Fill in Your California 540 Schedule P Template

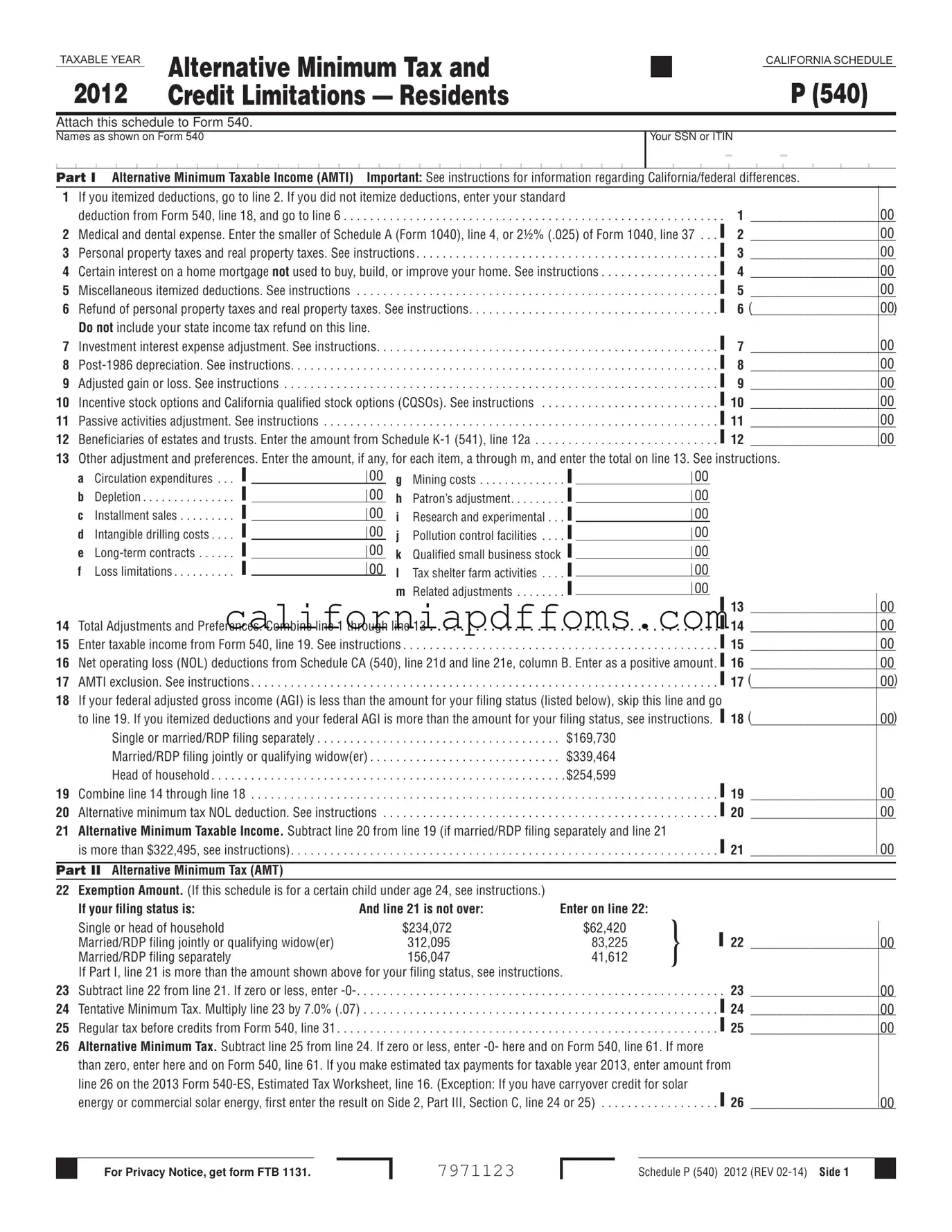

The California 540 Schedule P form plays a crucial role for residents who may be subject to the Alternative Minimum Tax (AMT). This form is designed to help taxpayers calculate their Alternative Minimum Taxable Income (AMTI) and determine any applicable credits that can reduce their tax liability. It consists of several parts, beginning with the identification of adjustments and preferences that affect taxable income. Taxpayers must account for various deductions, such as medical expenses and property taxes, and make necessary adjustments for specific items like incentive stock options and passive activity losses. The second part of the form focuses on calculating the AMT itself, including the exemption amounts based on filing status. Finally, the form outlines credits that may offset the tax owed, ensuring that taxpayers can leverage any available benefits to minimize their overall tax burden. Completing the California 540 Schedule P accurately is essential for compliance and to take full advantage of potential tax savings.

Create Common PDFs

California Cr 126 - Filing the CR-126 form on time is critical to ensure that the appeal process continues smoothly.

Who Pays for Attorney Fees in a Divorce in California - The petition for fees aims to ensure legal access for all individuals, regardless of income.