Fill in Your California 3803 Template

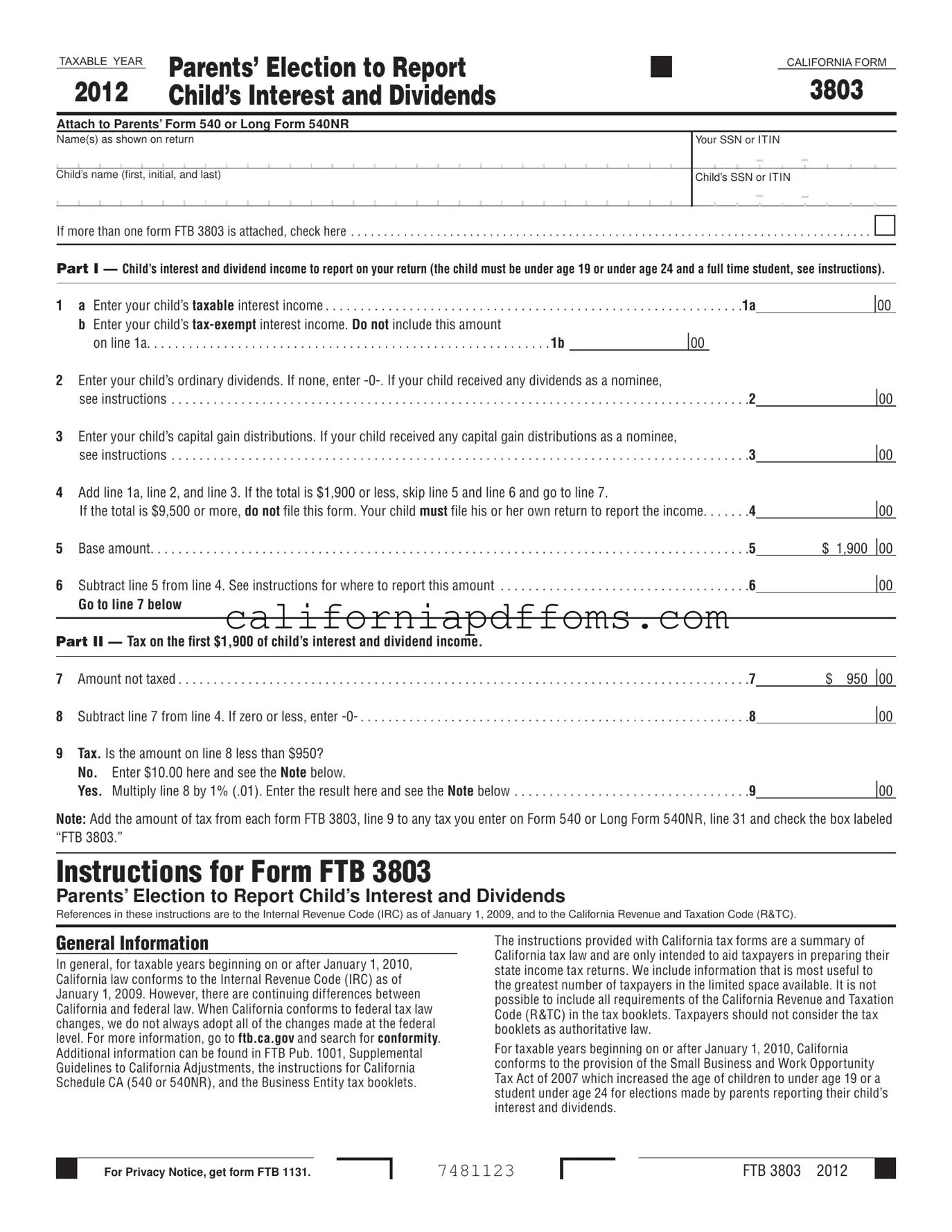

The California Form 3803, officially known as the Parents’ Election to Report Child’s Interest and Dividends, plays a crucial role for parents looking to streamline their tax reporting process. This form allows parents to report their child’s interest and dividend income directly on their own California income tax return, thereby eliminating the need for the child to file a separate return. To qualify, the child must be under 19 years old or under 24 and a full-time student, and their income must be solely from interest and dividends, not exceeding $9,500. The form requires detailed information about the child’s income, including taxable interest, tax-exempt interest, ordinary dividends, and capital gain distributions. It also includes a section to calculate any additional tax owed on the child’s income, which is particularly important for families navigating the nuances of tax obligations. By completing Form 3803, parents can simplify their tax filing, but they must ensure they meet specific eligibility criteria and follow the correct procedures to avoid complications. Understanding the ins and outs of this form is essential for parents aiming to maximize their tax benefits while adhering to California tax laws.

Create Common PDFs

Ftb Address Change - Signature is required to certify the accuracy of the statements.

California State Tax Exemption Form - The California STD 236 form is used by state agency employees to request a tax waiver for hotel or motel stays.