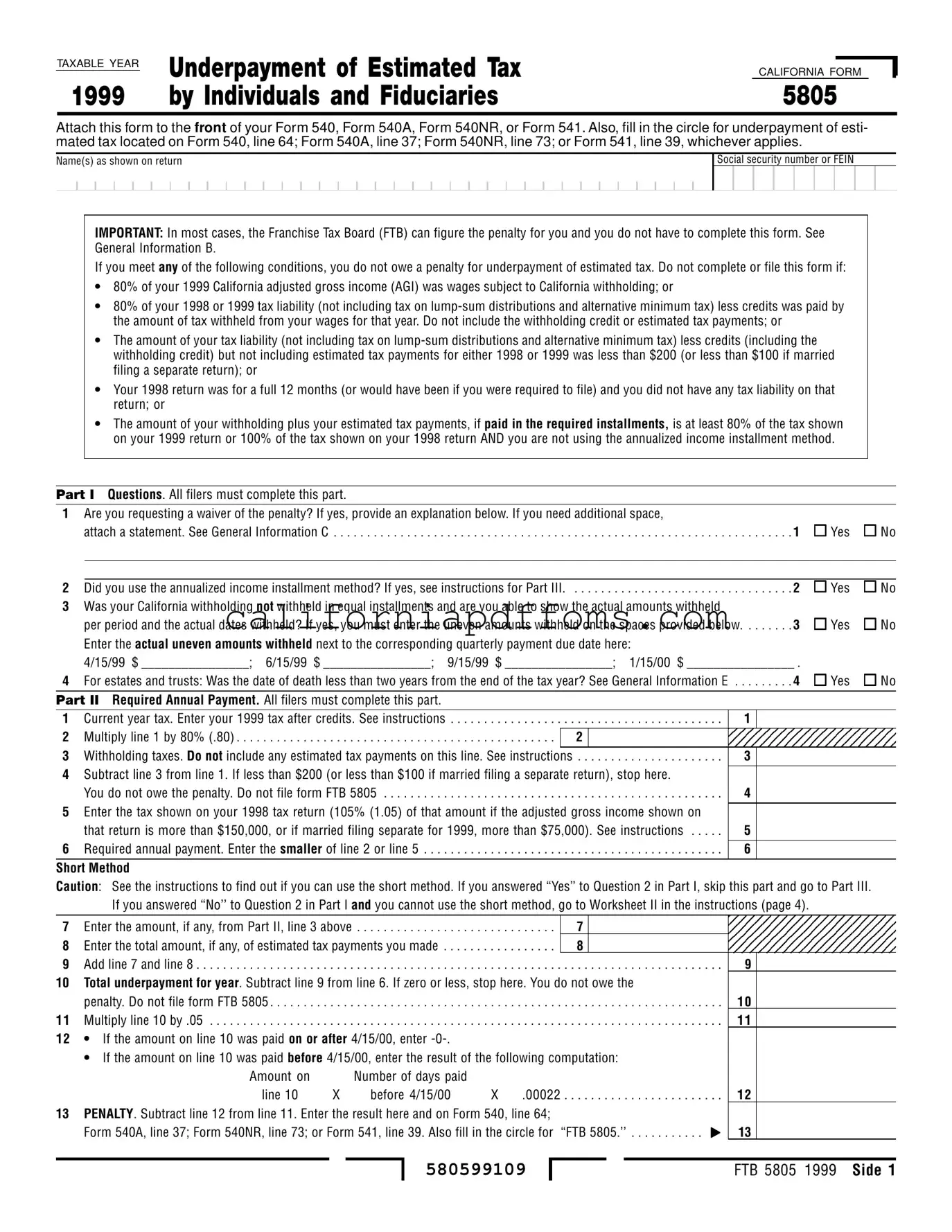

The California Form 5805 is an important document for individuals and fiduciaries who need to assess whether they owe a penalty for underpaying their estimated tax. This form must be attached to the front of various tax returns, including Form 540, Form 540A, Form 540NR, or Form 541. It serves several purposes, primarily to calculate any penalties related to underpayment of estimated taxes for the taxable year. Taxpayers must provide their names and social security numbers or FEINs, and they should be aware that the Franchise Tax Board (FTB) can often calculate the penalty automatically, which may eliminate the need for this form in many cases. However, specific conditions can exempt taxpayers from penalties, such as if a significant portion of their income was subject to California withholding or if their tax liability was minimal in the previous year. The form includes multiple parts, requiring filers to answer questions about their tax situation and to calculate their required annual payment. Additionally, there are provisions for requesting a waiver of the penalty under certain circumstances, such as retirement or disability. Understanding the nuances of Form 5805 can help ensure compliance and potentially avoid unnecessary penalties.

Create Common PDFs

How to Get a Class a License - The health questionnaire serves as a proactive measure for public safety on the roads.

California Cr 126 - The form asks for the specific brief that is being requested for extension, such as the appellant's opening brief.

California Acknowledgement 2023 - This form aims to prevent misuse of the acknowledgment process.