Fill in Your California 3555 Template

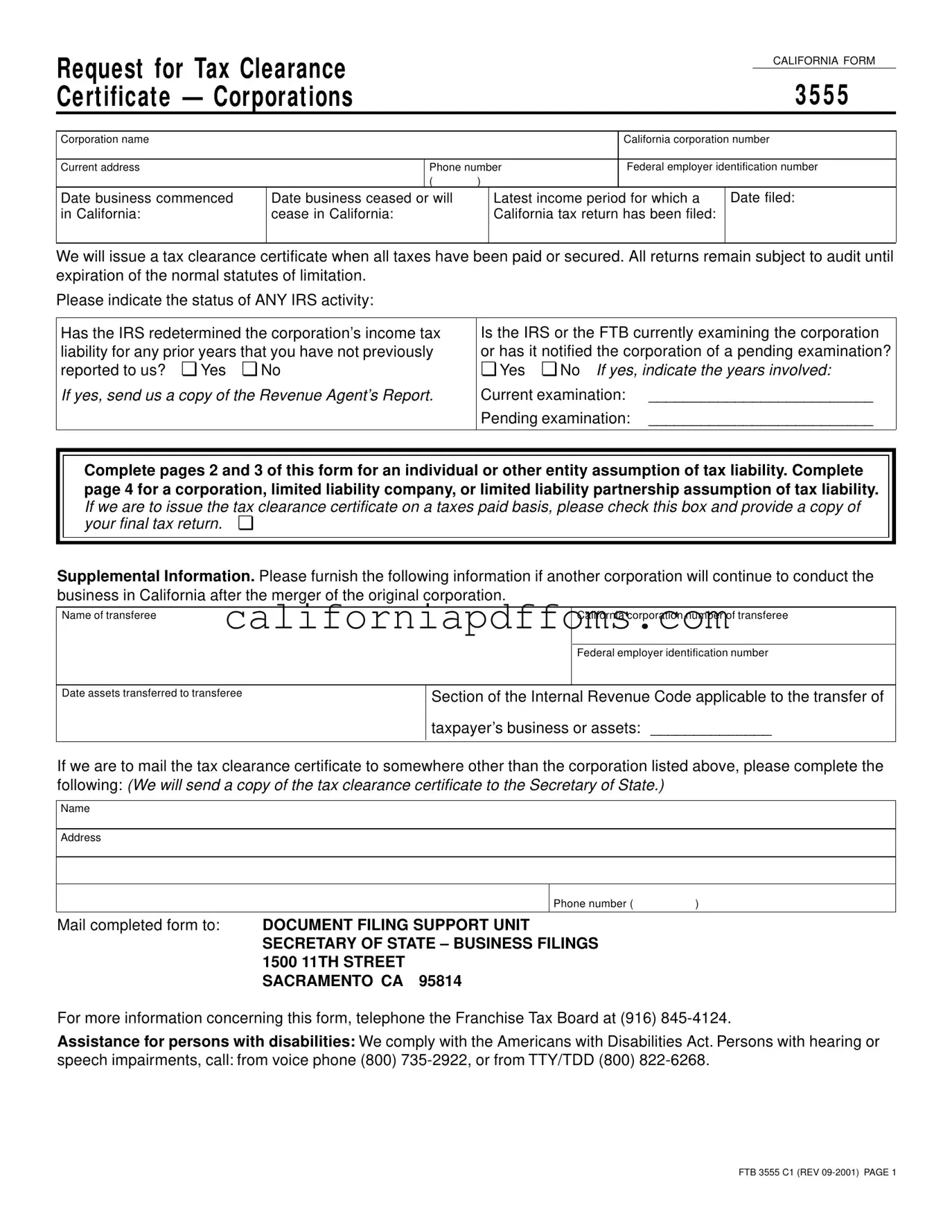

Understanding the California 3555 form is essential for corporations looking to secure a tax clearance certificate in the Golden State. This form, officially titled the Request for Tax Clearance, serves as a formal request to the California Franchise Tax Board. It is primarily used when a corporation is dissolving or ceasing business operations in California. Key details required on the form include the corporation's name, California corporation number, and federal employer identification number. Additionally, it asks for information about the business's operational timeline, such as the date it commenced and when it will cease. The form also addresses any outstanding tax liabilities, requiring corporations to disclose any IRS examinations or redeterminations that may affect their tax status. By completing this form accurately, corporations can ensure that all taxes have been paid or secured, facilitating a smooth transition during dissolution or business transfer. A tax clearance certificate is vital, as it confirms that the corporation has met its tax obligations, which is crucial for both compliance and peace of mind.

Create Common PDFs

Motion for Reconsideration California Family Law - Each court and respondent must cooperate to facilitate the appeal proceedings.

California Sr 10 - The form serves to enhance accountability in social service provision.