Fill in Your California 3528 A Template

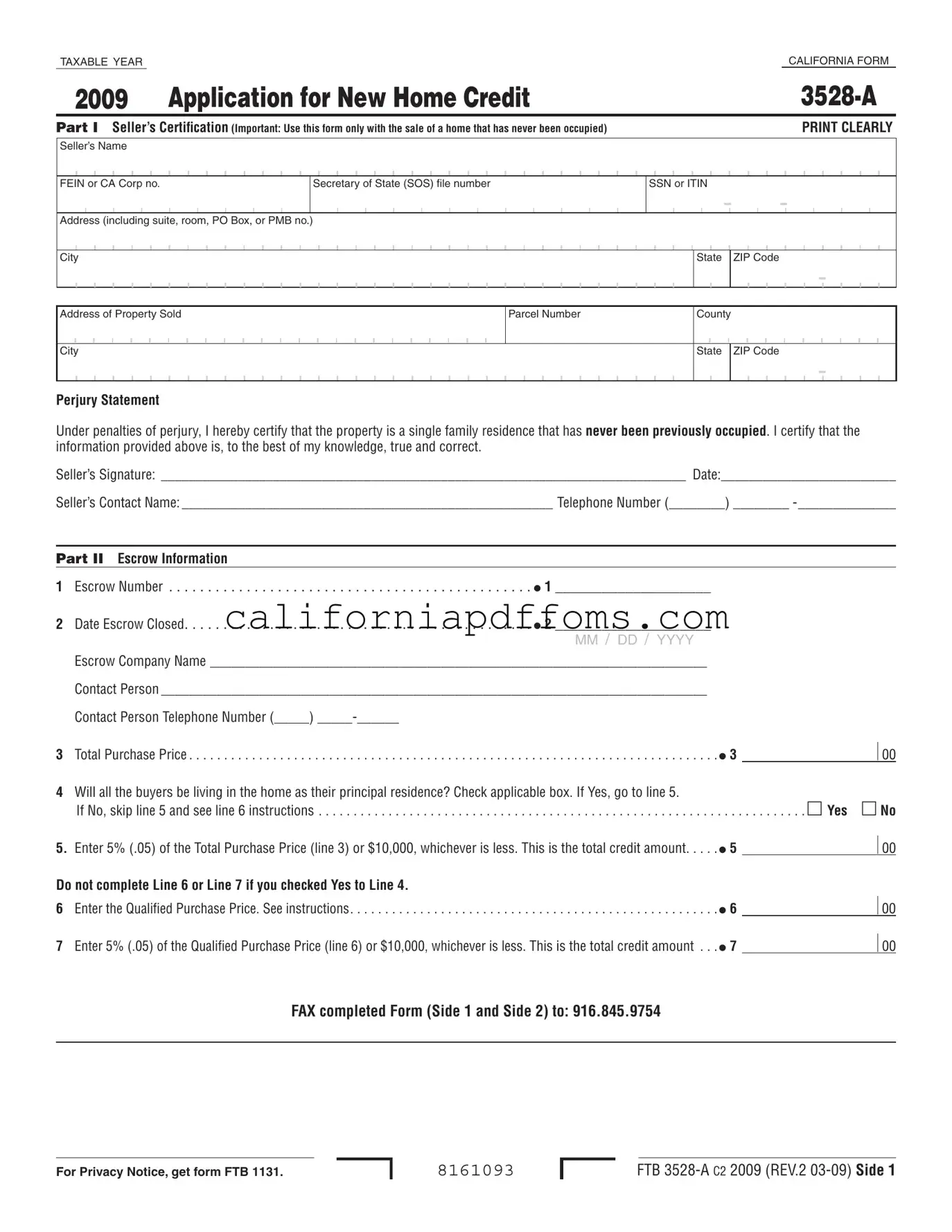

The California 3528 A form, officially titled the Application for New Home Credit, serves as a critical document for individuals looking to benefit from a tax credit associated with the purchase of a new home that has never been occupied. This form is designed for sellers and buyers alike, facilitating the declaration of eligibility for a tax credit that can significantly reduce net tax liability. The process begins with the seller certifying that the property in question is a single-family residence that has never been occupied, thereby meeting the criteria set forth by California's Revenue and Taxation Code. The form requires detailed information including the seller’s and buyer's identification, property details, and escrow information. Notably, the credit amount is capped at either 5% of the total purchase price or $10,000, whichever is less, and must be claimed on a timely filed tax return. Furthermore, the allocation of this credit is subject to specific limitations, including the requirement that the residence must be the principal home of the buyer for a minimum of two years. The urgency in submitting this form lies in the first-come, first-served basis for credit allocation, which has a total cap of $100 million, emphasizing the need for prompt action to secure available benefits.

Create Common PDFs

Notice of Entry - The FL-605 aids in documenting interactions in family law and other related legal matters.

Can You Get a Default Judgement Reversed - This form educates defendants about their rights to challenge a default ruling effectively.

California 51 055A - Additions or corrections to data should be submitted as soon as possible.