Fill in Your California 541 A Template

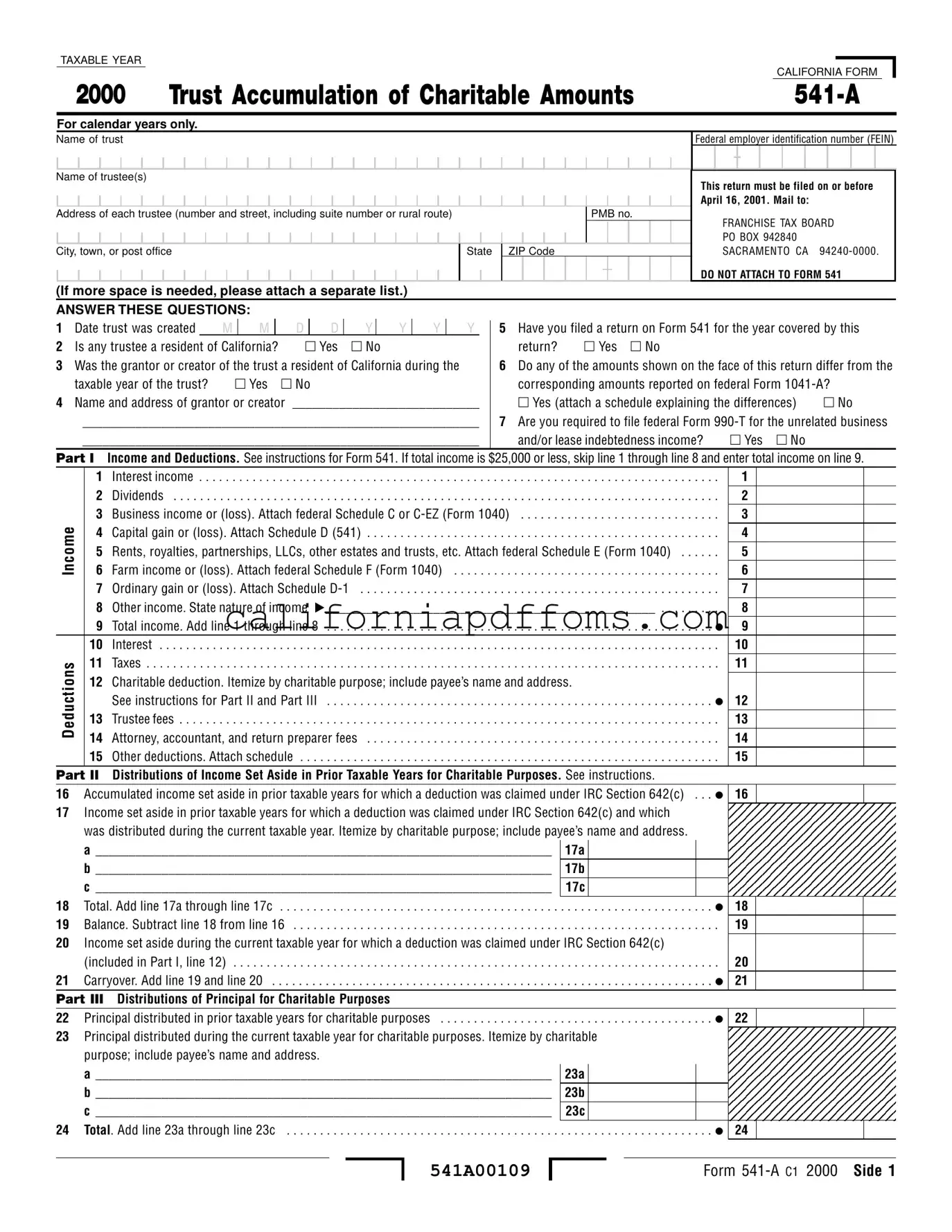

The California 541 A form serves as an essential tool for trustees managing charitable trusts, enabling them to report the accumulation of charitable amounts for tax purposes. This form is specifically designed for calendar years and requires detailed information about the trust, including the name of the trust, the federal employer identification number (FEIN), and the names and addresses of the trustee(s). It is crucial for trustees to complete this form accurately and submit it by the deadline of April 16, 2001, to the Franchise Tax Board. The form contains several sections that address the trust's income, deductions, and distributions, particularly focusing on charitable contributions made during the taxable year. Trustees must answer key questions regarding the trust's residency status, prior filings, and any discrepancies with federal forms. Additionally, the 541 A form requires a balance sheet that outlines the trust's assets and liabilities, ensuring transparency in financial reporting. Overall, this form is vital for maintaining compliance with California tax laws while supporting charitable endeavors.

Create Common PDFs

California 590 P - Be aware that filing deadlines apply; timely submission ensures compliance and exemption from withholding.

California Cv 71 - Jurisdictional checks help in managing case appropriate actions.

Mc 040 - Each section of the EA 250 form plays a vital role in the legal process.