Fill in Your California 3523 Template

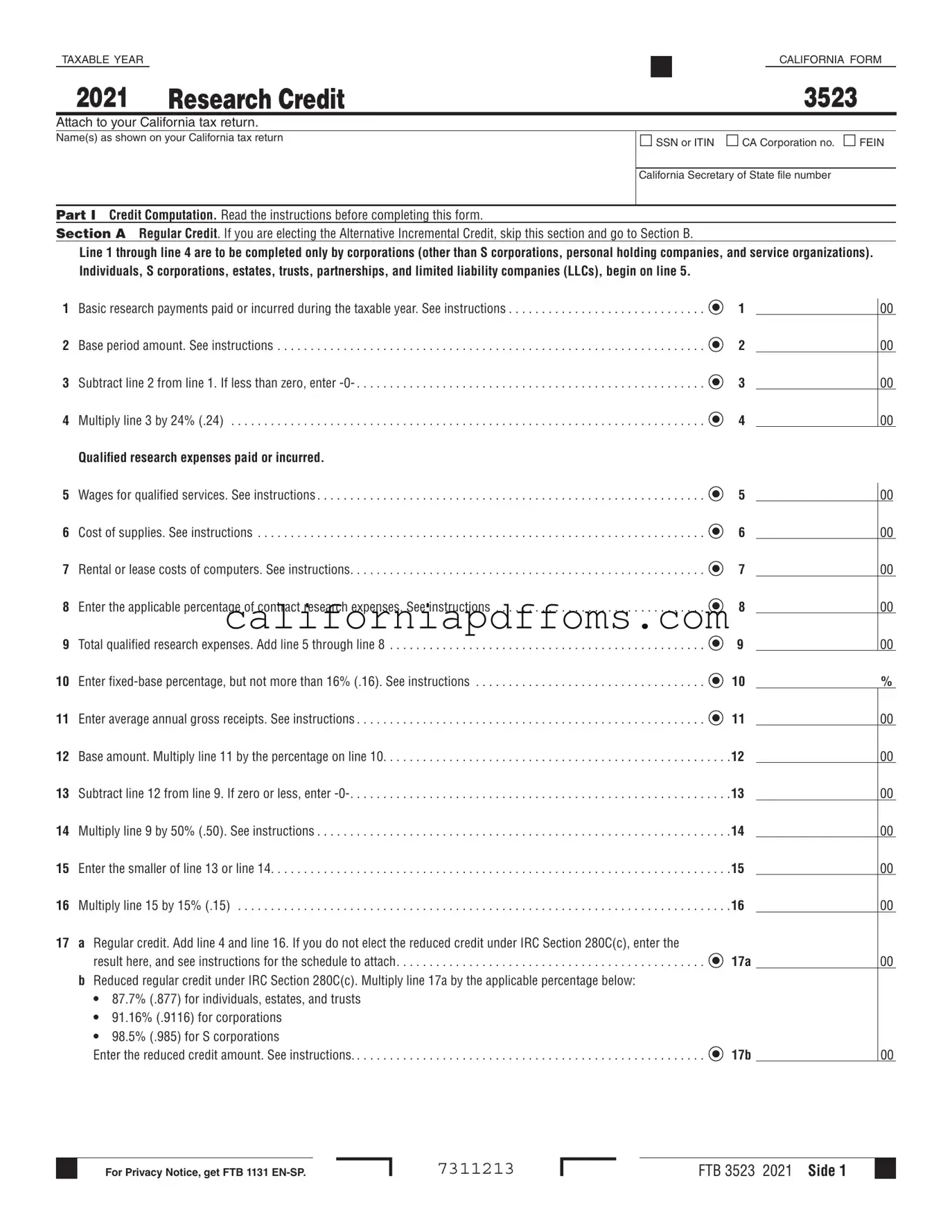

The California Form 3523 is an essential document for taxpayers seeking to claim the Research Credit on their California tax returns. This form is specifically designed for the taxable year 2020 and must be attached to your California tax return. It includes sections for both Regular Credit and Alternative Incremental Credit, allowing corporations and individuals to calculate their eligible research expenses. Taxpayers must provide information such as their name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and California Corporation number, among other details. The form requires a thorough breakdown of qualified research expenses, including wages for qualified services, costs of supplies, and rental costs for computers. Additionally, taxpayers must determine their base period amount and average annual gross receipts to accurately compute their credit. The form also includes provisions for reduced credits under IRC Section 280C(c) and offers guidance on how to handle credits from pass-through entities like S corporations and partnerships. Understanding how to navigate this form is crucial for maximizing potential tax benefits related to research and development activities.

Create Common PDFs

California Form 100 - Provide detailed explanations of changes in Part V of the form.

Gc-314 - It is important for attendees to know the courtroom where the hearing will occur.

Writ of Mandate Meaning - This petition allows individuals to challenge a ruling made by the trial court.