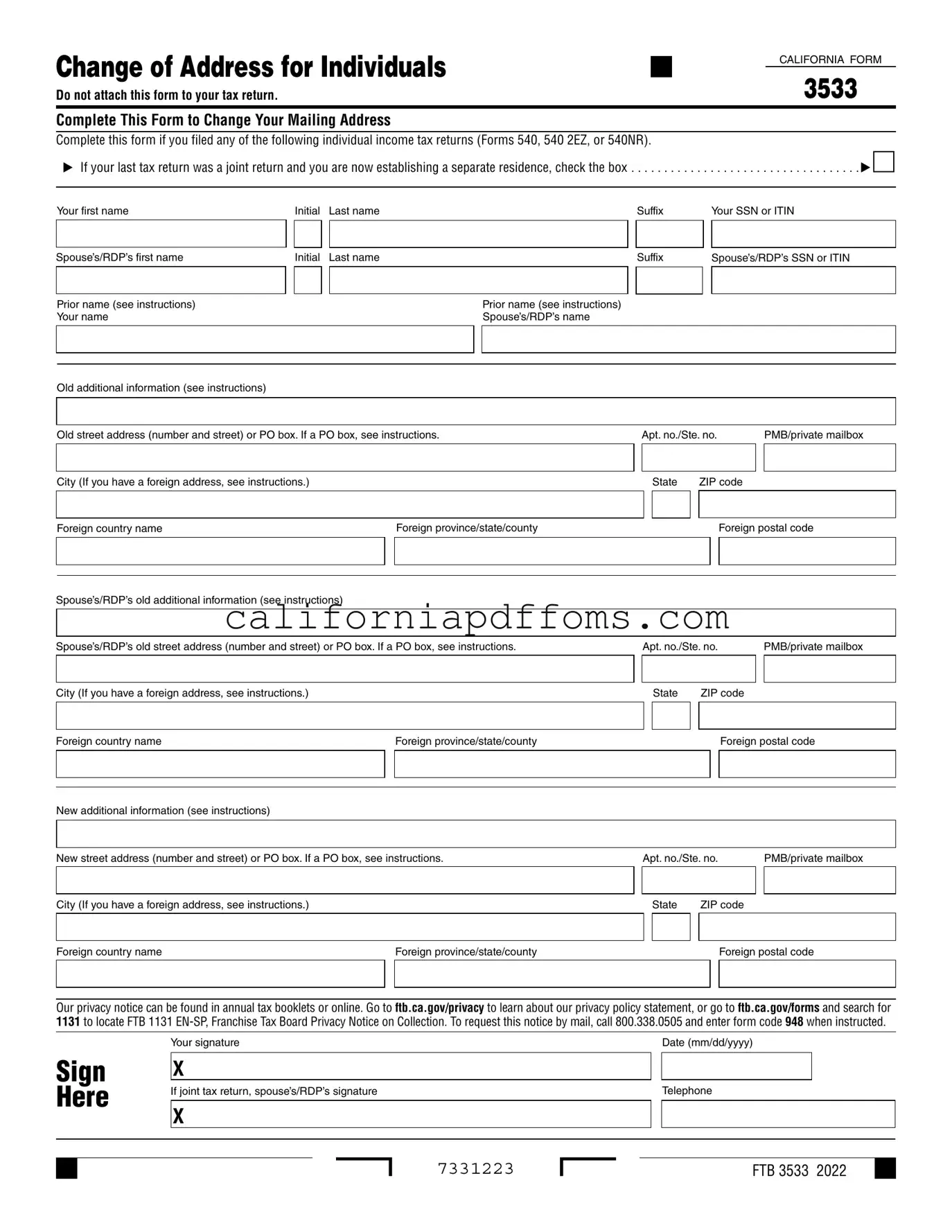

Fill in Your California 3533 Template

The California 3533 form serves a crucial purpose for individuals needing to update their mailing address with the Franchise Tax Board (FTB). If you have filed specific individual income tax returns, such as Forms 540, 540 2EZ, or 540NR, this form is essential for ensuring that your tax correspondence reaches you at your new residence. It is particularly important to note that if you previously filed a joint return and are now establishing a separate residence, you should indicate this change on the form. The document requires personal information, including names, Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs), and both your old and new addresses. Additionally, if you have a foreign address, specific instructions apply to ensure accurate processing. While completing the form, you will also find guidance on privacy rights and the importance of providing accurate information. Remember, this form should not be attached to your tax return, but rather submitted separately to maintain clear and updated records with the FTB.

Create Common PDFs

Confidential License Plate - All applications go through thorough processing to verify eligibility criteria.

Balance Sheet Meaning - It aids in providing a clear picture of the entity's fiscal responsibility and integrity.