Fill in Your California 3581 Template

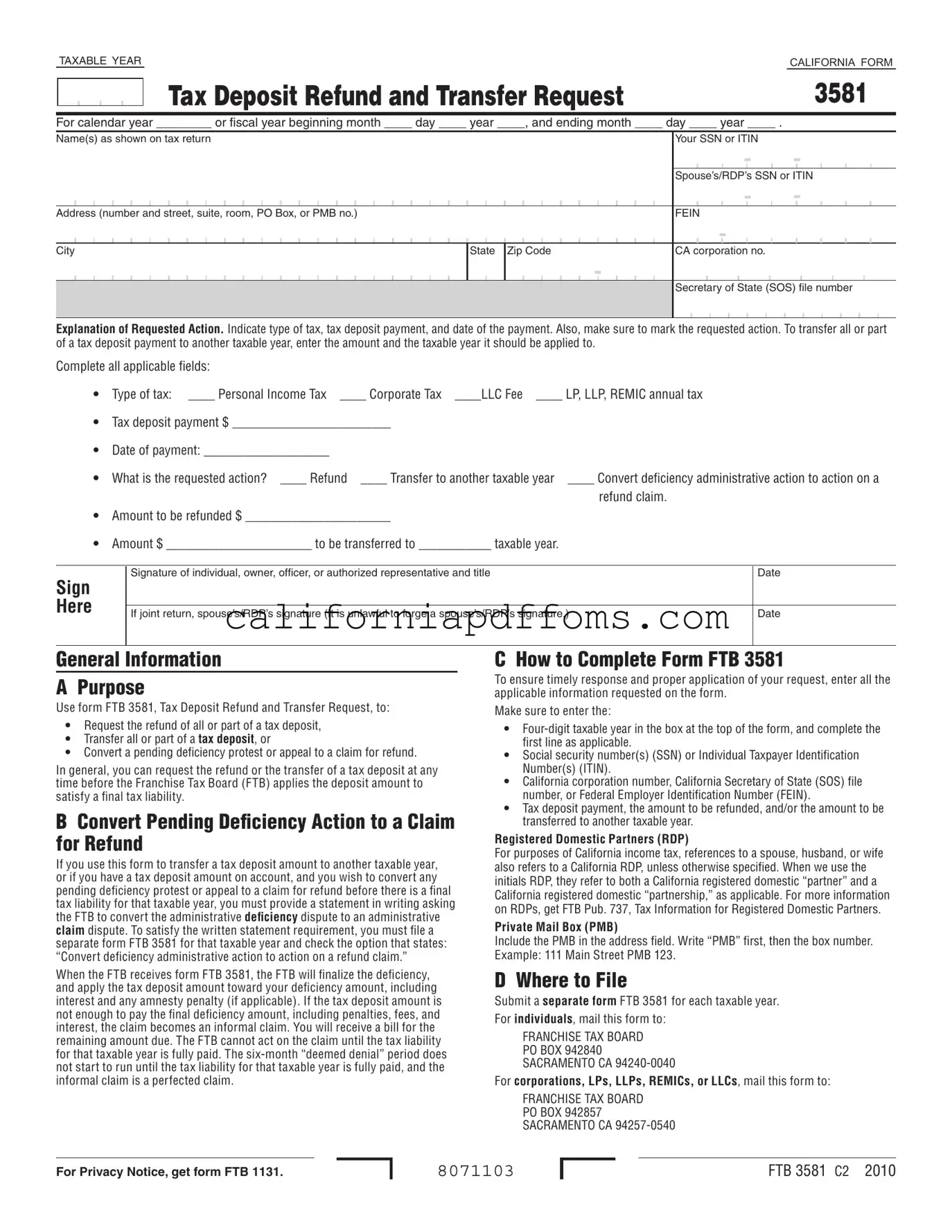

The California Form 3581, officially titled the Tax Deposit Refund and Transfer Request, serves as an essential tool for taxpayers seeking to manage their tax deposits effectively. Whether you are an individual, a corporation, or part of a limited partnership, this form allows you to request a refund of all or part of your tax deposit, transfer funds to another taxable year, or convert a pending deficiency action into a claim for refund. It is crucial to fill out this form accurately, providing details such as your Social Security Number or Individual Taxpayer Identification Number, the type of tax involved, and the specific amount you wish to refund or transfer. Additionally, the form requires you to indicate the taxable year relevant to your request, ensuring that your actions align with your tax obligations. For those who may have pending deficiency disputes, the California Form 3581 also offers a pathway to convert these issues into a formal claim for refund, provided certain criteria are met. Understanding how to complete this form properly can streamline your interactions with the Franchise Tax Board and help you navigate the complexities of California tax law with greater ease.

Create Common PDFs

Motion for Reconsideration California Family Law - Preparing this notice promptly can enhance the respondent's position in the appeal.

California 1296 32 - The form succinctly captures all findings and orders from the court in one document.