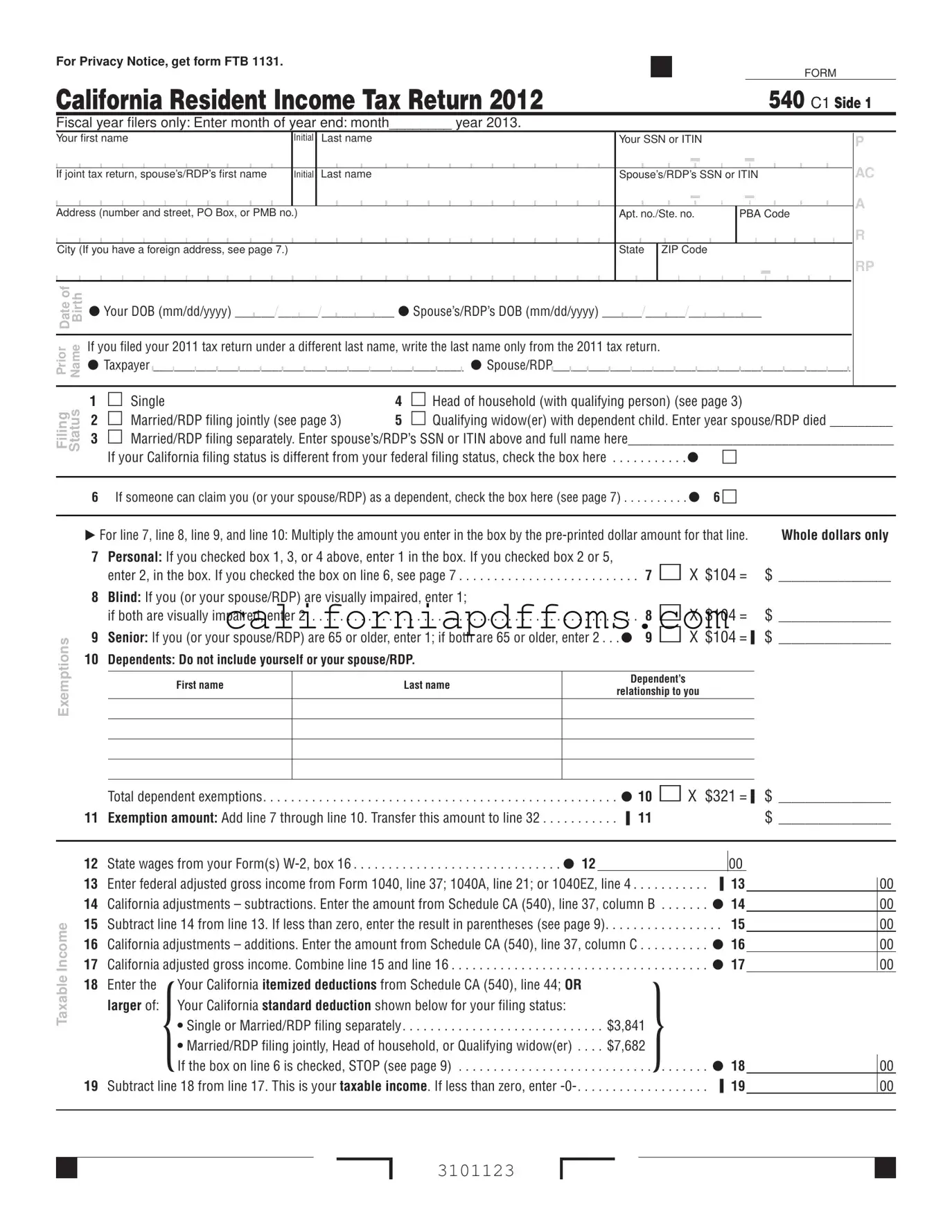

Fill in Your California 540 C1 Template

The California 540 C1 form is an essential document for residents filing their state income tax returns. Designed specifically for fiscal year filers, it requires detailed personal information such as names, Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs), and addresses. Taxpayers must also indicate their filing status, which can range from single to married filing jointly or separately. The form includes sections for exemptions, allowing taxpayers to account for personal and dependent exemptions, which can significantly affect their taxable income. Additionally, it requires the entry of state wages, federal adjusted gross income, and any California adjustments. The form culminates in calculating total tax due, credits, and payments, ultimately leading to either a refund or amount owed. For those looking to make charitable contributions, the form provides options to donate to various state funds. Understanding the nuances of the 540 C1 can help ensure accurate and efficient tax filing for California residents.

Create Common PDFs

Fair Political Practices Commission - Travel payments can be classified as either gifts or income, depending on the relationship of services provided.

Whats a Plea Hearing - The form is designed to protect the rights of the defendant while facilitating a fair legal process.