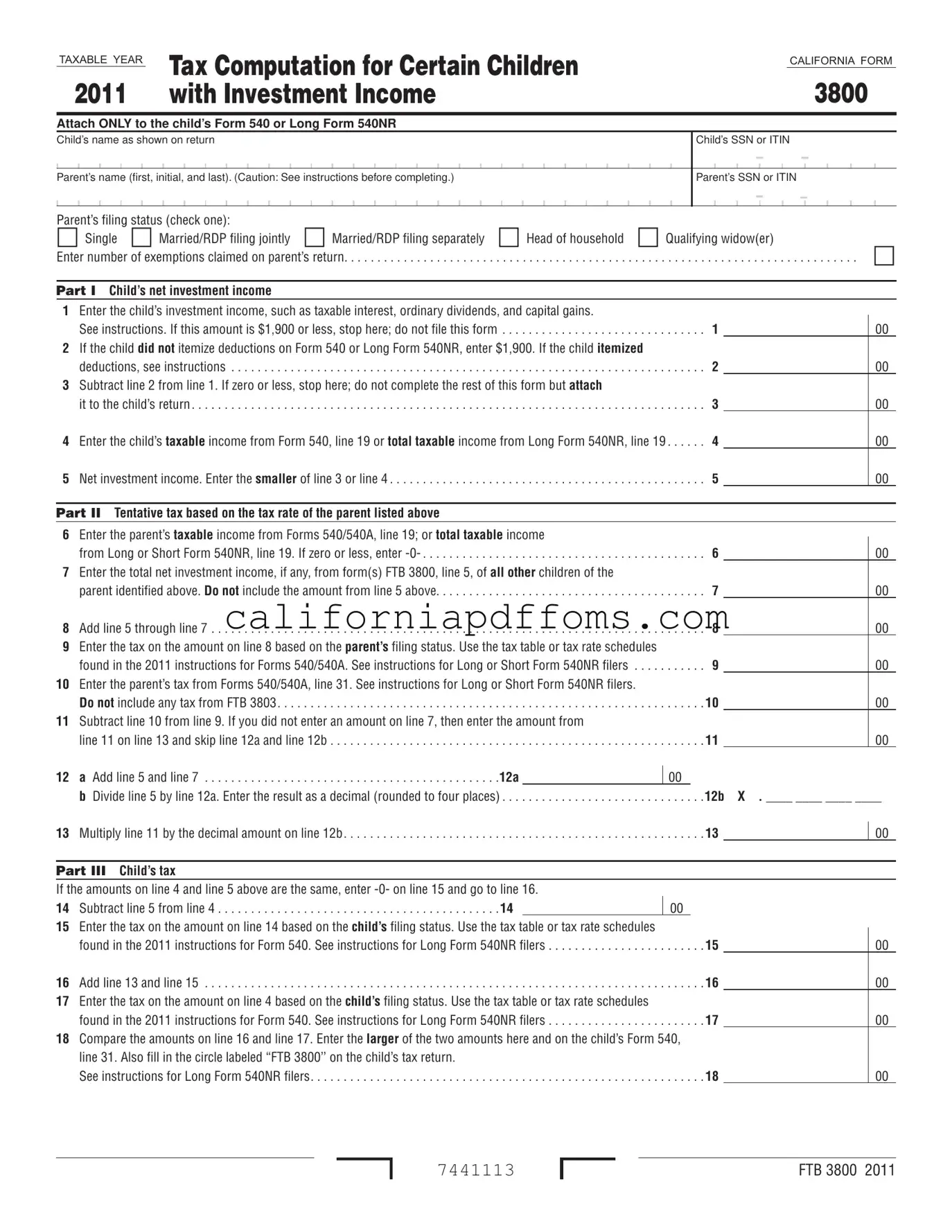

Fill in Your California 3800 Template

The California Form 3800, officially titled "Tax Computation for Certain Children with Investment Income," is a critical document for families navigating the complexities of tax obligations for minors. This form is specifically designed for children aged 18 and under, or students under the age of 24, who have investment income exceeding $1,900. Parents must complete this form if they wish to report their child's investment income on their own tax returns, particularly when the child’s income is subject to a higher tax rate than that of the child. The form requires details such as the child's name, Social Security Number (SSN), and the parent’s information, including filing status. Additionally, it outlines the calculation process for determining the child's net investment income, which includes interest, dividends, and capital gains. The form also guides parents through determining the tentative tax based on their own tax rate, ensuring that they accurately report and pay any taxes owed on the child's investment income. By completing Form 3800, parents can effectively manage their tax responsibilities while ensuring compliance with California tax laws.

Create Common PDFs

Cr180 - Complete honesty in disclosing all relevant information is vital to achieving a favorable decision.

Ftb Address Change - Ensure that both new and former addresses are completed.