Fill in Your California 570 Template

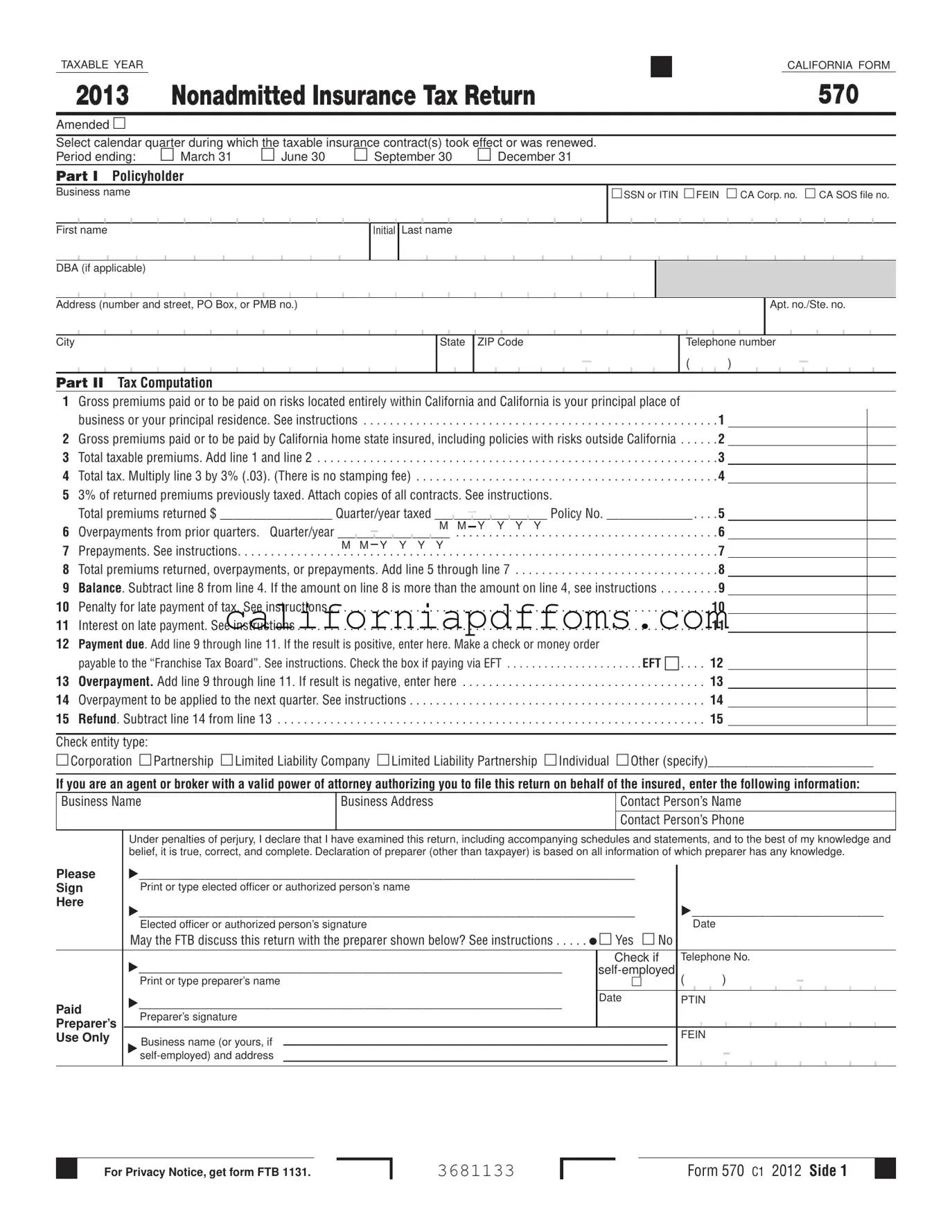

The California Form 570, known as the Nonadmitted Insurance Tax Return, plays a crucial role for businesses and individuals who purchase insurance from nonadmitted insurers. This form is essential for reporting premiums paid on insurance contracts that cover risks located within California or that involve California home state insureds. Notably, the tax rate is set at three percent, applied to the gross premiums for policies entered into or renewed during each calendar quarter. The form requires detailed information, including the policyholder's name, address, and identification numbers, as well as a breakdown of the premiums associated with each nonadmitted insurance contract. Additionally, it allows for the reporting of any returned premiums, overpayments, or prepayments, ensuring that taxpayers can accurately calculate their tax liabilities or refunds. Timeliness is key; the form must be filed by the first day of the third month following the end of each quarter to avoid penalties. Understanding the nuances of Form 570 is vital for compliance and to avoid unnecessary financial repercussions.

Create Common PDFs

Decedent's Estate - Filing this form involves a declaration under penalty of perjury.

California 5870A - On-time submission of the form can prevent unnecessary fines.