Fill in Your California 3522 Template

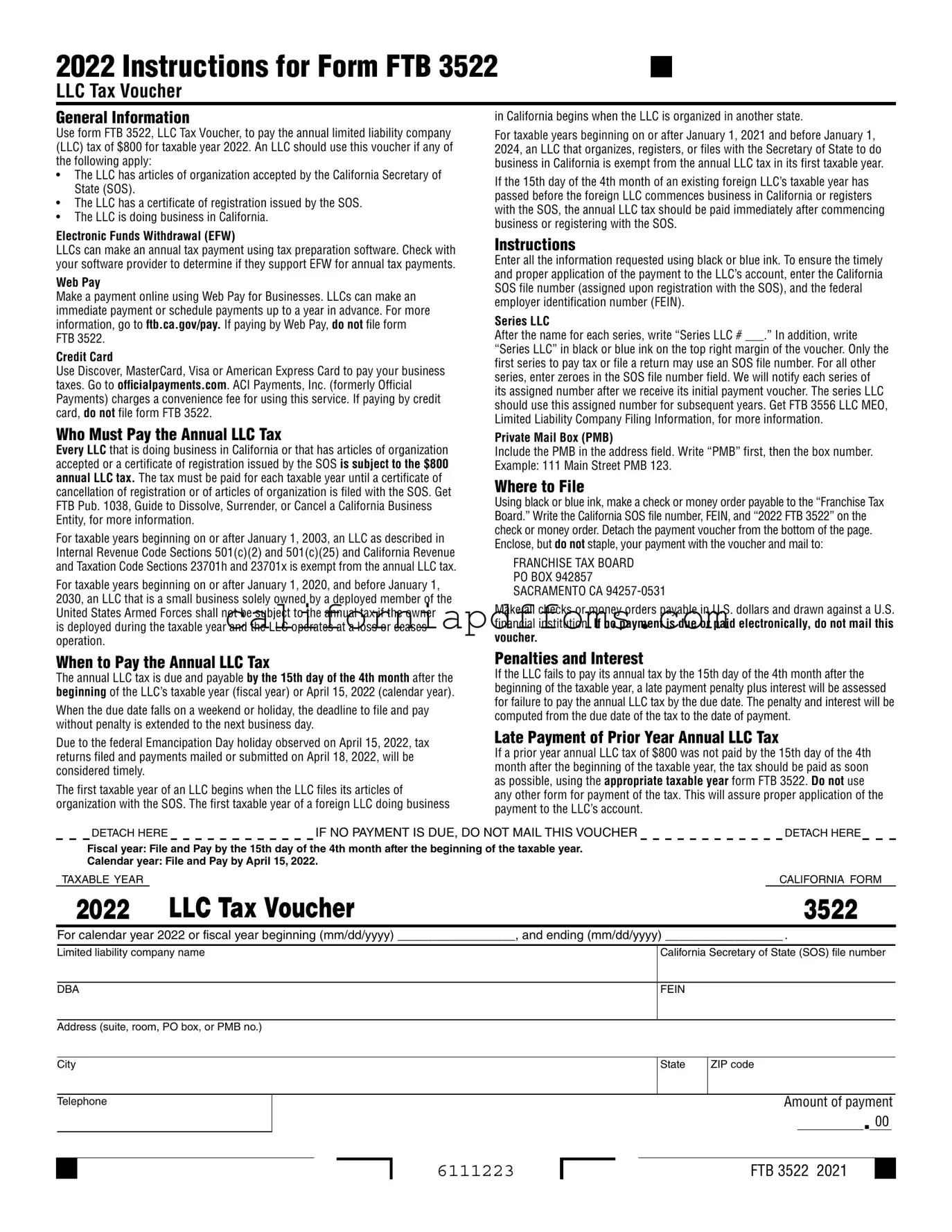

The California 3522 form, officially known as the LLC Tax Voucher, is a crucial document for limited liability companies (LLCs) operating in the state. Every LLC that has its articles of organization accepted by the California Secretary of State or holds a certificate of registration is required to pay an annual tax of $800. This payment is due by the 15th day of the 4th month after the start of the LLC's taxable year, which for many will be April 15, 2022, for the calendar year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It's important to note that certain LLCs, such as those owned by deployed members of the U.S. Armed Forces or those that qualify under specific tax codes, may be exempt from this tax. The form also provides options for payment, including electronic funds withdrawal, online payments through Web Pay, or credit card payments. However, if payment is made using these methods, the form itself does not need to be filed. Accurate completion of the form is essential, as it requires specific information like the California Secretary of State file number and the federal employer identification number. Understanding the requirements and deadlines associated with the California 3522 form can help LLCs avoid penalties and ensure compliance with state tax regulations.

Create Common PDFs

Balance Sheet Meaning - Long-term assets encapsulate real estate, equipment, and other significant holdings.

Ca Tax Credit - It is necessary to include a description of the action being requested for clarity.