Fill in Your California 3725 Template

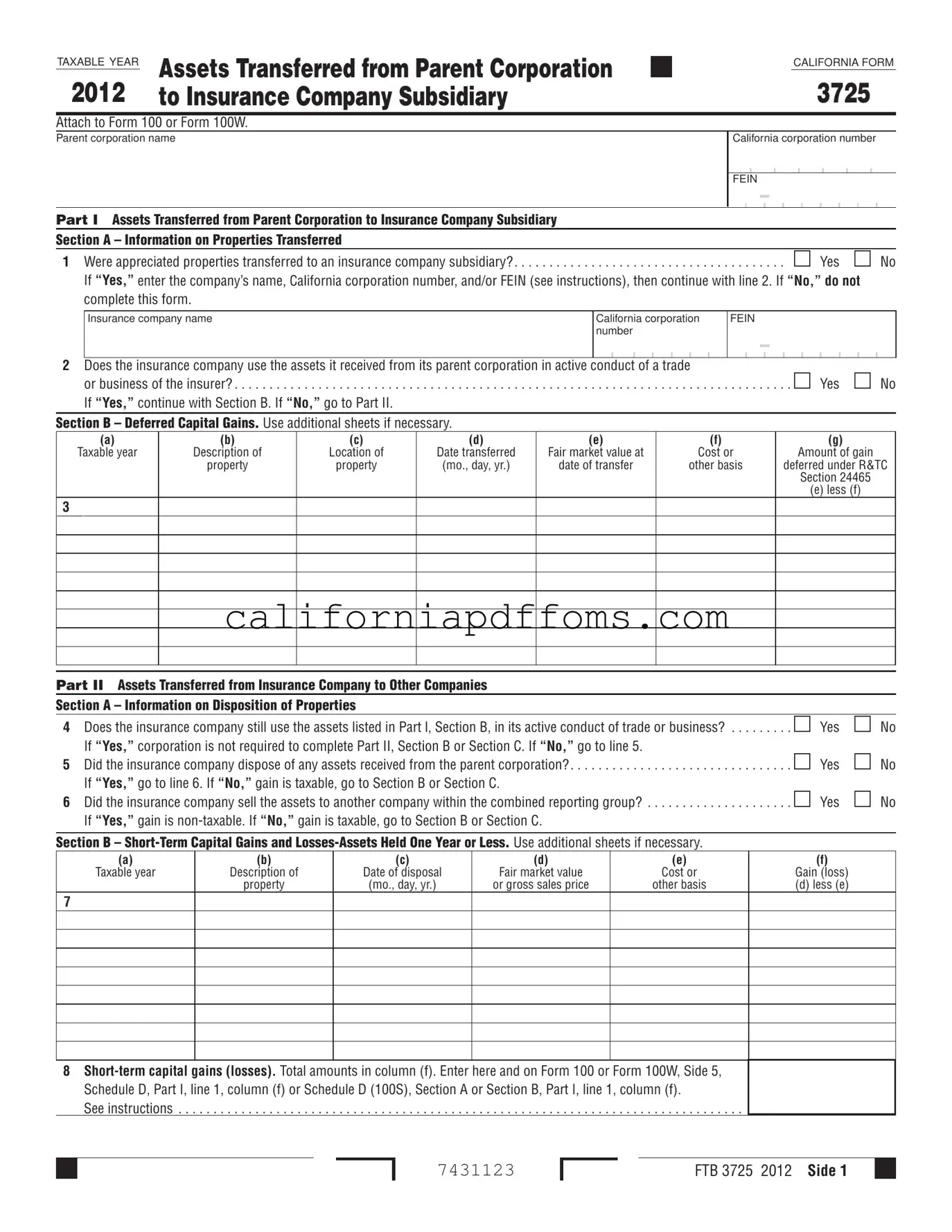

The California Form 3725 is a crucial document for corporations involved in the transfer of assets to insurance company subsidiaries. This form is specifically designed to report assets that a parent corporation transfers to its subsidiary, helping to track capital gains and losses that may arise from such transactions. When appreciated properties are transferred, the form requires detailed information about the properties, including their fair market value at the time of transfer and whether these assets are actively used in the insurer's business. If the insurance company disposes of any transferred assets, additional reporting is necessary to determine if the gains are taxable. Understanding the nuances of this form is essential for compliance with California Revenue and Taxation Code Section 24465, which governs the deferral of gains under certain conditions. Failure to properly complete Form 3725 can lead to significant tax implications, making it imperative for corporations to be diligent in their reporting practices. Whether you are a parent corporation transferring assets or an insurance company receiving them, navigating the requirements of Form 3725 is a critical step in ensuring financial accuracy and regulatory compliance.

Create Common PDFs

Benefit Audit - Make sure to input accurate information about the claims administrator's company name and address.

Confidential License Plate - Double-check that all information is filled out completely to avoid processing delays.

Ca Tax Extension 2023 - If taxes are owed, make your check or money order payable to the Franchise Tax Board.