Fill in Your California 3540 Template

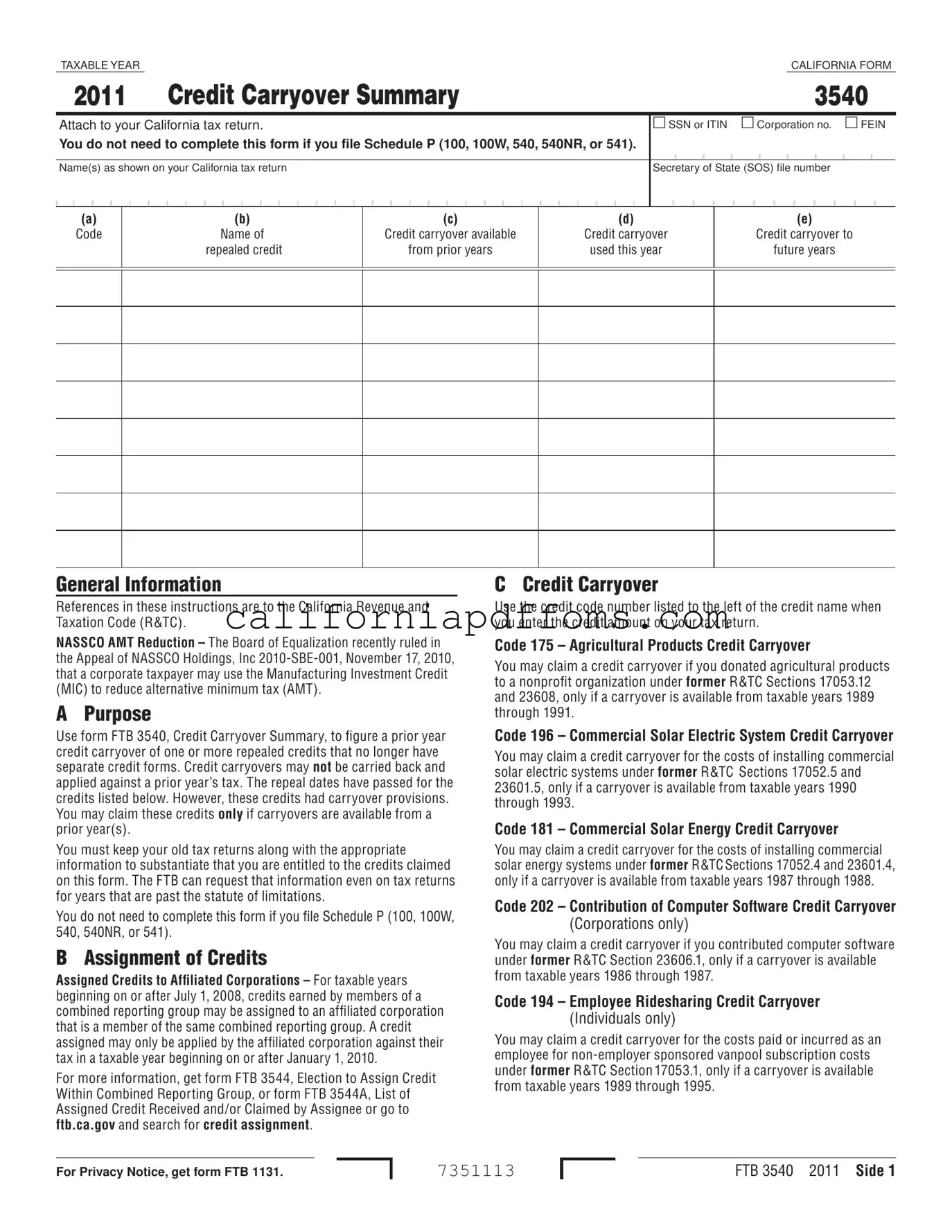

The California Form 3540, known as the Credit Carryover Summary, serves as an essential tool for taxpayers who wish to claim credits from previous years that are no longer active due to repeal. This form allows individuals and corporations to report and utilize any available carryover credits from prior taxable years, ensuring they can benefit from tax incentives that may have lapsed. Notably, taxpayers are not required to complete this form if they are filing certain schedules, such as Schedule P for various tax forms. The form requires detailed information, including the taxpayer's identification numbers, the specific credits being claimed, and the amounts available for carryover. Taxpayers must also maintain records of their prior tax returns, as the California Franchise Tax Board (FTB) may request documentation to verify claims, even for years that are past the statute of limitations. The form includes various credit codes, each corresponding to specific repealed credits, such as the Agricultural Products Credit and the Commercial Solar Electric System Credit, among others. Understanding the nuances of these credits, including their limitations and eligibility criteria, is crucial for effective tax planning and compliance.

Create Common PDFs

California 1296 32 - The local child support agency’s role in this form underscores its involvement in enforcement actions.

California Cdph 4461 - The form includes provisions for clients' preferred method of contact from providers.