Fill in Your California 3539 Template

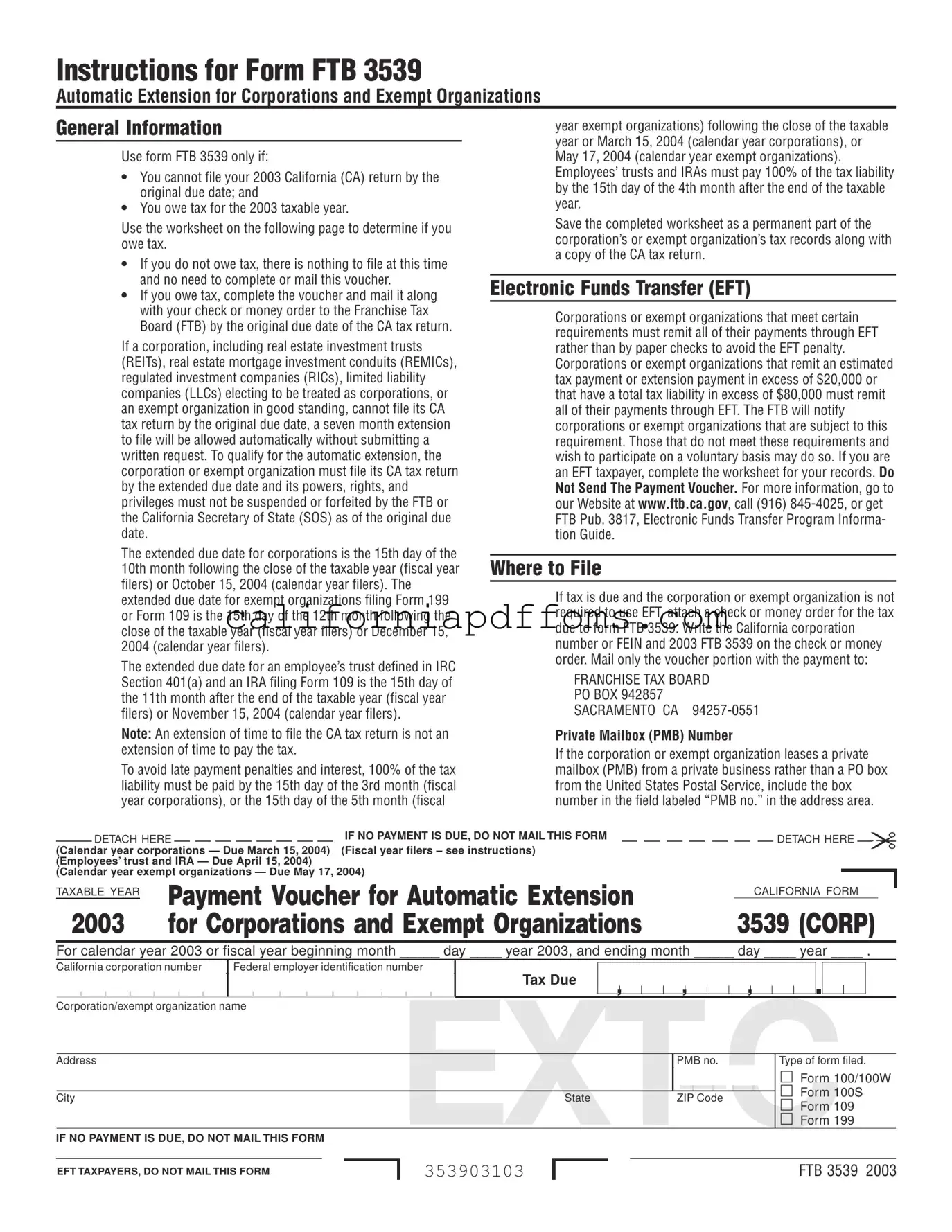

The California Form FTB 3539 serves as an essential tool for corporations and exempt organizations seeking an automatic extension to file their state tax returns. This form is particularly relevant for those who may not be able to meet the original filing deadline, allowing them to extend their filing period by seven months without the need for a written request. To qualify for this extension, organizations must ensure that their tax return is submitted by the extended due date and that they are in good standing with the Franchise Tax Board (FTB) and the California Secretary of State. It is important to note that while the form facilitates an extension to file, it does not extend the time to pay any taxes owed. Corporations and exempt organizations that owe taxes must remit payment by the original due date to avoid penalties and interest. Additionally, specific requirements apply to those making estimated tax payments or filing as part of a combined unitary group. Overall, understanding the nuances of Form FTB 3539 can help organizations navigate their tax obligations more effectively.

Create Common PDFs

California Jv 445 - Efforts made by the county agency towards a permanent placement for the child are assessed here.

Can Ex Wife Claim My Pension Years After Divorce? - The form specifies the employer or plan administrator involved with the retirement plans.

California 513 026 - It reflects California's commitment to safe and compliant agricultural products.