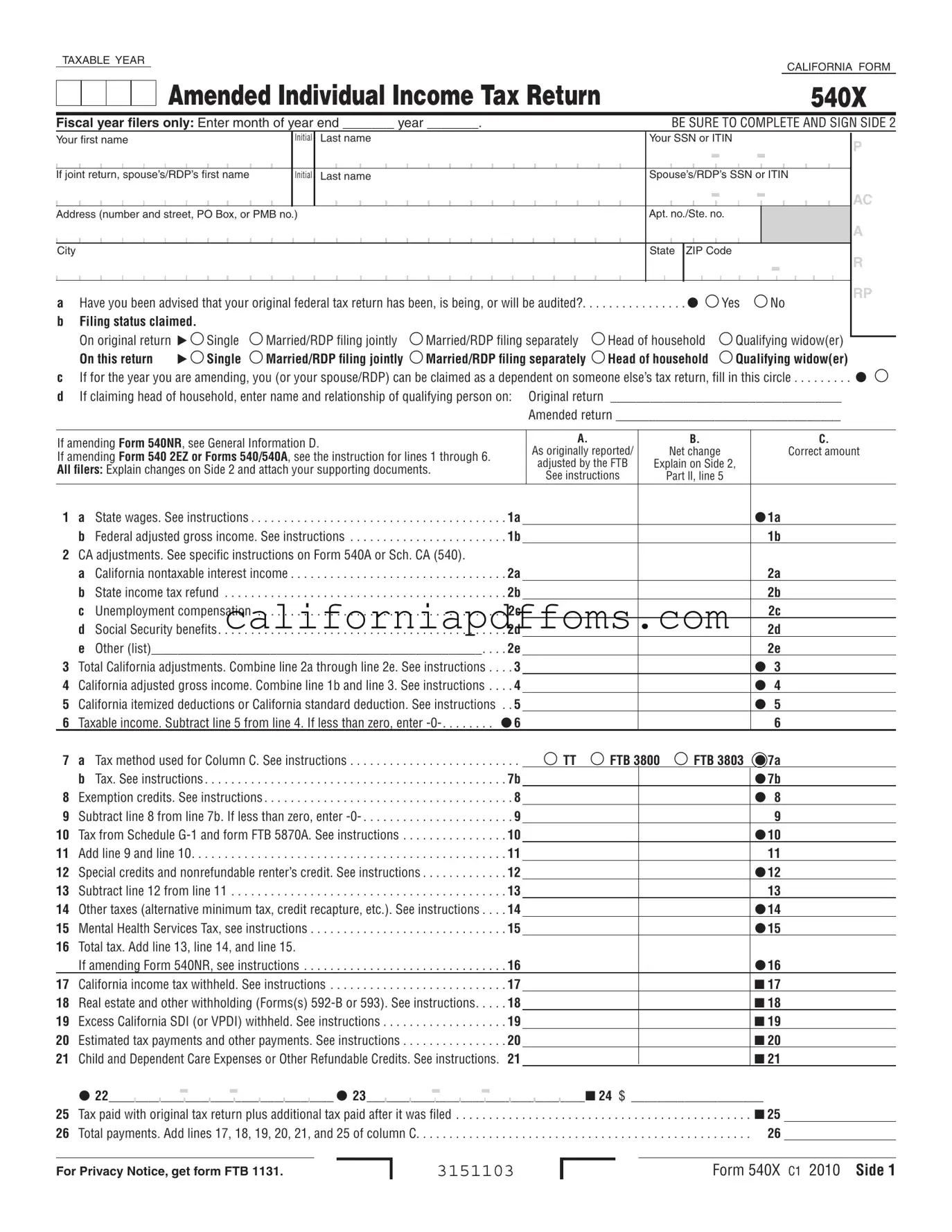

Fill in Your California 540X Template

The California 540X form is an essential document for individuals looking to amend their state income tax returns. This form allows taxpayers to correct any inaccuracies or omissions from their original filings, ensuring that their tax records are accurate and up to date. Whether you need to adjust your income, deductions, or credits, the 540X provides a structured way to communicate these changes to the California Franchise Tax Board. It’s important to note that this form is specifically for individual income tax returns, and it includes sections for both single and joint filers. The form requires detailed information, such as your Social Security Number or Individual Taxpayer Identification Number, and it prompts you to explain the reasons for your amendments. Additionally, if your original federal tax return is under audit, this must be disclosed on the 540X. Supporting documents may also be necessary to substantiate the changes you are making. Completing the 540X accurately is crucial, as it can impact your tax liability and any potential refunds. By following the guidelines provided in the form’s instructions, you can navigate the amendment process with greater confidence and clarity.

Create Common PDFs

What Are Form Interrogatories - The form must list the attorney or party without an attorney, along with their contact details.

Block Account - Judges will review the form for compliance with court procedures before signing.

Holographic Will California - The Will is effective only when properly witnessed and signed.