Fill in Your California 3805Z Template

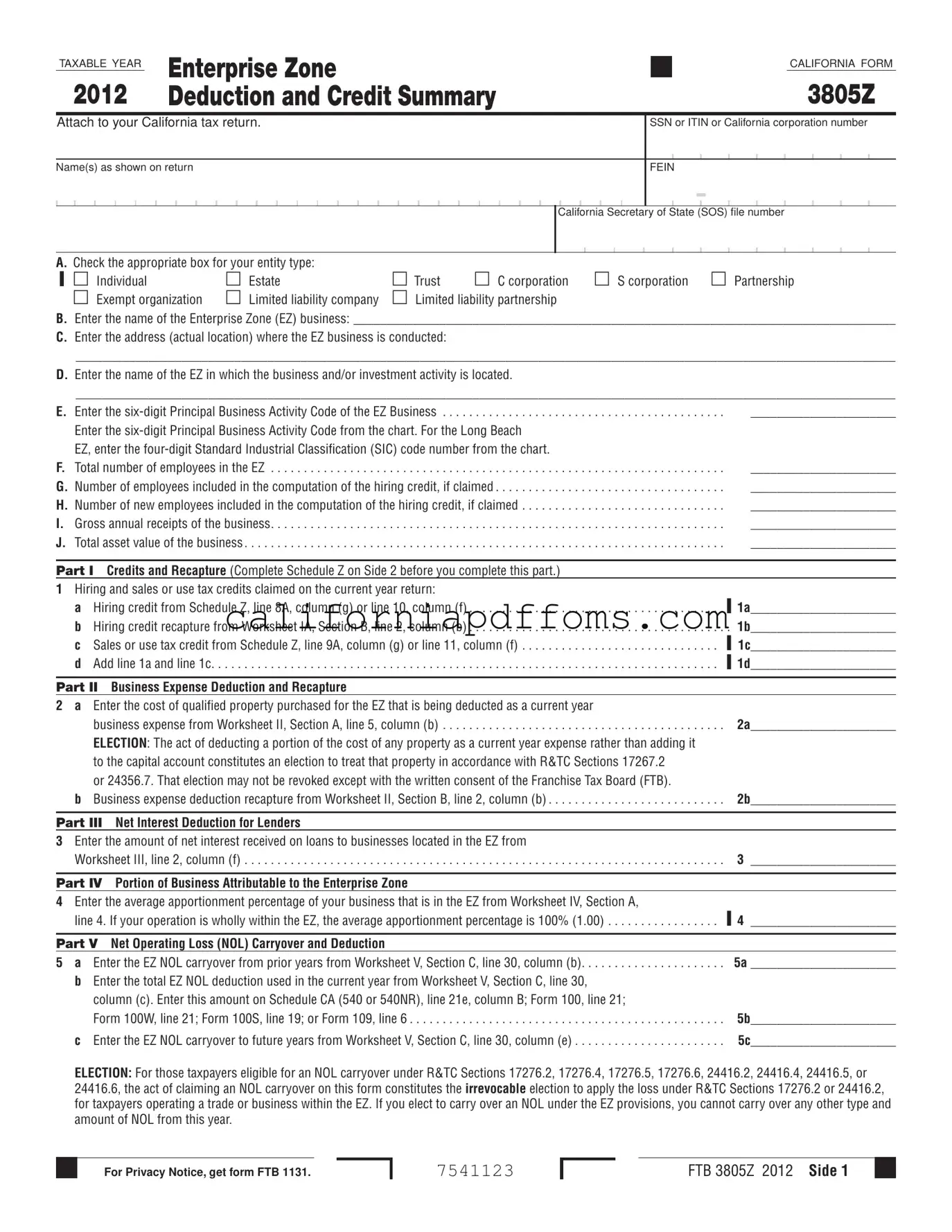

The California 3805Z form plays a crucial role for businesses operating within designated Enterprise Zones (EZs) in the state. This form is essential for claiming various tax deductions and credits, which can significantly benefit eligible businesses. Primarily, it allows businesses to report hiring credits, sales or use tax credits, and business expense deductions related to their activities in an EZ. It requires detailed information, such as the type of entity—be it an individual, corporation, or partnership—and specifics about the business location and operations. Additionally, businesses must provide data on employee counts and gross annual receipts, which are vital for calculating potential credits. The form includes sections for recapturing credits, reporting net interest received on loans to EZ businesses, and detailing net operating loss (NOL) carryovers. By accurately completing the 3805Z, businesses can optimize their tax benefits while contributing to the economic development goals of California's Enterprise Zones.

Create Common PDFs

California Fj 200 - Filling out FJ-200 accurately can influence the outcome of a child-centered court case significantly.

Ca 540 Instructions 2023 - Finally, taxpayers should consult the relevant instructions to ensure proper use of this adjustment schedule.

Am I Exempt From California Withholding - Form 587 is crucial in determining if a payee’s income is subject to California tax withholdings.