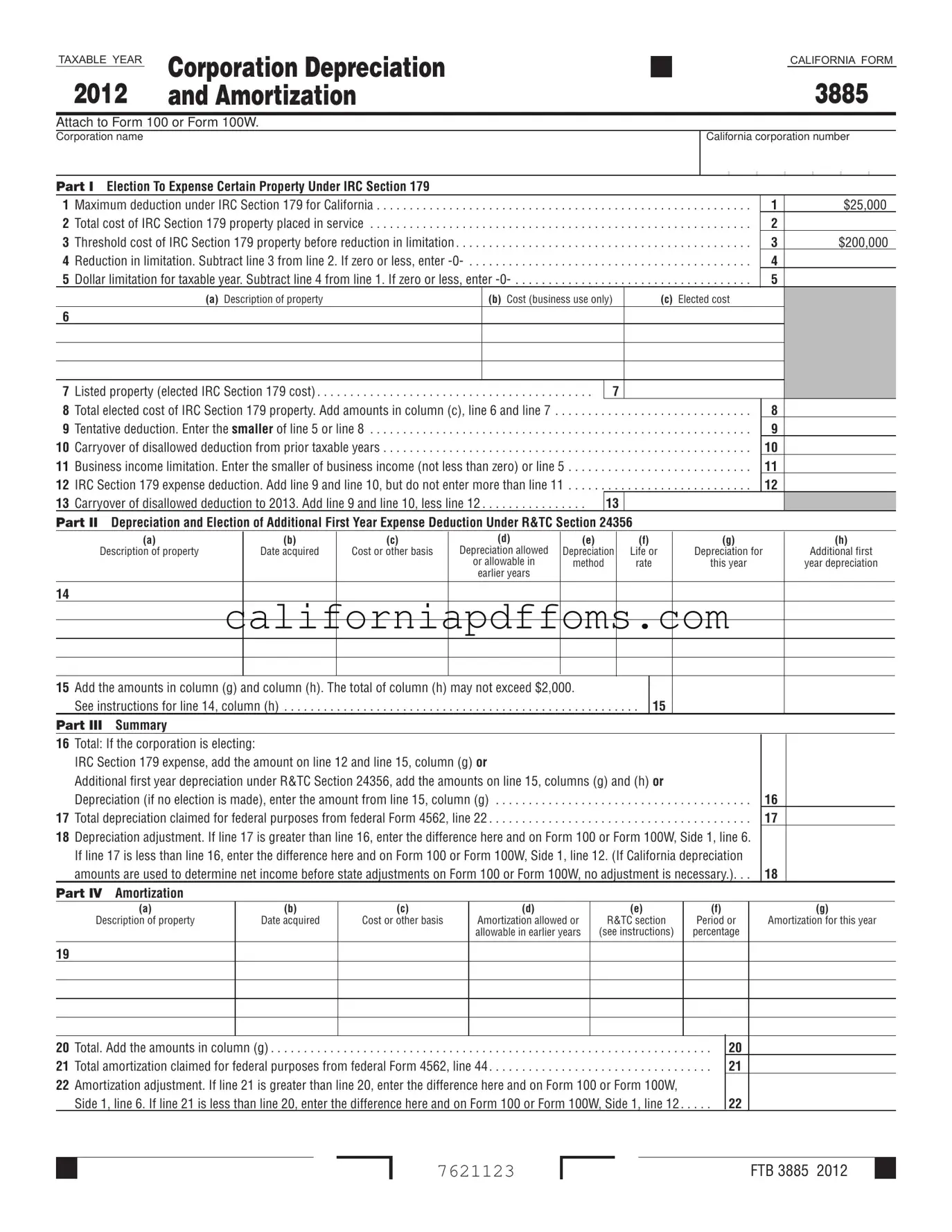

Fill in Your California 3885 Template

The California Form 3885 is an essential document for corporations, partnerships, and limited liability companies classified as corporations to calculate depreciation and amortization deductions. This form is particularly important for businesses looking to maximize their tax benefits related to property used in their operations. It consists of several parts, each addressing different aspects of depreciation and amortization. Part I allows corporations to elect to expense certain property under IRC Section 179, providing a maximum deduction of $25,000 for qualifying assets placed in service during the taxable year. Part II focuses on the calculation of depreciation, allowing businesses to choose from various methods such as straight-line or declining balance. Additionally, Part III summarizes the total deductions claimed, while Part IV covers the amortization of intangible assets. The form also highlights key differences between California and federal tax laws, ensuring that businesses are aware of the specific regulations that apply to them. Understanding and accurately completing Form 3885 can significantly impact a corporation's tax liability, making it a crucial component of the tax preparation process.

Create Common PDFs

Jv-180 Instructions - The JV-460 provides clear documentation regarding a child's understanding of their rights as they approach adulthood.

Cdph Laboratory Field Services - Review the related laws and regulations referenced in the application for a better understanding.