Fill in Your California 3588 Template

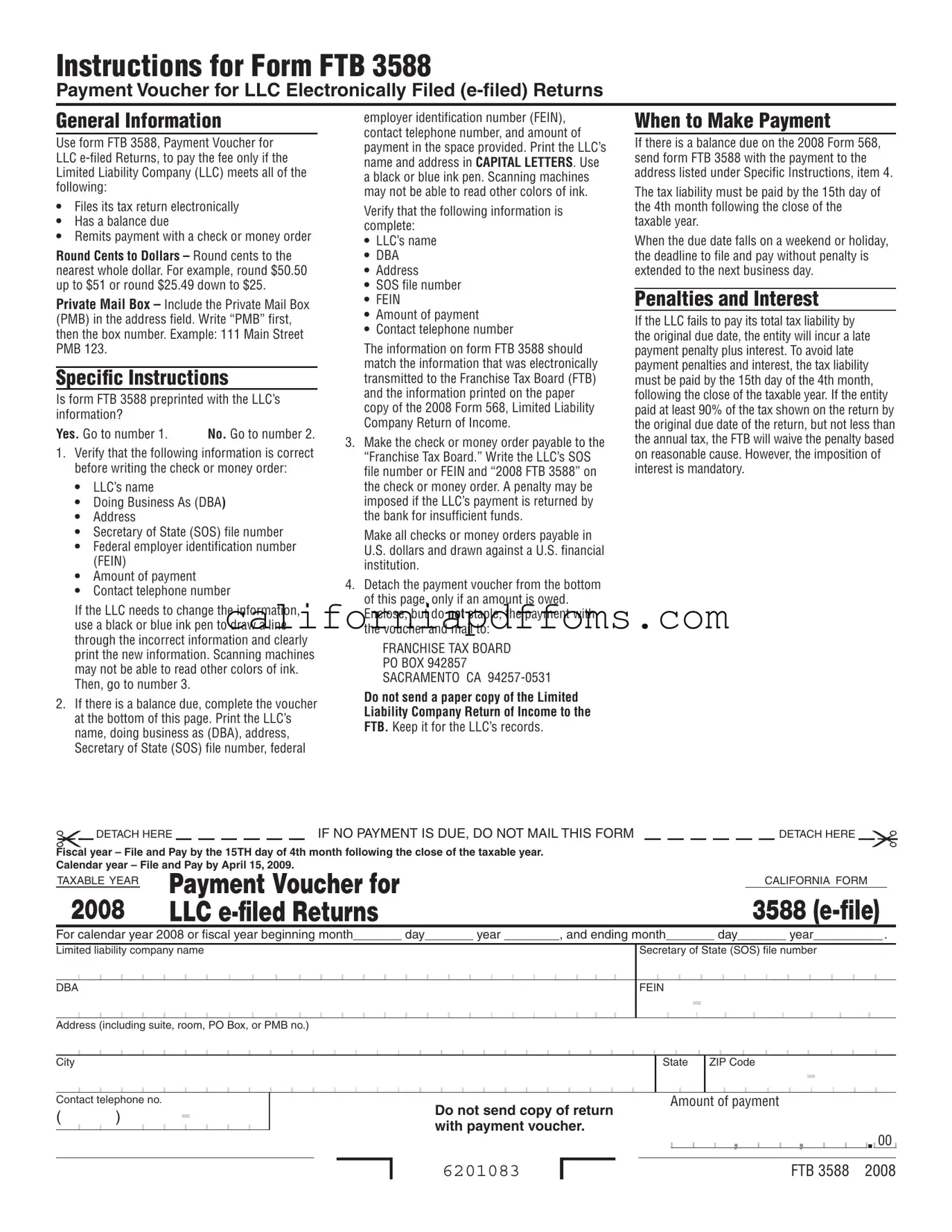

The California Form FTB 3588 serves as a crucial payment voucher for Limited Liability Companies (LLCs) that file their tax returns electronically. This form is specifically designed for LLCs that have a balance due and need to remit payment via check or money order. It is essential that the payment is rounded to the nearest whole dollar to ensure accurate processing. The form includes preprinted information about the LLC, such as its name, Doing Business As (DBA) designation, and federal employer identification number (FEIN). If any of this information is incorrect, it must be updated using a black or blue ink pen. The completed voucher should be mailed to the Franchise Tax Board along with the payment, and it is important to include specific details on the check or money order, such as the LLC's SOS file number and a reference to the form. Timely payment is vital, as penalties and interest may apply if the tax liability is not settled by the due date, which is typically the 15th day of the fourth month following the close of the taxable year. Understanding the requirements and deadlines associated with Form FTB 3588 can help LLCs avoid unnecessary fees and ensure compliance with California tax regulations.

Create Common PDFs

California E-file Requirements - The tax table or tax rate schedule can be referenced for tax calculation.

Form 3805p - Check all boxes carefully to signify the correct entity type at the beginning of the form.