Fill in Your California 3832 Template

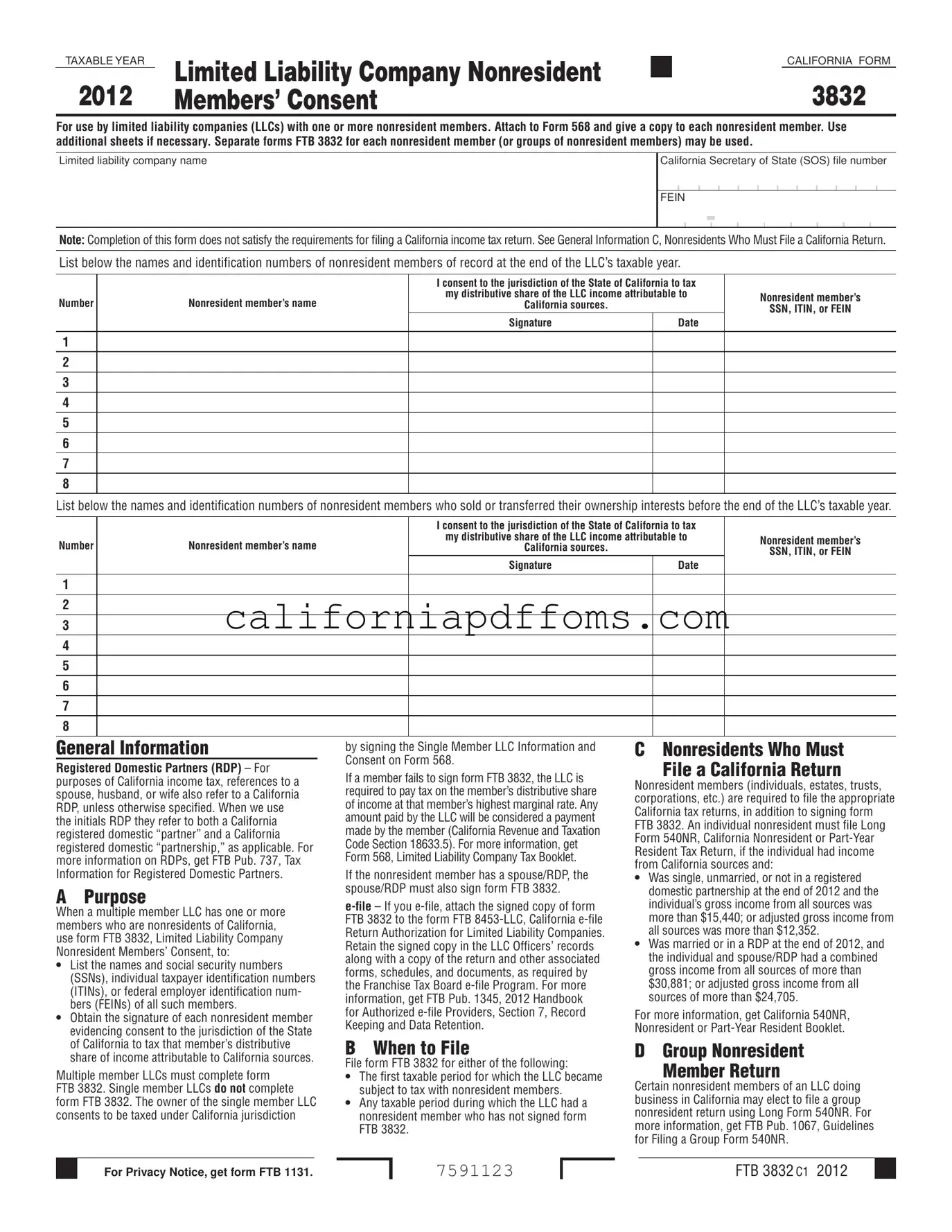

The California 3832 form is essential for limited liability companies (LLCs) that have one or more nonresident members. This form serves as a declaration of consent from nonresident members, allowing California to tax their share of the LLC's income that is sourced from within the state. It is important to attach this form to Form 568, which is the California Limited Liability Company Return of Income, and provide a copy to each nonresident member. The form requires the names and identification numbers of all nonresident members, along with their signatures, affirming their agreement to California's jurisdiction for taxation purposes. Additionally, if any nonresident member sold or transferred their ownership interest during the taxable year, their information must also be documented on this form. It’s crucial to note that completing the California 3832 does not fulfill the requirements for filing a California income tax return; nonresident members must still adhere to specific filing obligations. The form also outlines the consequences of a member's failure to sign, which could result in the LLC being liable for taxes at the member's highest marginal rate. Understanding the nuances of this form is vital for compliance and ensuring that all nonresident members are adequately accounted for in the tax process.

Create Common PDFs

What Does It Mean When a Court Case Is Vacated - The filing must be made within a certain time frame, typically 180 days or up to two years after the judgment.

California Llc Tax - Different types of business entities can apply using this form, including individuals, LLCs, and corporations.

Osha 5020 - The 5020 California form is essential for reporting workplace injuries or illnesses.