Fill in Your California 541 T Template

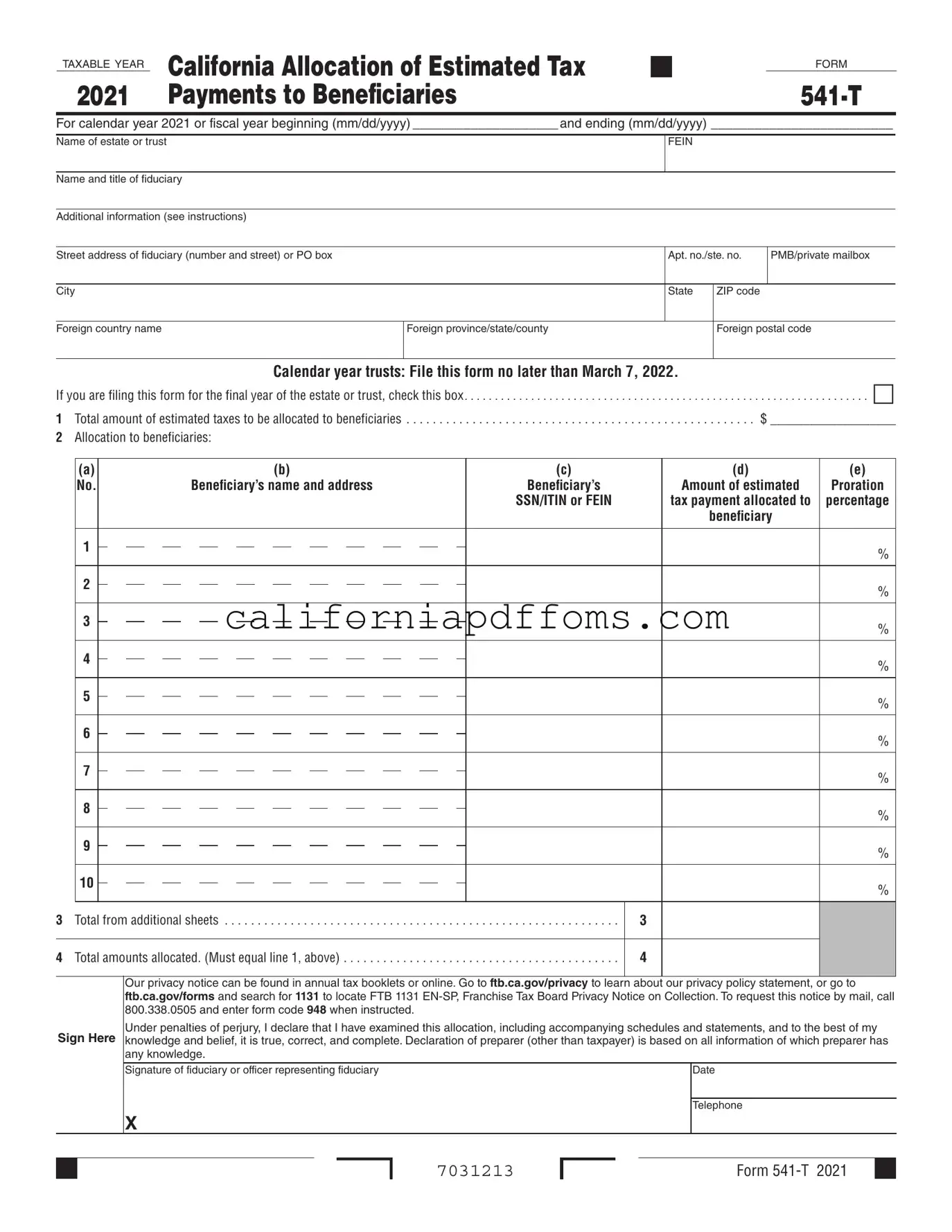

The California 541 T form plays a crucial role for fiduciaries managing trusts or decedents’ estates, particularly when it comes to the allocation of estimated tax payments to beneficiaries. This form allows the fiduciary to elect to treat a portion of the estate or trust's estimated tax payments as being made on behalf of its beneficiaries, a decision that can significantly impact tax liabilities. The form requires detailed information, including the fiduciary's name, address, and the Federal Employer Identification Number (FEIN). It also includes sections for listing beneficiaries, their Social Security Numbers or FEINs, and the specific amounts of estimated tax payments allocated to each. A critical aspect of this form is that it must be filed separately from the California Fiduciary Income Tax Return (Form 541) and submitted by a specific deadline to ensure the election is valid. Additionally, the fiduciary must ensure that the total amounts allocated match the total estimated tax payments reported, as any discrepancies could lead to complications. Understanding how to properly complete and file the 541 T form is essential for fiduciaries to fulfill their responsibilities while optimizing the tax positions of the beneficiaries involved.

Create Common PDFs

Motion for Reconsideration California Family Law - The form requires information about the appellant and the appeal being filed.

Form 100w - This form serves as a crucial step for corporations engaged in cross-border operations.

File a Motion for Child Support - The FL-301 form is used in California court for filing a Notice of Motion.