Fill in Your California 3521 Template

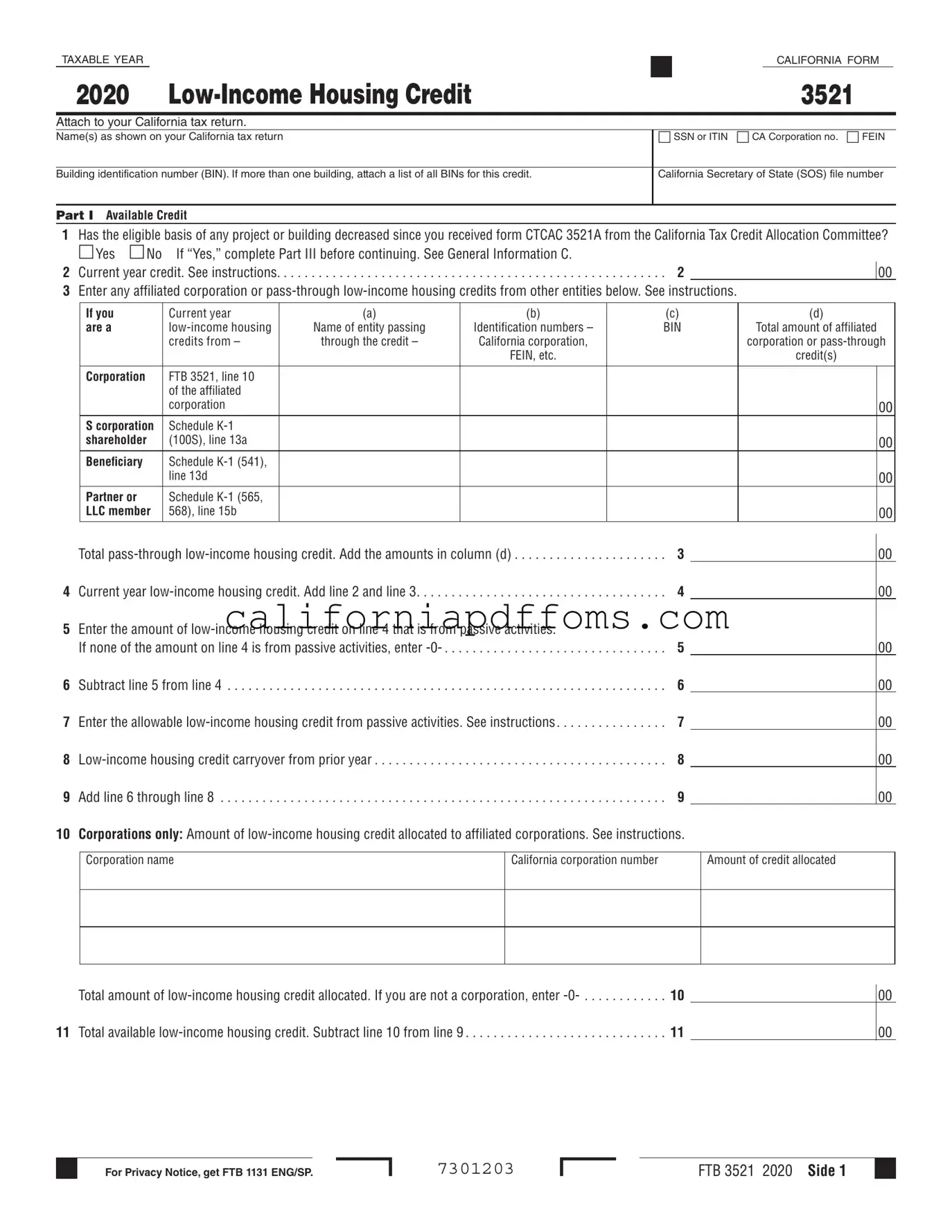

The California Form 3521 plays a crucial role in the state's tax system, specifically concerning the Low-Income Housing Credit. This form must be attached to an individual's California tax return and is designed for taxpayers who are involved in low-income housing projects. Key elements of the form include a section for reporting the eligible basis of the project, which may have changed since the last submission of Form CTCAC 3521A. Taxpayers must indicate whether the eligible basis has decreased and provide detailed calculations of the current year credit, including any affiliated low-income housing credits from other entities. Additionally, the form requires information about credit carryovers from previous years and allows for adjustments based on passive activities. The final calculations culminate in determining the total available low-income housing credit, which is essential for taxpayers seeking to benefit from these credits. Understanding the nuances of Form 3521 is vital for compliance and maximizing potential tax benefits related to low-income housing initiatives in California.

Create Common PDFs

Ftb Llc Fee - Differentiate between LLC name and DBA, as both are required on the form.

Holographic Will California - Clarity in designation helps prevent misunderstandings after your passing.

Can You Get a Default Judgement Reversed - The form requires personal knowledge of the matters being discussed in the declaration.