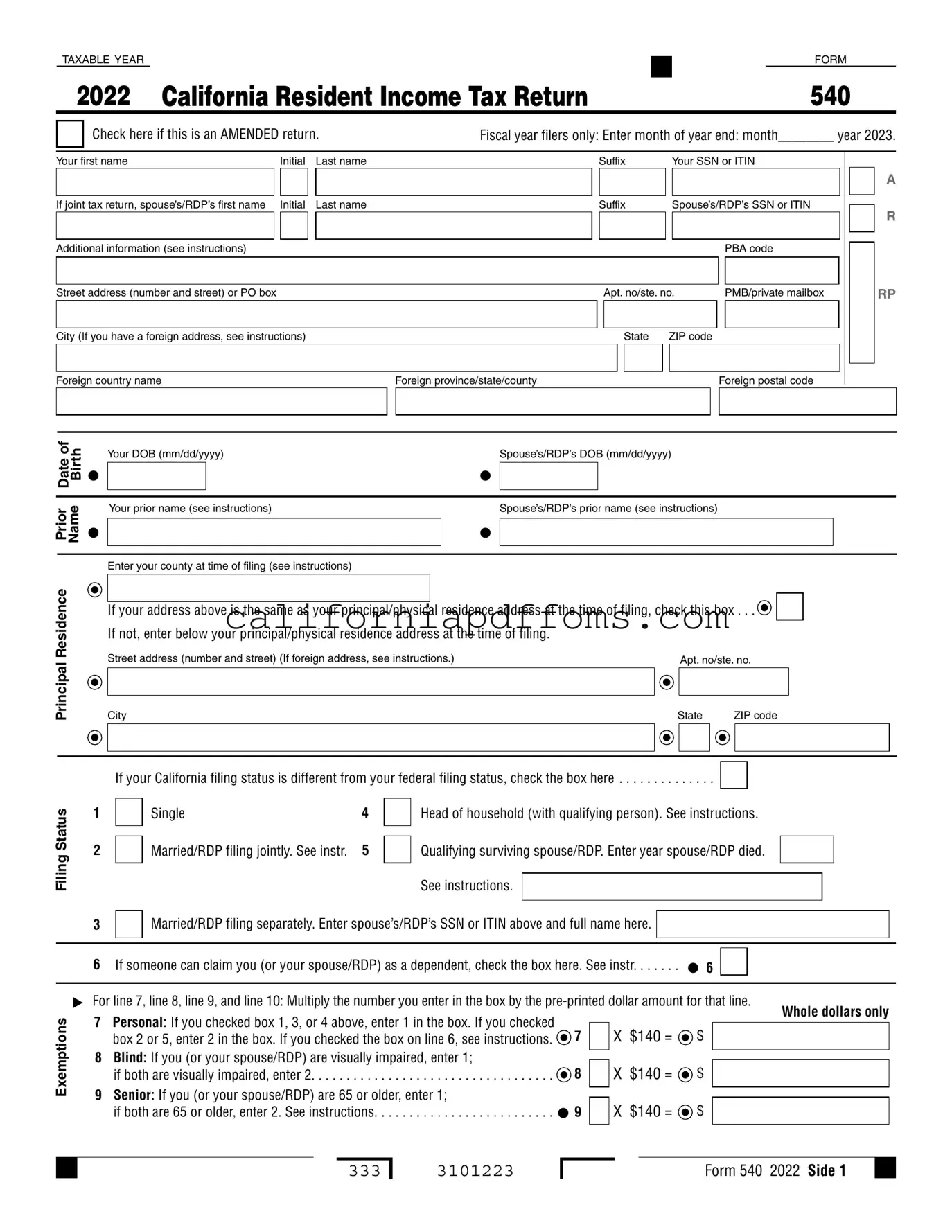

Fill in Your California 540 V Template

The California 540 V form, known as the Return Payment Voucher, plays a crucial role for individuals filing their state taxes. Designed to streamline the payment process, this form is particularly important for those who owe taxes for the 1997 tax year. While it is strongly encouraged to use the 540 V when submitting a payment, it is not mandatory, and no penalties will arise from its omission if a refund or no tax is due. To effectively utilize the 540 V, taxpayers must follow a series of straightforward steps, starting with preparing a check or money order made out to the Franchise Tax Board for the total amount owed. Important details, such as the taxpayer's social security number and the specific type of return, must be included on the payment. The form itself requires the taxpayer's name, address, and the payment amount, ensuring that the Franchise Tax Board can accurately process the payment. After completing the voucher, it must be attached to the front of the tax return, along with the payment, before mailing it to the designated address in Sacramento. This organized approach not only facilitates efficient processing but also helps taxpayers avoid potential issues with their state tax obligations.

Create Common PDFs

How to Form an Llc in California - The original filing date of the LLC helps determine future filing periods for periodic statements.

California 51 055A - Make sure to keep a copy of the submitted form for your records.

Landlord Eviction Notice Letter - The notice can foster communication between landlords and tenants regarding lease issues.