Fill in Your California 3582 Template

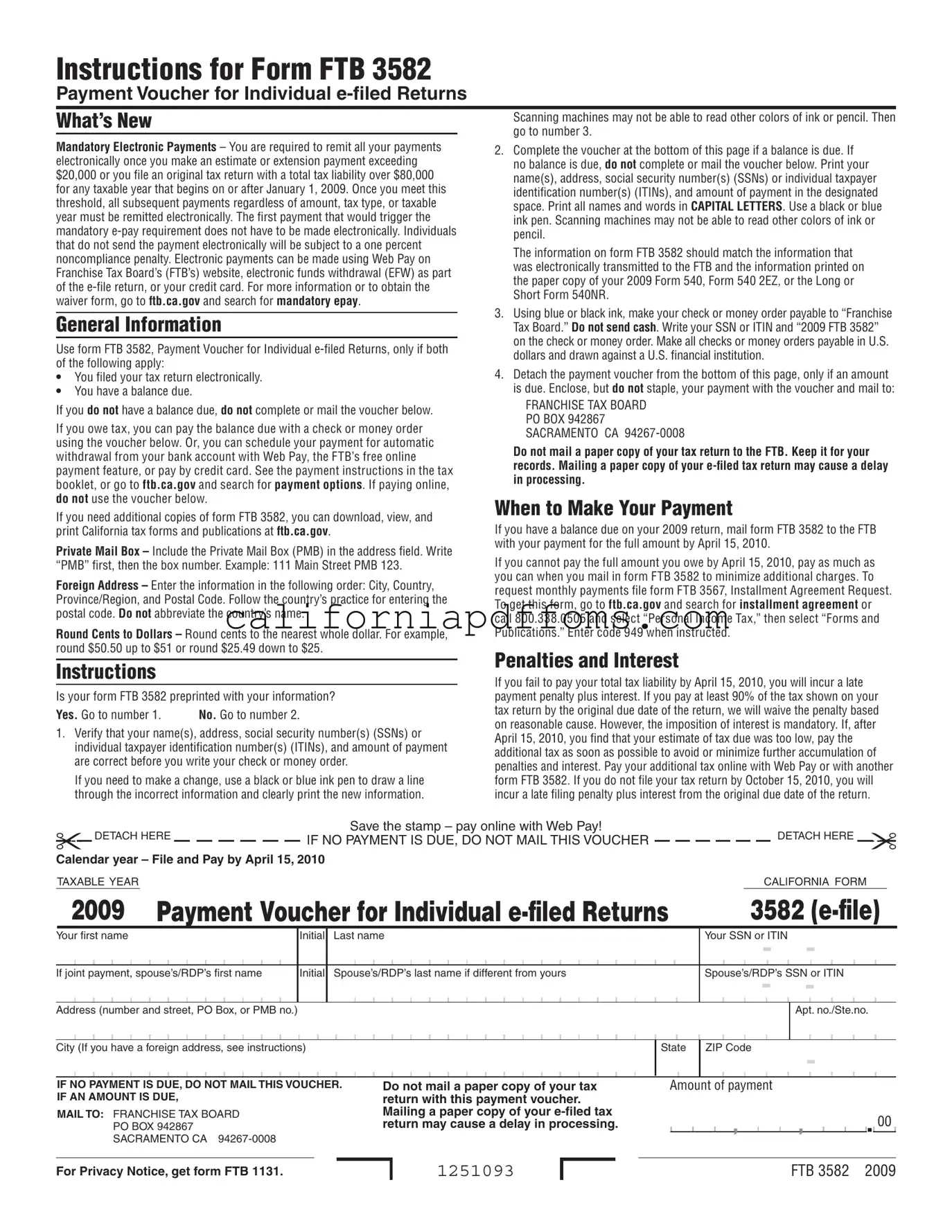

The California FTB 3582 form serves a crucial role for individuals who have filed their tax returns electronically and find themselves with a balance due. This payment voucher is specifically designed to facilitate the payment process, ensuring that taxpayers can remit what they owe efficiently. If your tax liability exceeds certain thresholds, electronic payment becomes mandatory, making it essential to understand the implications of this requirement. For example, any estimate or extension payment over $20,000 or an original tax return with a liability over $80,000 necessitates electronic payments for all subsequent transactions. The form also includes specific instructions on how to complete it correctly, emphasizing the importance of using black or blue ink and ensuring that all information matches what was submitted electronically. Failure to comply with these guidelines can result in penalties. Furthermore, individuals must be aware of deadlines, such as the April 15 payment due date for the previous tax year, to avoid additional charges. In summary, the FTB 3582 form is a vital tool for managing tax payments in California, requiring careful attention to detail and adherence to electronic payment mandates.

Create Common PDFs

California 3500 - This application form helps ensure proper governance and compliance with state tax laws.

Relative Information - The JV-250 is revised periodically to reflect current legal standards and best practices.

Relative Information - Understanding the full implications of this waiver is essential for parents and guardians alike.